-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

S.Korea’s hottest stock EcoPro may miss invitation from MSCI Korea in May

Korean stock market

S.Korea’s hottest stock EcoPro may miss invitation from MSCI Korea in May

Overvaluation concerns over EcoPro, Kosdaq's No. 2 market-cap stock, are rising following its bull run

By

Apr 19, 2023 (Gmt+09:00)

3

Min read

News+

Cosmo Advanced Materials & Technology Co. and Hanwha Aerospace Co. are expected to join the MSCI Korea Index next month but South Korea’s hottest stock EcoPro Co. may be left out of the list following its recent overrun.

Korean securities firms Samsung Securities Co., Yuanta Securities Korea Co. and Daol Investment & Securities Co. projected on Tuesday that Cosmo Advanced Materials & Technology, Hanwha Aerospace, KT Corp. and Kumyang Co. are highly likely join the MSCI Korea Index on May 12 when the New York-based indexing company conducts a regular reshuffle of the index as they have met some major requirements to join the index such as the minimum market capitalization.

Samsung Securities estimates the minimum market cap and free float-adjusted market cap requirements for securities to be added to the MSCI Korea Index are 4.5 trillion won ($3.4 billion) and 1.5 trillion won, respectively.

Free float-adjusted market cap is calculated with only shares readily available in the market while excluding locked-in shares, such as those held by insiders or promoters.

The market caps of Cosmo Advanced Materials & Technology and Hanwha Aerospace each stood at 5.5 trillion won based on each stock’s closing price on Wednesday. Kumyang’s market value amounted to 4 trillion won.

The ratio of each company’s free float market cap also topped 50%, meaning they meet the criteria for inclusion in the index.

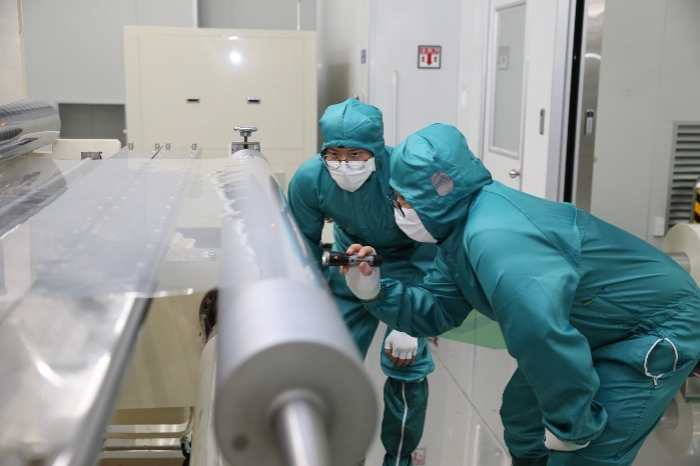

Cosmo Advanced Materials & Technology is a major cathode materials producer in Korea. Cathode is a core material of a lithium-ion battery, and the company consecutively reported record-breaking earnings in 2021 and 2022.

Hanwha Aerospace is a Korean defense system and aircraft engine manufacturer that is considered Korea’s answer to Elon Musk’s Space X.

Many local securities research houses expect KT to be reinvited to the MSCI Korea Index as the proportion of its foreign holdings against the maximum foreign share ownership has dropped, meaning more room for non-Korean investors to buy KT shares.

ECOPRO MAY MISS CHANCE

Eyes are on whether EcoPro, one of the most loved stocks by Korean retail investors recently, could become an MSCI Korea member after flying high on the rosy outlook for the electric vehicle battery materials market given the EV boom.

Shares of EcoPro, the holding firm of Korea’s top cathode manufacturer EcoPro BM Co., have zoomed by over six times so far this year. EcoPro BM's share price has also nearly tripled in the same period.

EcoPro BM is the biggest market-cap stock on Korea’s secondary Kosdaq market, with 28.8 trillion won in market value, followed by EcoPro with 15.9 trillion won.

EcoPro's market value is big enough to join the MSCI Korea Index, but analysts remain skeptical about it, citing the stock's overvaluation.

MSCI is known to identify an overvalued stock as one of which the relative return against its peers in the same industry exceeds 400% in the 60 trading days from its index shake-up date, and such a stock is not eligible to join its indexes.

Foreign investment banks such as Goldman Sachs and Morgan Stanley, as well as local hedge funds have recently upped their short-selling bets on EcoPro BM and EcoPro in anticipation of their decline following their recent flights.

EcoPro shares on Wednesday dropped 6.1% to end at 616,000 won.

Cosmo Advanced Materials & Technology also ended down 2% at 180,200 won while Hanwha Aerospace retreated 0.6% to 108,300 won.

Write to Tae-Ung Bae at btu104@hankyung.com

Sookyung Seo edited this article.

More To Read

-

PerspectivesSouth Korea’s MSCI campaign has time problem

PerspectivesSouth Korea’s MSCI campaign has time problemApr 14, 2023 (Gmt+09:00)

-

Mar 17, 2023 (Gmt+09:00)

-

Korean stock marketKakao Pay joins MSCI Korea Index

Korean stock marketKakao Pay joins MSCI Korea IndexFeb 10, 2023 (Gmt+09:00)

-

Aug 12, 2021 (Gmt+09:00)