-

KOSPI 2697.67 -22.97 -0.84%

-

KOSDAQ 734.35 -1.94 -0.26%

-

KOSPI200 359.62 -3.46 -0.95%

-

USD/KRW 1381 -7.00 0.51%

Future Unicorns

Future Unicorns

Wisely

Consumer goods

Wisely is a startup that offers a subscription service for razor blades and other grooming products. With an online direct to consumer (D2C) model, the company eliminates distribution margins and offers a price that is one third of its competitors. The founder says Wisely will grow to become the next generation’s P&G by expanding product lines to other consumer goods. Altos Ventures was a series A investor in 2018.

Published: 2020-09-20 01:05:16

Last updated: 2023-05-25 14:31:39

- Story

- Data

Korea's Take on Dollar Shave Club Eyes Future as Asia's P&G

“Why are these so expensive?”

It was 2012, and Dongwook Kim, now CEO of Wisely Co., Ltd, had just begun living alone as a student at Korea University. He had gone to the supermarket to buy some essentials, only to remove the razors from his shopping basket after seeing the price. Four Gillette razors were 27,000 won, more expensive than water, toothpaste, laundry detergent, and fabric softener combined.

“I never knew how expensive razors were because my mom bought them when I lived at home. After I saw how much they were, I resorted to using outdated razors or disposable ones. At times, the shaven areas would sting and I’d cut my chin but I just couldn’t get myself to buy an expensive new razor,” Kim says. “That was when I first realized there is something wrong with this market.”

And so began the story of Wisely: A startup shaking up the shaving products market with a subscription service for good-quality razors at a third of usual retail prices.

Contents

Click to move to each section

- [Problem to Solve] Manufacturing Cost to Sales Ratio 5% ... the Monopoly Bubble

- [Value Proposition] Lower price, good shaving habits, credibility

- [Team Building] Beta Service Begins in the Apartment Livingroom

- [Revenue Model] Revenue per Customer is 2.2x higher than Competitors ... 90% repurchsing rate

- [Customer Engagement] Customers request for afterparty post-FGI: 'We want to give feedback for improvement'

- [Threat of new entry] “Not a replicable strategy unless you commit 100% to a D2C model

- [Scalability] “Aiming to become Asia’s P&G”

