-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Hana Fin, Lotte Non-life lend $85 mn for US midstream project

Jul 29, 2019 (Gmt+09:00)

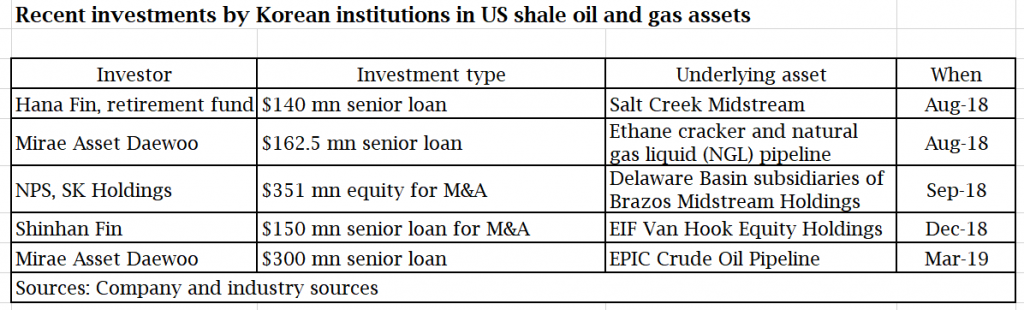

Hana Financial Investment Co. Ltd. and Lotte Non-life Insurance Co. Ltd. have lent $85 million in a mezzanine loan on Salt Creek Midstream LLC in Texas, as South Korean institutional investors are chasing US midstream assets for decent and stable yields.

The loan underwritten by the two South Korean firm represents about 40% of the latest mezzanine financing of $200 million raised for the project, according to sources of the companies on July 26.

Deutsche Bank underwrote $50 million of the credit package, with other unidentified institutions taking the remainder.

The yield of the mezzanine loan is expected to be about 10-11% per annum in US dollar terms and 9% in the Korean currency.

In comparison, the expected yield of a senior loan on the same project is 6.5-7% in US dollar terms and 5% after dollar/won currency hedging.

Salt Creek Midstream is a project company that offers gathering and processing of crude oil and gas produced in the Permian Basin that spans west Texas and southeastern New Mexico. It is a joint venture of ARM Energy Holdings LLC and funds managed by Ares Management LP.

HOTTEST AREA

With the US becoming the world’s largest crude oil producer, South Korean institutional investors have been chasing North America’s midstream assets on the upbeat outlook for US shale oil production which hit a new record in April.

Industry sources expect that Korean investors will continue their push into US midstream assets until at least next year.

Because supply of equipment used in midstream oil and gas processing falls short of rising demand, shale oil producers bear high borrowing costs to increase spending on midstream equipment, according to the sources.

“A number of strategic investors, including SK, are showing interest (in US midstream assets), too. It is the hottest area among overseas infrastructure assets,” said one the investment banking sources.

SK is the largest oil refiner in South Korea.

In comparison to the upstream sector which has uncertainties about output volume, midstream assets deliver stable returns with low risk.

A rate cut by the US Federal Reserve may narrow the interest rate differential between the US and South Korea and dent investment returns converted to the Korean won currency.

But long-term supply contracts sugned with energy companies such as ExxonMobil and Shell are likely to guarantee stable returns from LNG export terminals and relevant sectors.

“After building experience in debt investment, we are now increasing equity investment and diversifying beyond pipeline assets,” said an alternative investment company source. “As the US economy continues to grow and shale oil production is rising through next year, investment in relevant segments will gather further momentum.”

By Jung-hwan Hwang and Hyun-il Lee

jung@hankyung.com

(Photo: Getty Images Bank)

-

Foreign exchangeUS monitors NPS, sovereign funds in expanded currency oversight

Foreign exchangeUS monitors NPS, sovereign funds in expanded currency oversight16 HOURS AGO

-

Pension fundsNPS logs 0.87% return from first-quarter investment

Pension fundsNPS logs 0.87% return from first-quarter investmentMay 30, 2025 (Gmt+09:00)

-

InfrastructureKorea Post to commit $150 mn to mid-cap infrastructure funds

InfrastructureKorea Post to commit $150 mn to mid-cap infrastructure fundsMay 30, 2025 (Gmt+09:00)

-

May 29, 2025 (Gmt+09:00)

-

InfrastructureAustralian infrastructure offers compelling opportunity: QIC

InfrastructureAustralian infrastructure offers compelling opportunity: QICMay 29, 2025 (Gmt+09:00)