-

KOSPI 2697.67 -22.97 -0.84%

-

KOSDAQ 734.35 -1.94 -0.26%

-

KOSPI200 359.62 -3.46 -0.95%

-

USD/KRW 1381 -7.00 0.51%

Zero-sum fears arise in S.Korean airlines’ game of chicken

Airlines

Zero-sum fears arise in S.Korean airlines’ game of chicken

The country’s major airlines are locked in a fierce race to open new routes and increase popular flights to shore up profit

By

Oct 15, 2024 (Gmt+09:00)

3

Min read

News+

South Korea’s air carriers are fiercely vying for lucrative or untapped routes in a game of chicken to shore up their falling profit, raising concerns that heated competition in the country’s airline industry could end in a zero-sum game.

According to the Korean airline service sector on Monday, the country’s No. 1 full-service carrier Korean Air Lines Co. last month launched new flights between Incheon and Lisbon, Portugal, which will operate three times a week. This is the country’s first direct flight between the two cities.

Korean Air will also increase flights from the country’s gateway Incheon International Airport to Nha Trang, Taichung and Las Vegas, each, this month and to Phú Quốc in December.

The country’s second-largest full-carrier service Asiana Airlines Inc. will launch an Incheon-Cairo, Egypt route later this month, as well as an Incheon-Kumamoto route in November and Incheon- Asahikawa flights in December.

Their aggressive flight expansion comes as they are grappling with declining profit despite a recovery in travel demand in the endemic era.

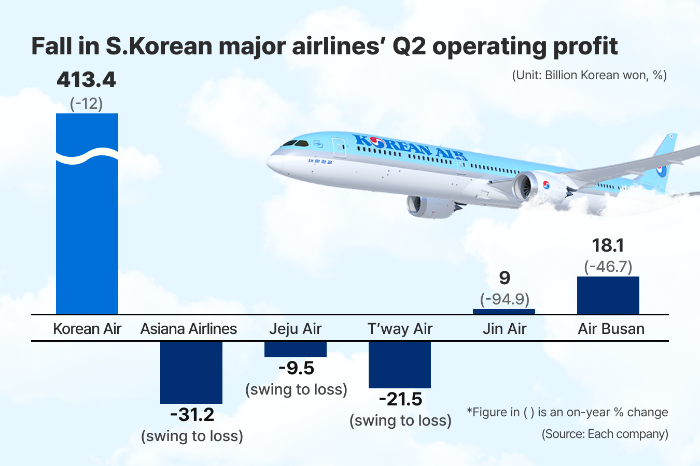

Of six listed major airlines in Korea, Asiana Airlines, Jeju Air Co. and T’way Air Co. all dipped in the red in the second quarter this year from the same period of last year, while Korean Air, Jin Air Co. and Air Busan Co. saw double-digit drops in their operating profit over the same period.

NEED TO OFFSET FALLING PROFIT

The strong US dollar against the Korean won and higher fuel costs are the main culprits of the Korean airlines’ poor performance.

Fuel costs, which usually account for about 30% of their operating costs, rose more than 25% compared with the pre-pandemic year of 2019.

The average foreign exchange rate was 1,371 won per dollar in the second quarter, meaning an additional 60 won was required to buy the greenback compared with a year ago, and 200 won more compared with the second quarter of 2019.

The higher dollar-won rate bodes ill for Korean airlines’ profitability as they settle jet fuel and aircraft maintenance costs in dollars.

On top of them, Korean airlines have aggressively added new flights and staff in recent years to accommodate so-called revenge travel following the end of the COVID-19 pandemic.

They enjoyed robust air travel demand in 2023 but such a pent-up demand for travel has recently started fading somewhat, forcing airlines to add new routes or increase flights in popular routes to revive travel demand.

LCCS JOIN THE GAME OF CHICKEN

Korean budget airlines are also joining their bigger rivals in the airline industry’s new game of chicken to improve their profitability.

The country’s leading low-cost carrier Jeju Air will launch new routes to Batam and Bali, Indonesia, this month to become the country’s first LLC to fly to Indonesia. Air Busan will follow suit by later adding a new route between Busan and Bali.

Considering that Korean Air and Asiana Airlines were Korea’s exclusive operators of flights in the Incheon-Batam and Incheon-Bali routes, LCCs’ new offers have helped lower flight costs to the two Indonesian cities from Korea.

Earlier this year, T’way Air also became the first Korean budget airline to operate flights to five European cities from Korea, while Jin Air plans to resume flights between Incheon and Clark, the Philippines and Incheon and Vientiane, Laos later this month.

Eastar Jet Co. will also add new flights to Okinawa and Chiang Mai from Busan in December, while Air Prema Inc. will start flying to Hong Kong and Da Nang from Incheon in January next year.

In response to the ascent of budget airlines on popular routes, Korean Air is considering launching new flights to its yet untapped cities such as Dublin, Ireland, Copenhagen, Denmark and Athens, Greece early next year.

Write to Jung-Eun Shin at newyearis@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Oct 08, 2024 (Gmt+09:00)

-

Sep 27, 2024 (Gmt+09:00)

-

Aug 16, 2024 (Gmt+09:00)

-

Feb 14, 2024 (Gmt+09:00)

-

Dec 16, 2022 (Gmt+09:00)