-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Snack maker Orion to pursue M&As, expand Vietnam facility

Food & Beverage

Snack maker Orion to pursue M&As, expand Vietnam facility

The brand, well-known for snack cake Choco-Pie, posts record earnings in 2022, driven by brisk sales in Vietnam and Russia

By

Feb 08, 2023 (Gmt+09:00)

2

Min read

News+

South Korea’s confectionery and snack maker Orion Corp. reported its largest-ever earnings last year, driven by strong sales in emerging markets such as Vietnam and Russia.

Buoyed by the results, Orion, well-known for its signature snack cake Choco-Pie, will build its third factory in Vietnam, while looking for M&A targets in the food and beverage industry.

“The new factory will cover demand from cities surrounding the Mekong River and from India, too,” said an Orion official.

Orion runs two factories in Vietnam, one each in Hanoi and Ho Chi Minh. Their operation rate reached 118% as of December last year.

The new facility will be located in southern Vietnam, a company official said, without elaborating.

The medium-sized Korean food company has been striving to cater to local tastes and localize production.

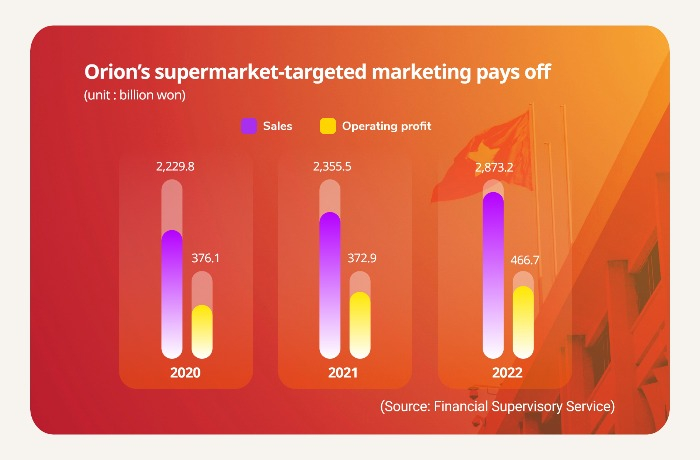

Particularly, Orion’s supermarket-targeted marketing has paid off in the Southeast Asian country. Small supermarkets, or mom-and-pop stores in traditional markets make up about 70% of its distribution channels.

Orion is among a handful of Korean food makers faring well despite an economic slowdown.

"Now that our operations (in Korea and other countries) generate a steady stream of revenue, we will actively chase M&A targets among domestic and overseas companies in the food and beverage industry," said the official.

Its operating profit jumped 25.1% on-year to a record 466.7 billion won ($370 million) last year, with sales up 21.9% to its largest-ever 2.9 trillion won on a consolidated basis.

Its operating margin came to 16.2%, or four to five times the average for food companies.

By country, sales in Vietnam and Russia surged 38.5% and 79.4%, respectively, far outstripping 16.3% growth in South Korea and a 14.9% increase in China.

GUMMY CANDIES, SNACKS

Orion’s Boom Jelly was a big contributor to its Vietnamese sales. According to the company, its sales reached 9.8 billion won last year, just half a year after it began to be locally produced.

To compete with Haribo, the No. 1 gummy candy worldwide, Orion introduced its heat-resistant gummies suitable for mom-and-pop stores with a lack of refrigeration.

Its potato snacks O’Star and Swing have maintained top spots in Vietnam since beating Pepsico Inc.’s popular Lay’s potato chips in 2017.

To cater to the Vietnamese, Orion has introduced various, localized flavors such as potato snacks with spicy, red-pepper, seaweed and egg yolk tastes.

"Vietnamese tend to go to the stores they already know and frequent and pick foods they're accustomed to," said Lee Dae-sung, a senior research of Orion’s global research institute.

Sales of both O’Star and Swing stood at a combined 70.9 billion won in Vietnam last year, up 39.5% on-year.

Rice cracker An enjoyed 13.4% on-year growth in sales to 38 billion won in Vietnam. A bag of snacks sells for 300 won, or about 25 cents in US dollar terms, in the country.

In July of last year, Orion set up a global snack research house at its headquarters to develop flavors specific to its target markets.

Write to Gyeong-je Han at hankyung@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Dec 22, 2022 (Gmt+09:00)

-

Jul 13, 2022 (Gmt+09:00)

-

Feb 23, 2021 (Gmt+09:00)