-

KOSPI 3008.49 +30.75 +1.03%

-

KOSDAQ 789.19 +6.68 +0.85%

-

KOSPI200 403.71 +4.42 +1.11%

-

USD/KRW 1379 -6.00 0.44%

Friday Jun 20, 2025

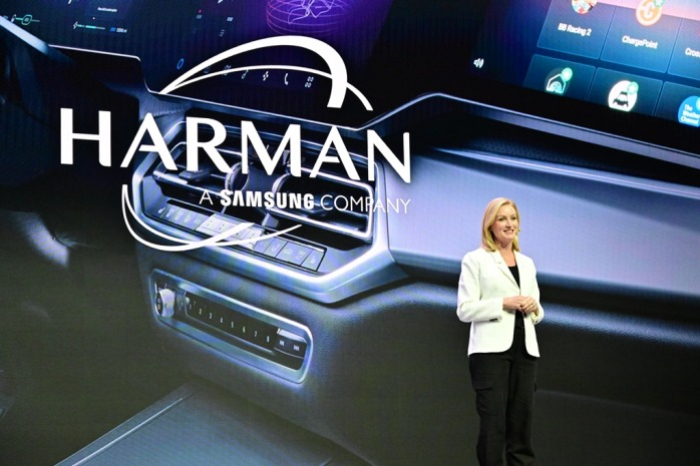

Harman to spearhead Samsung’s automotive solutions business

Electronics

Harman to spearhead Samsung’s automotive solutions business

Samsung’s automotive electronics business is expected to play a key role in accelerating its AI-driven hyper-connectivity

By

Dec 08, 2024 (Gmt+09:00)

3

Min read

News+

Samsung Electronics Co. will bolster cooperation in in-vehicle technology with its fully owned US subsidiary Harman International Industries Inc. to lead the burgeoning automotive electronics market, forecast to grow to $470 billion in 2030.

According to electronics industry sources, Samsung Electronics recently changed the name of the automotive electronics team under its device eXperience (DX) division to the Harman relations team during a recent organizational reshuffle.

Through the change, Samsung is expected to allow Harman to lead the Korean technology giant’s automotive electronics business by leveraging the parent’s hardware and software capabilities.

Harman became a wholly owned subsidiary of Samsung in 2017 after the Korean company acquired it for about $8 billion — its biggest deal since inception.

Stamford, Connecticut-based Harman is a global leader in connected-car technology, lifestyle audio systems, cloud services and Internet of Things (IoT) solutions.

Its mainstay business is audio systems offered via its 16 audio brands including AKG, Harman Kardon, Infinity, JBL, Lexicon, Mark Levinson and Revel.

But its automotive solutions business covering connected car systems has powered the company’s earnings growth in recent years.

Harman supplies in-vehicle systems such as digital cockpit systems, heads-up displays and infotainment systems to more than 50 million vehicles worldwide, including those of BMW and Toyota.

Its operating profit surged above 1 trillion won ($702 million) in 2023 from 60 billion won in 2017, when it joined Samsung.

GREAT SYNERGY

Harman’s stellar performance has been driven by the synergy created by its enhanced collaboration with its parent Samsung, a top global tech software and hardware developer.

Harman’s in-cabin Ready product portfolio, unveiled earlier this year, combines Harman's strengths with Samsung’s technologies to improve safety, personalization and sustainability for carmakers and consumers alike.

The systems are powered by Samsung’s latest display, processor and deep learning neural networking technologies.

To strengthen Harman’s in-vehicle technology, Samsung last year acquired Roon Labs, a US multi-device and multi-room audio technology firm, and France-based audio software company FLUX.

BURGEONING AUTOMOTIVE ELECTRONICS MARKET

With its latest reorganization, Samsung will raise the ante in the automotive electronics market, which is set to grow rapidly amid the auto industry’s fast migration to digitalization.

Grand View Research recently forecast that the global automotive solutions market will grow to $468.1 billion in 2030 from $262.6 billion in 2023.

Samsung’s cross-town rival LG Electronics Inc. is also pinning its hopes on automotive electronics and recently announced a vision to foster its vehicle solutions business into a global leader.

Chinese rivals TCL and Hisense are also vigorously expanding their related businesses.

With more enhanced support from Samsung, Harman is also expected to play a key role in building the parent company’s artificial intelligence technology-driven hyper-connectivity leveraging the fact that cars are a means of enabling people to stay connected to devices across time and space.

If more global car brands adopt Harman’s connected car systems, the reasoning goes, more devices will be connected by Samsung’s AI technology.

The two companies boasted of their enhanced partnership at a shared booth set up at CES 2024 earlier this year where they unveiled their new in-vehicle technology.

Harman’s success is also expected to rejuvenate Samsung’s business, which has recently lost steam due to the lackluster performance of its mainstay chip business.

This year, Harman is set to break its previous record earnings considering that it already reported 920 billion won in operating profit for the January-September period this year versus 830 billion won over the same period last year, when it logged a record-high profit.

Write to Eui-Myung Park at uimyung@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Korean innovators at CES 2024Samsung, Harman move in lockstep to advance in-vehicle technology

Korean innovators at CES 2024Samsung, Harman move in lockstep to advance in-vehicle technologyJan 10, 2024 (Gmt+09:00)

-

Tech, Media & TelecomSamsung’s Harman ups ante in home audio market with Roon

Tech, Media & TelecomSamsung’s Harman ups ante in home audio market with RoonNov 28, 2023 (Gmt+09:00)

-

Tech, Media & TelecomSamsung’s Harman to buy French audio software firm FLUX::

Tech, Media & TelecomSamsung’s Harman to buy French audio software firm FLUX::Nov 10, 2023 (Gmt+09:00)

-

Oct 31, 2023 (Gmt+09:00)

-

Korean Innovators at CES 2023Samsung, Harman unveil in-vehicle driver alert system

Korean Innovators at CES 2023Samsung, Harman unveil in-vehicle driver alert systemJan 06, 2023 (Gmt+09:00)