-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

SK Hynix to invest $14.6 bn to build HBM plant in S.Korea

Korean chipmakers

SK Hynix to invest $14.6 bn to build HBM plant in S.Korea

The S.Korean memory giant was set to build a NAND fab at the site but changed the plan to meet rising HBM demand

By

Apr 24, 2024 (Gmt+09:00)

4

Min read

News+

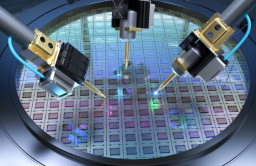

SK Hynix Inc. will spend 20 trillion won ($14.6 billion) to build a new memory chip manufacturing plant on a site originally designated to build a NAND flash memory facility in North Chungcheong Province to cement its leadership in the high-performing memory chip market by meeting burgeoning demand amid the AI chip boom.

On Wednesday, the board of directors of South Korea’s second-largest memory chip producer approved an agenda to produce dynamic random access memory (DRAM) chips, instead of NAND memory chips, from the M15X fab planned to be built in Cheongju, North Chungcheong Province.

It has earmarked a total of 20 trillion won to build the DRAM fab, including 5.3 trillion won to construct the building and the remaining to purchase machinery and equipment.

SK Hynix expects to be able to start mass production of DRAM chips at the new plant in November next year, earlier than expected, as it has completed excavation at the lot for the earlier-planned NAND memory plant, thus it is ready to construct the building and to install equipment and machinery.

The M15X fab is expected to churn out 100,000 sheets of 12-inch DRAM wafers monthly.

The Korean chipmaker, also the world’s No. 2 memory player, has decided to give up NAND production to expand DRAM lines in a preemptive move to meet rapidly growing demand for high value-added DRAM products such as high-bandwidth memory (HBM) and double data rate 5 (DDR5) chips, essential parts in running AI chips.

“This decision has been made to respond to burgeoning AI chip demand,” said an official at SK Hynix. “The company has made the change because the M15X site is also near the M15 fab, in which HBM packaging lines are being added.”

Last year, SK Hynix started adding new HBM chip packaging lines to the M15 fab in Cheongju.

The chip maker, also the world’s leading HBM chip producer, expects its HBM chip sales will increase at a compound annual growth rate of 60% in the next five years thanks to the global AI boom.

Companies like Nvidia Corp., which produce AI accelerators or machine learning processors with HBM chips, are willing to make advance payments to SK Hynix to ensure a seamless supply of HBM chips without delay to meet expected demand for AI chips in the generative AI era.

HBM OUTPUT FALLS SHORT OF DEMAND

According to Goldman Sachs, the global HBM market is forecast to expand to $23 billion in 2026 from $3.3 billion in 2022 on surging demand.

HBM is a high-performance DRAM chip made of eight or 12 DRAM chips vertically stacked together to speed up data processing and increase bandwidth. It is an essential part of an AI accelerator with a graphics processing unit.

SK Hynix is the global leader in producing HBM chips, controlling more than half of the entire HBM market partly thanks to its close ties to its biggest customer Nvidia, the world’s No. 1 AI chip company.

It even commanded more than 90% of the market for more advanced HBM chips that are fifth generation and above, such as HBM3 and HBM3E.

But SK Hynix’s HBM chip production capacity falls short of the strong demand. In general, HBM production requires not only highly advanced manufacturing technology and complex fabrication processes but also twice as much manufacturing facility space to churn out the same amount matching that of conventional DRAM chips.

“We should have a manufacturing facility ready to produce chips promptly upon receiving orders,” a SK Hynix official said. “Capex will change depending on market conditions."

HOME FOR ADVANCED CHIP PRODUCTION

Chip industry observers expect that SK Hynix's investment in the M15X fab will ease concerns about the chipmaker’s advanced memory chip production capacity.

SK Hynix’s total DRAM production capacity is less than half that of its bigger memory rival Samsung Electronics Co., spurring concerns that Samsung will eventually beat SK Hynix in the HBM race.

With the aggressive DRAM output expansion plan, SK Hynix is expected to up the ante in the HBM battle to take a firm grip on both technology and production capability.

The addition of the M15X DRAM fab is also expected to place Korea on the front line of semiconductor production, reaffirming Korea’s position as a global cutting-edge chip-producing hub.

“The M15X will become a core facility producing AI memory chips for customers across the world,” said Kwak Noh-jung, chief executive officer and president of SK Hynix.

“I am confident that the latest investment will propel another big leap, contributing to not only the company but also the future of the national economy.”

Write to Jeong-Soo Hwang, Eui-Myung Park and Chae-Yeon Kim at hjs@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacy

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacyApr 19, 2024 (Gmt+09:00)

-

Korean chipmakersSK Hynix mass-produces HBM3E chip to supply Nvidia

Korean chipmakersSK Hynix mass-produces HBM3E chip to supply NvidiaMar 19, 2024 (Gmt+09:00)

-

Jan 25, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chip

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chipNov 14, 2023 (Gmt+09:00)

-

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

-

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIW

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIWSep 11, 2023 (Gmt+09:00)