-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

SkyLake offers to fully take over BusinessOn; stock rallies

Mergers & Acquisitions

SkyLake offers to fully take over BusinessOn; stock rallies

The S.Korean PE agreed to buy 70.7% of the country’s No. 1 digital tax invoice provider in late July

By

Aug 12, 2024 (Gmt+09:00)

2

Min read

News+

Seoul-based private equity firm SkyLake Equity Partners has offered to buy the remaining shares of BusinessOn Communication Co., South Korea’s leading digital tax invoice provider, and will delist it, the company said in a regulatory filing on Monday.

Kosdaq-listed BusinessOn shares jumped 7.2% to end at 15,720 won ($11.46) apiece on the day on the news as investors bet on a further rise in its stock price during the tender offer scheduled from Aug. 12 to Sept. 2.

According to the filing, SkyLake will buy 6,579,452 shares, or 28.9%, of BusinessOn at 15,849 won apiece, a 17.9% premium to the stock’s monthly average price. The bid, which will cost SkyLake 254.5 billion won in total, includes employee stock options but not treasury shares.

The bid’s lead manager is NH Investment & Securities Co.

The offer comes less than a month after the Korean PE agreed to buy a 70.7% stake in BusinessOn from Praxis Capital Partners and other major shareholders of the latter last July.

If SkyLake succeeds in acquiring all of the remaining shares, it will own nearly 100% of BusinessOn. With full ownership, the PE plans to delist the company from the Kosdaq market, according to the filing.

Under the current law, the largest shareholder of a company with 95% or more, excluding treasury shares, can delist the company without other shareholders’ approval.

KOREA’S NO. 1 DIGITAL TAX INVOICE SERVICE

Founded in 2007, BusinessOn is Korea’s leading digital tax invoice software provider. It also offers other business-to-business portal services, ranging from digital contracts to market intelligence, banner advertising, approval of purchase issuing and supply chain management services.

It provides its services as a cloud-based software as a service (SaaS).

It reaped 16.4 billion won in operating profit on a 51.1 billion won revenue in 2023, up 35.8% and 16.3% from the prior year, respectively. It went public in 2017.

SkyLake will buy BusinessOn through its 12th blind fund worth 1.2 trillion won. Formed in 2023, the fund has already invested in EcoPro BM Co. and DeepX, a Korean neural network and artificial intelligence chip developer.

The Korean PE, founded in 2006, has an impressive track record of cashing out on its previous investments.

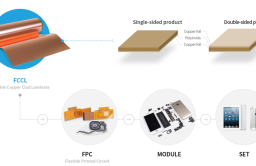

It exited from NexFlex Co., Korea’s No. 1 manufacturer of flexible copper-clad laminates (FCCLs) for smartphones, in 2023 with a huge profit.

It also succeeded in exiting from its investments in Solus Biotech Co. and Helinox.

It is currently seeking to cash out on its investment in a portfolio that includes SoftBank-backed Yanolja Co.

The PE's assets under management are estimated at 3.7 trillion won.

Write to Seok-Cheol Choi at dolsoi@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Artificial intelligenceDeepX attracts $80 mn new investment

Artificial intelligenceDeepX attracts $80 mn new investmentMay 10, 2024 (Gmt+09:00)

-

Tech, Media & TelecomKorean B2B cloud computing firm BusinessOn up for sale

Tech, Media & TelecomKorean B2B cloud computing firm BusinessOn up for saleSep 19, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsMBK to acquire Korea’s top FCCL maker NexFlex for $407 mn

Mergers & AcquisitionsMBK to acquire Korea’s top FCCL maker NexFlex for $407 mnMar 17, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsUK's Croda to buy Korean bio materials maker for $286 mn

Mergers & AcquisitionsUK's Croda to buy Korean bio materials maker for $286 mnFeb 02, 2023 (Gmt+09:00)