- [Funding] Preparing to raise Series B funding

[Problem to Solve] Manufacturing Cost to Sales Ratio 5% ... the Monopoly Bubble

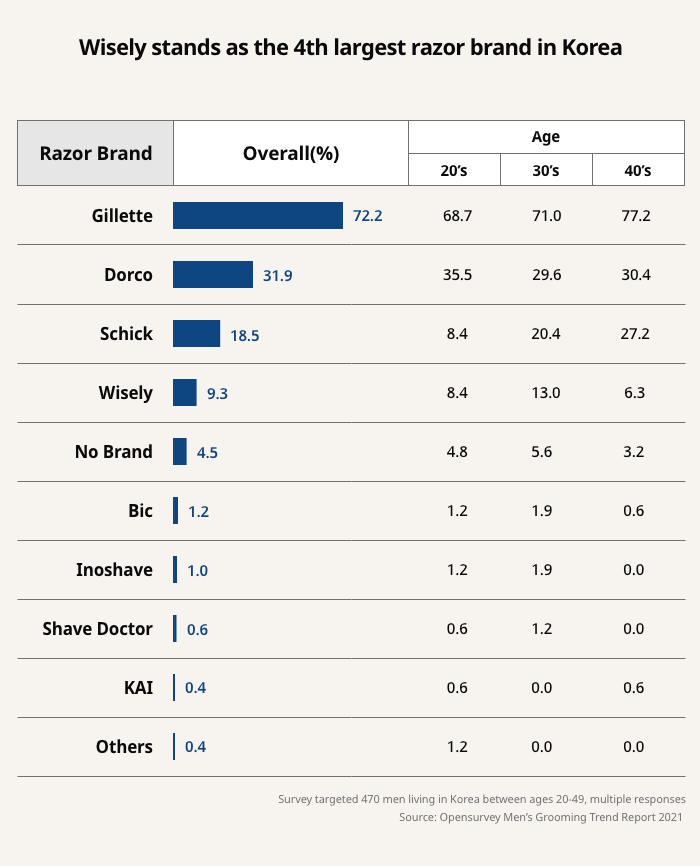

First, Kim saw that the oligarchical structure of the razor/razor blade market in Korea was the fundamental cause for the high blade prices. He learned that Gillette accounted for over 70% of the market, with Dorco and Schick sharing the remainder. Patents and capital power were tough entry barriers. Gillette had a dominating relationship with the major distributors through its capital and brand power, the reason why Gillette products are the most accessible at supermarkets and convenience stores. Also, each razor blade product comes with dozens of patents attached to it, meaning that new players entering the market face the risk of patent lawsuits. All this was fertile soil for the big three companies to secure high market shares with frontrunner Gillette raking in an operating profit of 30%.

The second problem was the distribution structure. Razors are generally sold in large supermarkets, convenience stores, and H&B stores which all have high distribution margins. Some have distribution margins close to 50%, and the high distribution fees are passed on to consumers in high retail prices.

The third problem was endorsing a growth strategy based on price hikes. Major players, including Gillette, continued to launch new products at higher prices to fuel sales in the razor market, which already has a fixed size. This strategy boosts revenue by opting to increase price over quantity. The release of expensive new products pushed older products off the shelf, leaving consumers with no choice but to purchase new, expensive products.

“I examined the distribution structure and calculated the manufacturing cost to not even reach 5%. It got me thinking that if I were able to disrupt the dysfunctional market structure, then I’d be able to provide good quality razor blades at reasonable prices. That’s when I began considering starting my own company,” says Kim.

[Value Proposition] Lower price, good shaving habits, credibility

The service that opened in Korea was modeled after the US company Dollar Shave Club, launched in the US with a mission to: 1) offer razors at a reasonable price; and 2) make it easier to purchase razors. It provided regular delivery service for existing razor brand products from companies such as Dorco. The company was very well received in the US and eventually acquired by a consumer goods company Unilever for $1 billion in 2016.

“The company that launched in Korea provided regular delivery service for Schick products. It was cheaper than large supermarkets, but more expensive than Coupang, a leading e-commerce platform in Korea. It made the purchasing process more convenient, but I didn’t think that held much value in Korea,” says Kim. “In the US, you drive to Walmart to buy a single razor, and then it’s secured with an anti-theft device so you have to call a shop assistant to buy one.” Enter Dollar Shave Club.

“But this is not an issue in Korea. Here in Korea, you walk for five minutes and you’ll find many convenience stores and we even have same-day delivery service.”

Kim identified two key pain points for local razor consumers. First, good quality razors are expensive, and second, users often forget to replace razor blades. As a result, many consumers use low-quality and/or outdated razor blades for a long time, which causes skin problems and frequent cuts to the chin. These pain points could be addressed by offering significantly lower-priced razor blades, without compromising on quality, through a subscription service.

Dedicated to securing high-quality products, Kim sought out a German manufacturer with technology equivalent to Gillette instead of reselling existing brand products. After two years of research, exhaustive legwork, and much persuasion, Wisely partnered with a German company having 100 years’ history making razor blades. Thus, Kim was able to sell premium razors without worrying about any patent lawsuits.

Further, Kim adopted a Direct-to-Consumer (D2C) model for the products on the company website. By doing so, he wiped out distribution margins and could drastically lower product prices. Many large e-commerce companies such as Auction and Coupang courted Wisely, but Kim held firm on the zero-distribution margin – as e-commerce platforms also gain on margins, even if less than large offline retailers.

Following the decision to eliminate distribution margins, Kim focused heavily on product design and packaging to build credibility and consumer trust in high-quality products.

“The reason why inexpensive private-label company products don’t sell well is because they don’t pay attention to packaging and design, which gives the impression the products are cheap,” says Kim.

“Korean consumers tend to associate a product’s poor design and presentation as indicators of poor quality. We don’t advertise our affordable price. Instead, we communicate that we are an innovative and honest startup intending to change an unreasonable market structure. We pay a lot of attention to the branding and design.”

