-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

How Carlyle aligned interests with Hyundai Motor chair

The PE giant's bet on Hyundai Glovis is likely to create decent returns and extra investment opportunities from the automotive group

By

Feb 13, 2022 (Gmt+09:00)

South Korea's strengthened antitrust rules relating to inter-affiliate trade provided the Carlyle Group with a valuable opportunity to invest in Hyundai Glovis Co., undervalued compared to its global peers. To comply with the regulations, the automotive group's founding family was required to reduce their stake in Glovis by 10% to 19.99%.

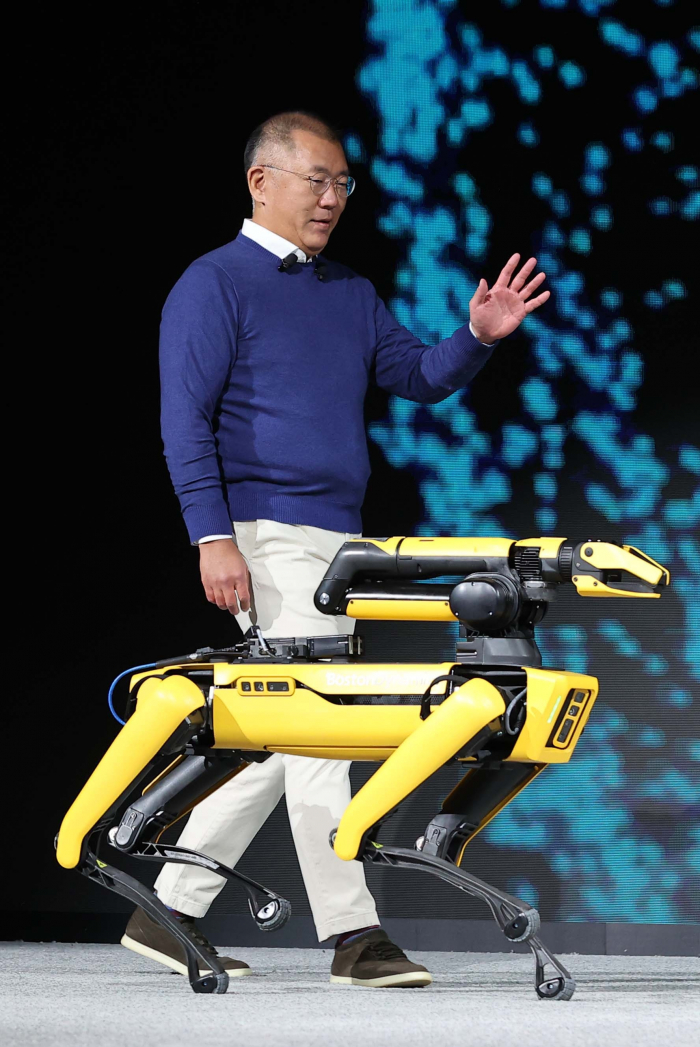

Carlyle's $500 million investment in the logistics arm of Hyundai Motor Group last month is also considered a deal that aligns the private equity giant's interests with those of Hyundai Motor Chairman Chung Euisun: lifting Glovis' enterprise value to maximize returns for both its top shareholder Chung and Carlyle.

Its purchase of a 10% stake in Glovis has other implications too: as an investor that won the trust of Chairman Chung, it stands to benefit from the automotive group's potential reform of its complex ownership, which has been shelved for several years.

Its circular ownership structure may seem complicated enough to put off western investment firms, but helping Chung resolve the cross-shareholdings is expected to create new investment opportunities for Carlyle in other Hyundai Motor Group companies.

INTERESTS ALIGNED

Hyundai Motor Group is the only major Korean conglomerate that has yet to streamline its circular shareholdings: auto parts supplier Hyundai Mobis Co. controls Hyundai Motor, the top shareholder of Kia Corp., which is then the largest shareholder of Mobis.

Responding to calls from the government and investors to revamp corporate governance, its ownership reform should be aimed at eliminating its circular shareholding structure and at the same time, ensuring Chung maintains his control over the group.

In the process, its governance reform should satisfy the interests of minority shareholders, the government and other stakeholders.

Whatever the scenario, Chung needs to secure as many shares in Mobis as possible, which will likely be at the center of the group's efforts to streamline its cross-shareholding structure. Currently, he holds a meager 0.3% stake in Mobis.

