-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Global supply crisis endangers S.Korea’s manufacturers

Supply chain

Global supply crisis endangers S.Korea’s manufacturers

Few companies have established 2022 business plans given growing uncertainty over supply of commodities, parts

By

Nov 09, 2021 (Gmt+09:00)

4

Min read

News+

A South Korean electric equipment maker has decided not to seek any new orders as a spike in prices of commodities such as copper and supply disruptions are expected to result in contract losses. “Extreme volatility in the commodity markets has made it really difficult to predict,” said a source at the company.

Companies in Asia’s fourth-largest economy are suffering from supply chain disruptions across all stages of production. A prolonged interruption in the supply chain may lead to a collapse in overall production, some analysts said.

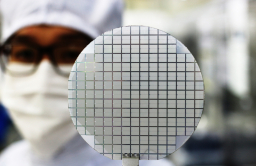

LS Electric Co., a South Korean electric power and automation equipment maker, recently spent about 40 times as much as before to buy analog chips for automation facilities that need about 4,000 units of the semiconductors, according to industry sources on Nov. 8. Among the chips, some 400 products such as power management integrated circuits (PMICs) and microcontroller units (MCUs) disappeared in the market due to the global semiconductor supply shortage.

LS-Nikko Copper Inc., the world’s second-largest electrolytic copper maker, and Korea Zinc Co., the world’s largest lead and zinc smelter, are scrambling for raw materials such as copper and zinc that the companies import for all their needs. That came as China constructed major smelters, ramping up non-ferrous metals production to meet all of the domestic demand, which is predicted to disrupt the global supply chain.

Surging energy and commodity prices was selected as the most important factor facing South Korean companies' management, according to a recent survey of research heads at local brokerage houses by the Federation of Korean Industries (FKI).

“Energy and commodities are likely to further weigh on the corporate sector next year,” said Kim Bong-man, who heads FKI's international cooperation division.

GLOBAL SUPPLY DISRUPTION

Global major companies are also suffering from supply chain disruption. They have had to suspend factory production even after piling up parts and raw materials whenever possible. The COVID-19 pandemic added to the supply chain disruption, while logistics costs surged amid rising crude prices.

Automakers were among the hardest-hit industries. Hyundai Motor Co. and its domestic peers are setting up production plans every week as they cannot predict how many key parts, including semiconductors, they can secure given the ongoing automotive chip shortage. Last year, they worked on monthly production plans even as they had issues with the supply of other parts such as wiring harnesses.

Ford Motor Co. produced 2.5 million vehicles in the first nine months of the year, down 36.2% from the same period in 2019 before the outbreak of the pandemic. The output of General Motors Co. and Renault-Nissan skidded 28.1% and 32.7%, respectively, while Hyundai and Kia Corp. logged a 14% decline in production during the period.

The global automotive chip shortage is estimated to slash car production by about 10.2 million units this year, according to market tracker AutoForecast Solutions. The shortage is expected to last until next year, it predicted.

German chip giant Infineon Technologies’ Chief Marketing Officer Helmut Gassel urged automakers to rethink their "just-in-time" supply chain strategy and instead start building up stockpiles of semiconductors in a recent interview with Nikkei Asia. "Just-in-time" supply chain management -- in which parts are delivered just as they are needed for assembly -- has been the norm in the auto industry for decades, as it helps minimize inventory and increase efficiency, according to the media.

NO 2022 BUSINESS PLANS YET

Most South Korean companies have yet to set up their business plans for 2022 as it is hard to establish plans for sales and marketing given the sustained disruption in production. Their investment plans also stayed unclear.

“It is difficult to estimate how much money we need for investment as it is hard to predict supply and demand for next year,” said an executive at a major conglomerate.

Samsung Electronics Co., which usually unveils its plans for the following year when it announces its third-quarter earnings, has not mentioned anything about investment plans for 2022 due to growing uncertainties such as parts supply.

The Korea Development Institute’s business survey index (BSI) continued to fall, indicating manufacturers’ sentiment deteriorated with the deepening supply chain disruption.

Business survey index for the manufacturing sector

※ A reading below 100 indicates that pessimistic views outnumber optimistic views.

(Source: Korea Development Institute)

Graphics by Jerry Lee

The supply crisis forced companies to raise product prices. The average price of new vehicles of 15 carmakers rose 12.1% to $45,031 in September from a year earlier, according to Kelley Blue Book, a US automotive research house. The industry expected car prices to increase further in 2022.

The electronics industry is also struggling to deal with rising raw material prices with few sales events planned ahead of Black Friday.

“Even though we want to have a massive sales event, we cannot afford it. We don’t have enough products and logistics costs are really high,” said an industry source.

Write to Kyung-Min Kang, Su-Bin Lee, Hyung-Suk Song and Byung-Uk Do at kkm1026@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Oct 06, 2021 (Gmt+09:00)

-

Aug 20, 2021 (Gmt+09:00)

-

Semiconductor shortagesChip shortage worsens, keeps Samsung execs on edge

Semiconductor shortagesChip shortage worsens, keeps Samsung execs on edgeApr 19, 2021 (Gmt+09:00)

-

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2Mar 10, 2021 (Gmt+09:00)

-

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)