Kim chose a regular delivery subscription service as its sales method. Customers would input their skin type and shaving habits on the customized website, and then receive specific recommendations on products and replacement period. The strategy was to regularly replace razor blades to prevent skin problems and to endorse healthy shaving habits.

In brief, Wisely’s value proposition was to: 1) maintain premium quality and brand credibility; 2) dramatically lower costs; and 3) promote healthy shaving habits through a new concept of regular delivery service. To this end, Wisely opted to forego all distribution channels and stick solely to the D2C model.

[Team Building] Beta Service Begins in the Apartment Livingroom

After leaving his job, Kim made his apartment living room the distribution center and launched a beta service named ‘Square Shave’. His daily routine included packaging products until 8:30pm which is when the delivery man came, and then eating his first meal late at night after shipping off the products. His younger brother Younho Kim, current Team Lead at Wisely, had just joined Google Korea at the time and would come to help Kim after work. Just two months after launching the beta service, they were able to secure 4,000 customers.

The company’s official establishment was in September 2017 with three co-founders: Kim as the CEO, his former P&G colleague Youngpyo Jeon as the Director, and his younger brother Younho as the Team Lead.

Jeon, current CFO/COO at Wisely, had joined P&G the same year as Kim. He was also the co-founder of Bagel Labs, a provider of Smart Tape Measure. In 2017, Jeon left Bagel Labs and was preparing to set up a new business when Kim persuaded him to join Wisely. Now Jeon is in charge of product planning, logistics, production, and finance at Wisely thanks to his previous experiences of launching a manufacturing startup and handling sales planning and finance at P&G.

Younho, Kim’s younger brother, had led a double life by handling advertisement sales at Google during the day and helping his brother at night. One day, Kim told him to choose between the two to get something done successfully and properly. Younho chose Wisely.

“I brought my brother into this team because I was confident of his performance and level of execution,” Kim says.

“In the beginning, Younho was in charge of finding packaging providers. He went and met with 50 businesses at Bangsan Market in Jongno and became really close with a few of them. Soon, he completely learned their ecosystem and ultimately, we were able to purchase directly from the manufacturer instead of having to go through a middleman,” says Kim. It was this type of fierce execution style that Younho brought to the company and now he is in charge of developing a new brand for Wisely. He is also responsible for creating a long-term plan for the company and handling marketing and customer relationships.

One thing that sets Wisely apart from other startups is that it created a People Team from the start. Wisely had five executive and employees including the founders when they hired Yeawon Choi, a former BCG Consultant, as the Head of People Team. She was the sixth member of the company, and the third employee excluding the co-founders. This was an extremely unconventional move considering that startups generally start discussing company culture when there are over 20 employees, and create a People Team when there are about 100 employees.

“We recruited the Head of People Team when we were just a company of five, including the co-founders. Even our investor Altos Ventures was puzzled by this decision, but we believed that we would need to establish a good and sound culture from the start to be a sustainable company,” Kim says.

Choi joined the team about a year after the co-founders had worked together. It was a small organization, but their work culture had already been established to some degree. Choi saw that even if she were to replicate a superb Silicon Valley company culture, it would not be easy to implement it into Wisely. Instead, Choi decided to nurture the strengths from the existing Wisely company culture, and the co-founders agreed. Choi proceeded by interviewing the co-founders and came up with ‘7 Ways of Working for Wisely Team’.

2. Prioritize user experience: Be a step ahead of customers and offer the best user experience

3. Prioritize and concentrate: Focus on the 20% core task that leads to the 80% result

4. Long-term perspective: Look beyond short-term performance and results.

Make decisions based on long-term growth.

5. Voluntary leadership: Leadership flows from bottom to top. Every team member should think and perform like a leader and propose high-level responses.

6. Critical thinking and rational discussions: Make reasonable decisions through logical, honest, and mature discussions

7. The will to do the right thing: Act ethically and legally for customers, society, Wisely’s team, and competitors

“The first was to obsess over high quality. It’s basically setting the highest standards and refusing to compromise completion. Often startup communities speak of ‘act fast, fail fast’, but Wisely is not a free social media platform like Facebook. It’s a company that makes household goods that consumers pay for, meaning that a single mistake could require years of recovery. We set up a culture that focuses on minimizing mistakes while aiming for perfection from the very beginning.”

