-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

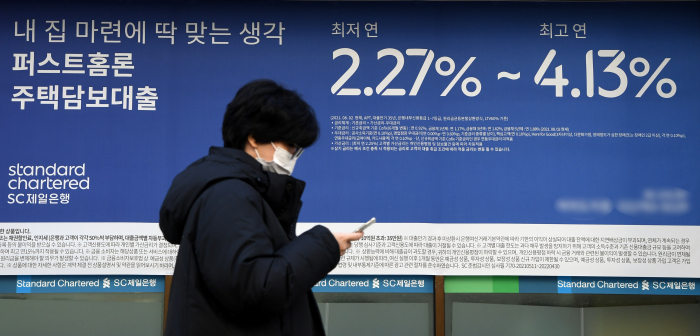

Mortgage loan growth slows to near four-year low in November

Tightened lending rules have driven home buyers to non-banking institutions for new loans

By

Dec 09, 2021 (Gmt+09:00)

Mortgage loan growth at banks in South Korea slowed to near a four-year low in November, on the back of tightened lending rules and an interest rate hike, data from the Bank of Korea showed.

The government's toughened controls on household loan growth, aimed at curbing skyrocketing home prices, led banks to freeze new loans and raise lending rates. That drove home buyers into non-banking financial services firms, which subsequently saw a threefold month-on-month rise in household loans last month.

The outstanding balance of mortgage loans at banks in the country increased 2.4 trillion won ($2 billion) in November to 776.9 trillion won ($662 billion) from a month before. That marked the smallest month-on-month increase since the 1.8 trillion won rise in February 2018.

The pace of loan growth halved from October when the mortgage credit expanded by 4.7 trillion won, according to the Financial Market Trends in November released by the Bank of Korea on Wednesday.

Overall, the balance of South Korea's household loans, which include non-mortgage lending, climbed 3 trillion won on-month to 1,060.9 trillion won last month, the weakest monthly growth since the decline of 1.6 trillion won last May.

NON-BANKING FINANCIAL INSTITUTIONS

By comparison, non-banking financial services firms, including credit card issuers and insurance companies, saw their outstanding balance of household loans surge 2.9 trillion won in November, according to the regulatory Financial Servies Commission (FSC) on Wednesday.

The month-on-month increase compared with October's rise of 1 trillion won at the non-banking financial institutions.

The Bank of Korea delivered its second interest rate hike last month, pulling the base rate by 25 basis points to 1.0%, as part of an effort to cool the overheating housing market and ease inflationary pressure.

Following the rate move, home prices in the capital Seoul have shown signs of falling.

Finance Minister Hong Nam-ki said in a ministerial meeting on the real estate market on Wednesday that apartment prices in some areas of Seoul have begun stabilizing thanks to a series of policy efforts, including supply increase, interest rate hikes and controls on household loan growth.

Next year, regulators will likely continue to tighten their household loan controls, further limiting room for mortgage credit expansion.

FSC Chairman Koh Seung-beom told a recent news conference that the total household loan growth at the top five banks in the country would be capped at 4-5% in 2022, compared with this year's ceiling of 5-6%, according to a report from News1.

Separately, corporate loans at banks in South Korea rose sharply in November, up 9.1 trillion won on-month to 1,068.4 trillion won.

Write to So-ram Jung and Dae-hun Kim at ram@hankyung.com

Yeonhee Kim edited this article.

-

Dec 07, 2021 (Gmt+09:00)

-

Jul 23, 2021 (Gmt+09:00)

-

Aug 12, 2020 (Gmt+09:00)