-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Shares of chip machinery makers rise on foundry boom

By

Apr 09, 2021 (Gmt+09:00)

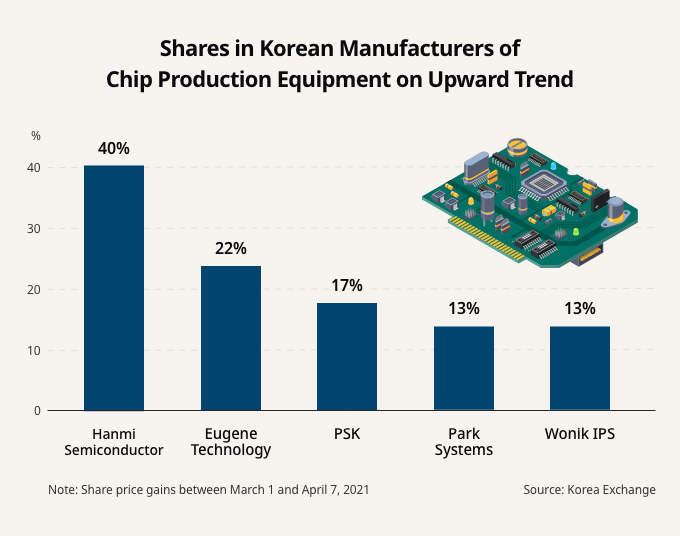

South Korean manufacturers of chip production equipment have seen their share prices rising sharply, buoyed by a series of new orders received from global semiconductor makers, combined with the aggressive investment plans from Intel Corp. and the largest foundry company TSMC Co.

Shares in Hanmi Semiconductor Co., which produces semiconductor fabrication post-process equipment, have skyrocketed 81% year to date, versus a 9% advance in the broader Kospi market where it is traded. Over the past month, the stock was up 40%, with the semiconductor index on the main bourse touching a peak of 4,037.32 this week.

Over the past month, Hanmi had disclosed nine orders it received from outsourced semiconductor assembly and test (OSAT) companies, including Taiwan's Unimicron Technology Co. and ASE Technology Holding Co. They are suppliers of TSMC.

The stock with a market capitalization of 1.6 trillion won also moved in tandem with gains in global chip machinery makers. Nasdaq-listed Applied Materials Inc., the world’s biggest equipment maker, has shot up 60% year to date.

Traditionally, Korean chip machinery makers, which are small and medium-sized, had tended to advance around the time when the country's two chip giants -- Samsung Electronics Co. and SK Hynix Inc. -- ramped up production on a large scale.

Since the beginning of the year, however, they have been driven higher by aggressive investment plans by non-memory chipmakers, or foundry companies despite no prospect of a memory chip capacity build-up. A global chip shortage, in particular depleting supplies of automotive chips, led to their heavy investment plans, with automakers, including Hyundai Motor Co. and Kia, forced to idel some of their productoin lines.

CAPACITY EXPANSION

Intel Corp., the largest US chipmaker, said last month that it will significantly expand its advanced chip manufacturing capacity and jump into the foundry business.

Last week, Taiwan-based TSMC, the world's No.1 foundry company, has announced a $100 billion investment over the next three years to increase production capacity to meet surging demand. Adding to the upbeat outlook, US President Joe Biden earmarked $50 billion to subsidize the semiconductor industry out of his $2 trillion infrastructure investment proposal.

An increase in TSMC's facility spending will prompt OSAT companies to boost investments and then will have a positive ripple effects on Hanmi Semiconductor and other chip machinery suppliers.

"In the past, Hanmi Semiconductor's earnings and share price had moved in the same direction as TSMC," said Shinhan Investment analyst Choi Do-yeon. "Thanks to TSMC's brisk business, Hanmi will continue to see its bottom line impvoing."

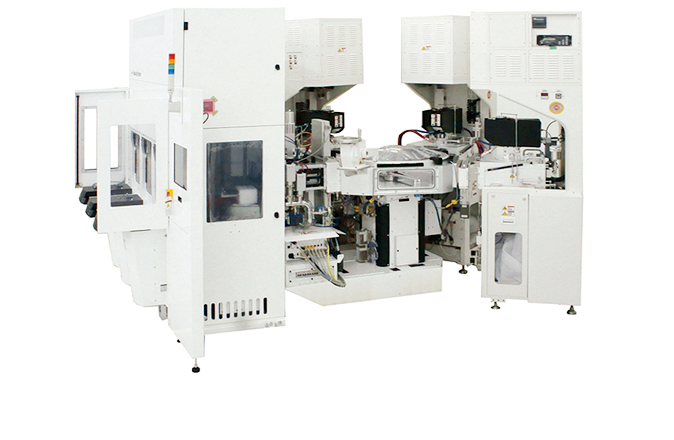

Hanmi closed up 3.3% at 32,850 won on Friday, near a 52-week high of 33,000 won. It manufactures apparatus for cutting single or multiple semiconductor packages from a multilayer substrate, and washing, drying, inspecting, sorting and loading chips.

"In the past, the key was whether they had long-term domestic clients. Now the focus moved to whether they have global chipmakers as clients," said Hana Financial Investment analyst Kim Kyung-min. "It is because semiconductor investments are taking place around the world in competition to gain dominance."

In comparison, PSK Inc., a long-term supplier of Samsung Electronincs, has not seen its share price gaining as much as domestic rivals, in the aftermath of Samsung's shutdown of its Austin chip plant in February due to the cold spell. But the Texas plant resumed operations.

Semiconductor tool makers had moved in advance of the memory chipmakers' business cycle, but this year they have been going up on expectations of non-memory chipmakers' capacity expansion, said Shinhan Asset Management fund manager Chung Sung-han.

"Among them, those with capabilities of securing global clients will receive premiums," he added.

Write to Jae-Yeon Ko at yeon@hankyung.com

Yeonhee Kim edited this article.

-

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMC

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

-

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2Mar 10, 2021 (Gmt+09:00)

-

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone production

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone productionMar 08, 2021 (Gmt+09:00)

-

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

-

Chip shortagesGM Korea to curb production as global chip shortages worsen

Chip shortagesGM Korea to curb production as global chip shortages worsenJan 22, 2021 (Gmt+09:00)

-

Jan 06, 2021 (Gmt+09:00)