[Revenue Model] Revenue per Customer is 2.2x higher than Competitors ... 90% repurchsing rate

According to a survey which targeted 470 men living in Korea between ages 20-49 (multiple responses included), Wisely posted 9.3% usage between 2020 and 2021, up by 3.3% point from the year-earlier period -- a reflection of its reasonable price, premium quality, and positive customer experience. Wisely came fourth in Korea after Gillette, Dorco, and Schick.

The profit margin is important. Wisely sells razor blades at a third the price of the big razor players, and also engages in intensive SNS marketing, though perhaps not as much as Gillette. Their shipping costs are also quite high. So what if their deficit increases along with their increased revenue?

Kim isn’t worried. “We’re in the red for now, but we will soon switch over to surplus and see an increase in profit margin.”

The repurchasing rate is key to Wisely’s confidence. Over 90% of Wisely customers repurchase the company’s products. The customer acquisition cost is substantial in the early process of securing customers, but the cost is decreasing day by day. Thus it’s a structure where the profit ratio will increase as marketing costs are reduced relative to sales.

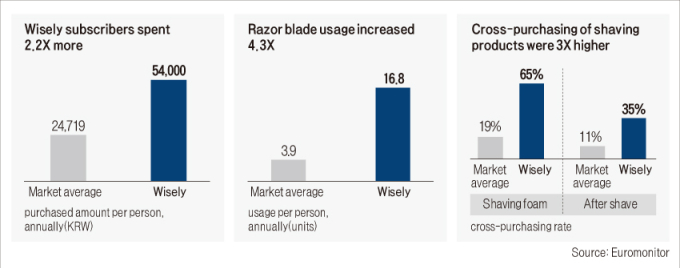

Also, Wisely customer spending per capita is twice as much as its competitors. On average, Korean men spend about 25,000 won annually on shaving products, but Wisely customers spend about 54,000 won. Wisely’s low price and regular delivery service result in higher razor-blade consumption than that of their competitors’.

Also, the purchasing rate for shaving-related products such as shaving gel and aftershave is significantly higher than the market average.“The average rate of purchasing shaving gel with razor blades is 19%, but it is about 65% for Wisely customers. When a customer orders various products in a single order, it raises our profit rate since the shipping cost is lower relative to sales.”

[Customer Engagement] Customers request for afterparty post-FGI: 'We want to give feedback for improvement'

In February 2018, Kim missed quality time with his family during the Lunar New Year holidays following strong response to a Facebook post, wherein he had discussed the unfair structure of the razor market and Wisely’s solution. The post unleashed a flood of comments and Kim was tied to his phone all day replying to each of them.

“The comments were explosive,” Kim remembered. “When I personally responded to every one, people said that I was crazy and posted even more comments. We ended up getting 30,000 comments and 24,000 shares. This is still talked about as a successful case of content marketing.

“The next morning our sales numbers were weird; the figures were too high to make sense. We had hit the jackpot. We received more orders than we could handle so we had to ask our German manufacturer to make products in advance with deferred payment.”

This type of active customer engagement, which Wisely has demonstrated from the beginning, may explain the strong customer participation whenever Wisely holds a Focus Group Interview (FGI) for product planning, and why attendees often request an after-party. “Our customers like to talk with us and provide feedback,” Kim says. “Some 99% of the reviews posted on social media are written voluntarily by our customers.”

Wisely released its second-generation razor, Wisely 2.0, in April 2020, a product of customer engagement. After launching its first product in February 2018, the company carefully examined customer reviews and began developing its second-generation razor in June of that year. The direction of the product upgrade was solely based on user feedback. Wisely noted that there were consumers who complained of redness, swelling and cuts on the chin, which made skin protection a main priority.

Analyzing customer experiences and finding a solution led to the ‘case and dock’ feature, a design feature that has received the most attention. There were complaints that razors fell easily when placed on the sink, as well as requests for a portable case suited for traveling. This prompted Wisely to create a stand to hold the razor upright instead of lying flat on the sink. Wisely also asked its collaborator Aruliden, a design studio in New York, to combine a standing dock feature into a portable case. This led to the creation of a portable case in which a razor can stand upright if the case is put on a flat surface.

