-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Hyundai Motor invests $100 mn in US battery startup SES

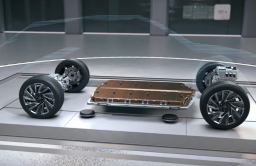

EV batteries

Hyundai Motor invests $100 mn in US battery startup SES

The automaker's latest investment is set to speed up its in-house battery development and boost Korea-US battery alliance

By

Jul 04, 2021 (Gmt+09:00)

4

Min read

News+

Hyundai Motor Co. is set to invest $100 million in US-based electric vehicle battery startup SolidEnergy Systems (SES) to obtain next-generation technologies for its in-house battery development.

According to investment banking industry sources on July 4, Hyundai Motor signed an equity investment agreement with SES last month. The investment will make Hyundai Motor one of SES' five major shareholders, along with SK Group, Singapore’s sovereign wealth fund Temasek Holdings Ltd., General Motors Co., and its founder, Qichao Hu.

Founded in 2012, SES is a spinoff of the Massachusetts Institute of Technology. The startup develops high-performance Li-Metal batteries, called all-solid-state batteries (ASSBs), which feature longer mileage and a shorter charging time than current electric vehicle batteries due to their higher energy density.

A STEP CLOSER TO IN-HOUSE BATTERY DEVELOPMENT

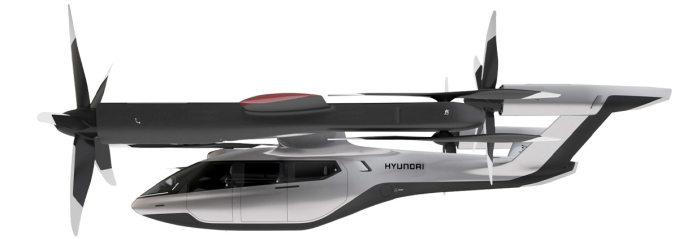

Hyundai Motor has been beefing up its research team to develop ASSBs ever since Chairman Chung Euisun identified future mobility, such as urban air mobility, as the group's future growth driver.

Industry watchers have interpreted Hyundai Motor's $100 million investment as a strategic move to drive in-house battery development alongside inking a partnership.

SES is also preparing to list on the New York Stock Exchange (NYSE) this year through a special purpose acquisition company (SPAC) merger, which may have been another factor behind Hyundai Motor's investment.

So far, SES and QuantumScape are the only two battery startups that have raised over $100 million from global automakers. Last September, QuantumScape went public via a SPAC merger with a valuation of $3.3 billion. On July 2, the company's market capitalization stood at around $10.8 billion.

SES is widely expected to be valued at more than $3 billion once listed.

KOREA-US BATTERY ALLIANCE EVOLVES

Industry experts expect the latest investment to strengthen the battery alliance between Korea and the US. The two countries already have a co-dependent relationship in the lithium-ion battery segment.

"The US wasn't able to lay the groundwork for battery manufacturing after its major battery maker A123 Systems went bankrupt in the early 2010s," said an EV industry official, explaining that Korean EV battery makers eventually filled the space as core suppliers.

Another driving force behind the Korea-US battery alliance is competition with China.

China's battery maker Contemporary Amperex Technology Co. (CATL) is currently the world's leading EV battery supplier and among the key beneficiaries of Volkswagen's decision to make batteries in-house for its electric cars and switch its battery type in favor of Chinese manufacturers.

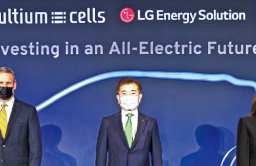

To keep China in check, Korean battery makers and US carmakers have fortified their partnerships. LG Energy Solution Ltd. has teamed up with GM to build two battery plants in the US. Also, SK Innovation Co. and Ford Motor Co. have agreed to launch a 6 trillion won ($5.3 billion) joint venture to set up multiple battery plants.

"Hyundai Motor and GM are also expected to put up a united front in the next-generation battery sector," said an investment banking industry official.

Hyundai Motor's investment in SES should serve as a stepping stone for the Korean automaker to tap into the urban air mobility market in the US, which is estimated to reach 360 trillion won in 2030.

Hyundai Motor has set up a corporate body dedicated to urban air mobility in Delaware after determining that the US would spearhead the commercialization of UAM.

"Hyundai Motor aims to roll out UAM services in the US by 2024," said a company official.

KOREAN BATTERY SUPPLIERS RUSH TO SECURE NEXT-GEN TECH

While global automakers speed up efforts toward in-house battery development, domestic battery suppliers are working hard to prepare effective counter-strategies.

Most of the battery makers expect the commercialization of all-solid-state batteries to occur after 2030 and their goal is to enhance the performance of lithium-ion batteries to offer the same degree of efficiency. For example, high-nickel batteries are considered an option.

"Having the technology and being able to mass-produce are two completely different issues," said a battery industry official, adding that even if automakers achieve in-house battery development, they may not be able to mass-produce at the desired price.

Write to Dong-hui Park, Byung-Uk Do and Jae-kwang Ahn at donghuip@hankyung.com

Danbee Lee edited this article.

More To Read

-

Electric vehiclesHyundai innovates EV manufacturing with smart factory system

Electric vehiclesHyundai innovates EV manufacturing with smart factory systemJul 02, 2021 (Gmt+09:00)

-

Jul 01, 2021 (Gmt+09:00)

-

Jun 23, 2021 (Gmt+09:00)

-

[Exclusive] EV batteriesSK Group eyes jackpot from investment in battery maker SES

[Exclusive] EV batteriesSK Group eyes jackpot from investment in battery maker SESApr 05, 2021 (Gmt+09:00)

-

EV battery plantsGM, LG to build second US EV battery plant in Tennessee

EV battery plantsGM, LG to build second US EV battery plant in TennesseeApr 19, 2021 (Gmt+09:00)

-

EV battery plantsLG Energy, GM in talks to build 2nd EV battery plant in Tennessee

EV battery plantsLG Energy, GM in talks to build 2nd EV battery plant in TennesseeMar 05, 2021 (Gmt+09:00)