-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

MBK signs $2 bn deal to acquire 3D dental scanner firm Medit

Mergers & Acquisitions

MBK signs $2 bn deal to acquire 3D dental scanner firm Medit

The deal represents MBK’s first megadeal in Korea this year as its previous bids for Kakao Mobility and MegastudyEdu went awry

By

Dec 29, 2022 (Gmt+09:00)

3

Min read

News+

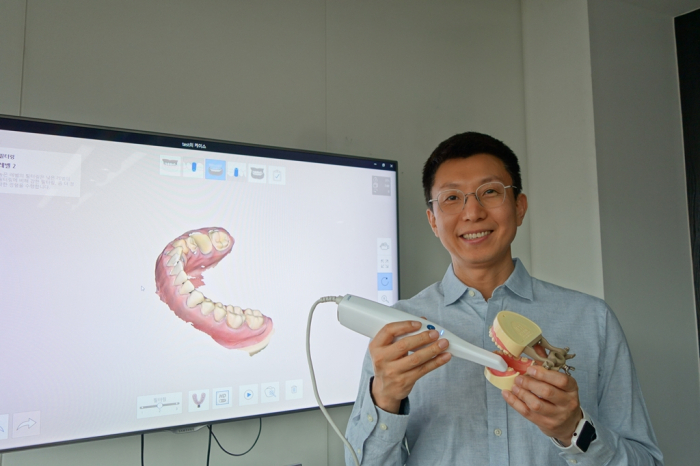

Asia-focused private equity firm MBK Partners is acquiring Medit Corp., the world’s third-largest 3D dental scanner maker, for 2.45 trillion won ($2 billion).

MBK on Thursday signed a share purchase agreement to buy a 99.5% stake in the South Korean digital dental equipment maker from Unison Capital Korea, Medit’s top shareholder, investment banking sources said.

Citigroup Global Markets advised on the deal for Unison Capital Korea.

The two sides plan to complete the transaction by February, sources said.

Minho Chang, Medit's founder and a Korea University mechanical engineering professor, and his friendly shareholders, who also sold their stakes, plan to reinvest most of their proceeds in the company to remain MBK’s business partners, sources said.

Following the deal, MBK will hold a 70% stake in Medit while Chang and his related parties will own the remaining 30%.

Last month, MBK was chosen as the preferred negotiator for the Medit acquisition after earlier talks between the seller and potential buyer – a consortium led by US-basd PEF The Carlyle Group and Korea’s GS Holdings – went awry.

MBK was known to have offered about 2.7 trillion won for the deal, lower than the Carlyle consortium’s proposed bid of 3 trillion won.

After talks with the Carlyle consortium failed, Unison Capital and its advisor opened sales talks with other bidders, including global PE firm Kohlberg Kravis Roberts & Co. (KKR), CVC Capital Partners and MBK Partners.

FOUNDER TO REINVEST PROCEEDS IN MEDIT

Founder Chang, who studied at MIT, established Medit in 2000.

Unison Capital Korea acquired a 50% stake plus one share in Medit for about 320 billion won in 2009.

Medit’s products are competitive as they can shape the tooth structure in less than a minute, unlike their competitors' which use rubber clay or plaster molds that take hours to achieve the same outcome. With Medit's digital equipment, a dental prosthesis can be manufactured in a single day. Previously, it took more than a week to make one.

The digital dental scanner market is still in its infancy, accounting for less than a 30% share of the US and European markets.

Medit’s competitors in the 3D digital scanner market include 3Shape, Envista Holdings Corp. and Align Technology.

Medit’s earnings before interest, taxes, depreciation and amortization (EBITDA) nearly tripled to 103.9 billion won last year from 36.7 billion won in 2019, with sales more than doubling to 190.6 billion won from 72.2 billion won during the period.

The company’s 2022 sales and EBITDA are expected to rise over 40% on-year to 270 billion won and 150 billion won, respectively, according to industry forecasts.

MBK’S FIRST MEGADEAL THIS YEAR IN KOREA

For MBK Partners, the Medit purchase represents its first megadeal in the trillion won range in Korea’s M&A market this year.

The PEF had earlier tried in vain to acquire Kakao Mobility Corp., the country’s No. 1 taxi-hailing app, and MegastudyEdu Co., Korea’s top online education company.

MBK is known to be acquiring Medit through its $6.5 billion Fund V, which it created in 2020.

The blind fund has invested in other Korean companies, including e-commerce firm Koreacenter Co., Dongjin Textile Co. and Kyung Jin Textile Co.

With the purchase of Medit, MBK’s Fund V has used some 35% of its funding pool, investment banking sources said.

Write to Chae-Yeon Kim at Why29@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Mergers & AcquisitionsMBK to buy Medit at lower price than Carlyle-GS bid

Mergers & AcquisitionsMBK to buy Medit at lower price than Carlyle-GS bidNov 29, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsSale of Korean dental scanner maker Medit fails

Mergers & AcquisitionsSale of Korean dental scanner maker Medit failsNov 14, 2022 (Gmt+09:00)