Celebrating the release of its second-generation razor, Wisely gave away 100,000 razors to existing customers. Kim says that it was to thank the customers who helped them build the brand. Customers who received the new product posted pictures of the razor on Instagram with the hashtag #Wisely – there were about 400 to 500 posts per day.

[Threat of new entry] “Not a replicable strategy unless you commit 100% to a D2C model

“It won’t be easy for competitors to copy Wisely’s model,” says Kim. This is due to the longstanding relationship between the manufacturer and retailer.

For example, traditional consumer goods manufacturers such as P&G and LG Household & Health Care would find it difficult to implement the D2C model. This is because major retailers will not sit back and watch manufacturers sell products at a cheaper price on their websites instead of offline stores, Kim explains.

It is also not easy for major retailers to enhance their private label products because it will take over the manufacturers’ premium products that are already in stores. Not only will there be a reverse growth in revenue, but also a tainted relationship with manufacturers.

“Unless companies introduce a 100% D2C model which frees them from other distribution channels, they will be face limitations in acquiring user data or marketing strategies,” Kim said adding “that’s a hard strategy for existing companies to follow.”

[Scalability] “Aiming to become Asia’s P&G”

“Often, the products do not contain enough of the advertised ingredients to have a real effect. With the D2C model we can eliminate the distribution margin and use the savings on products.”

Wisely believes this will allow them to create products that contain enough of the active ingredient to make a difference. Also, the company has earned a reputation for credibility, which means there is no need for excessive advertisement or marketing. Wisely is currently conducting clinical trials on scalp care products.

Wisely’s greatest asset is its lock-in effect, a virtuous cycle where marketing and shipping costs decrease relative to sales due to increased repurchasing and cross-selling as a result of customers satisfied with the quality and service of the D2C platform.

“For example, test trials are important in cosmetics marketing,” Kim says, “Wisely includes samples in its shipping boxes so we are able to introduce our new products without additional costs and also offer bundle discounts.”

South Korea accounts for the world’s largest grooming market, and it serves as a growth platform for Wisely. According to Euromonitor, 34% of South Korean men use skincare products or go to hair salons at least once a week. This figure jumps to 58% if narrowed down to men born since 2000.

“The APAC region accounts for 65% of the world’s grooming market,” Kim says. “It is culturally homogenous with the Korean market, so we believe we will be able tap into the Asian market while maintaining our brand influence.”

Wisely’s mid-term goal is to become a leading company in the Asian grooming market, and its long-term goal is to become the next-generation’s P&G.

“The household products market is far from innovative. It’s a market where consumers prefer ‘buy one, get one free’ products over their favorite brands,” says Kim.

“Wisely’s vision is to transform an unreasonable market structure to help customers spend more wisely.”

In this way, the Wisely name aptly reflects Kim’s philosophy, which calls for “wise spending.”

[Funding] Preparing to raise Series B funding

Then Wisely received Series A funding from Altos Ventures seven months after establishing the company. Han Kim, the CEO of Altos Ventures, said they invested into Wisely because it is an ‘innovative organization’. He says “Wisely provides a daily essential product at a reasonable cost with good quality. It helps customers start their day in a good mood and that’s innovation.”

Wisely is currently preparing to raise Series B funding. It has gained much interest from existing investors, partners, and both domestic and overseas investors.

Wisely Razor Unboxing

By Gayung Chu and Hanjong Choi; edited by Danbee Lee

(gychu@hankyung.com)

- [Problem to Solve] Manufacturing Cost to Sales Ratio 5% ... the Monopoly Bubble

- [Value Proposition] Lower price, good shaving habits, credibility

- [Team Building] Beta Service Begins in the Apartment Livingroom

- [Revenue Model] Revenue per Customer is 2.2x higher than Competitors ... 90% repurchsing rate

- [Customer Engagement] Customers request for afterparty post-FGI: 'We want to give feedback for improvement'

- [Threat of new entry] “Not a replicable strategy unless you commit 100% to a D2C model

- [Scalability] “Aiming to become Asia’s P&G”

- [Funding] Preparing to raise Series B funding