To that end, Chung is expected to use his shares in other units including Glovis, where he has a 19.99% stake. That means the chairman needs to enhance Glovis' corporate value from the current 6.5 trillion won to bolster his returns, matching the interests of Carlyle.

Glovis is one of a few Hyundai Motor units in which Chung holds a sizeable stake, alongside unlisted Hyundai Engineering Co. with an 11.72% stake and Hyundai Autoever Co. with a 7.33% stake.

Moreover, the recent decision by the automotive group to indefinitely postpone the public offering of Hyundai Engineering would make Glovis a more important asset as a source of liquidity. Chairman Chung is the No. 2 shareholder in the plant engineering and construction unit with an 11.7% stake.

The 52-year-old chairman also needs to raise cash to prepare for inheritance taxes, estimated roughly at 3 trillion won.

Hyundai Motor Group Chairman Chung Euisun’s shareholdings

(Unit: KRW)

| Company Name | Stake | Market Value* |

|---|---|---|

| Hyundai Mobis | 0.30% | 661.0 billion |

| Hyundai Motor | 2.60% | 1.08 trillion |

| Kia | 1.70% | 527.1 billion |

| Hyundai Glovis | 19.99% | 1.2 trillion |

| Hyundai Autoever | 7.30% | 255.5 billion |

| Hyundai Wia | 2.00% | 36.0 billion |

| Hyundai Engineering | 11.70% | 1.2 billion** |

Note: *As of end-January, 2022 ** Based on the estimated enterprise value of 10 trillion won

Honorary Chairman Chung Mong-koo’s shareholdings

(Unit: KRW)

| Company Name | Stake | Market Value* |

|---|---|---|

| Hyundai Mobis | 7.50% | 1.7 trillion |

| Hyundai Motor | 5.30% | 2.2 trillion |

| Hyundai Steel | 11.80% | 625.0 billion |

| Hyundai Engineering | 4.70% | 470.0 billion** |

| Total | 4.9 trillion |

Note: *As of end-January, 2022 ** Based on the estimated enterprise value of 10 trillion won

TAG-ALONG RIGHTS

In addition to making concerted efforts to boost Glovis' share price, Carlyle secured another option to align its interests with Chung's: the right to tag along with him to sell Glovis shares to a third party under the same terms.

The tag-along rights also apply to the cases where Chung swaps his Glovis shares with those in other affiliated companies or offers Glovis shares instead of cash to buy new shares to be issued by Mobis.

"It remains to be seen what Chairman Chung will do with his Glovis shares. But under the terms of the agreement, Chairman Chung will have to talk to Carlyle first, whatever the case," said a person with direct knowledge of the transaction.

"In South Korea, top shareholders' interests are not necessarily aligned with those of minority investors. But in this transaction, Carlyle matched its interests with Chairman Chung's with the tag-along rights."

Carlyle, led by CEO Kewsong Lee, has tried to nurture a good relationship and build trust with Chung. Back in 2019, Lee invited the chairman to a public fireside chat in Seoul and the two have stayed in touch since then.

Such efforts might help convince Chung that Carlyle is not a hedge fund operating like Elliott Management, which blocked Hyundai Motor Group's proposed governance reform in 2018. The following year, the US activist fund sold all its shares in Hyundai Motor Group companies after their share prices rebounded.

Given that there was no put option clause included in their agreement, Carlyle seemed to believe Glovis has little downside risk at its current valuation, about five times earnings before interest, tax, depreciation and amortization (EBITDA). That compared with its previous multiple of 15.5 in 2014.

Hyundai Glovis valuation (EV/EBITDA)

Source: Bloomberg

Its Japanese rival Nippon Yusen Kobushiki, which has a similar business structure to Glovis', is traded at eight times EBITDA, below the median multiple of 10.8 for car shipping companies around the world.

Valuations of Hyundai Glovis peers

| Peers | EV / EBITDA |

|---|---|

| Nippon Yusen Kobushiki | 8.1x |

| Mitsui OSK Lines | 13.6x |

| Kawasaki Kisen | 17.3x |

| Wallenius Wihelmsen | 5.6x |

| Median | 10.8x |

Glovis' shares have been hovering below the 300,000 won level since 2015, when the Chung family sold off its shares in accordance with tightened antitrust regulations.

Carlyle's purchase of Glovis shares in block trade resolved its stock overhang concerns, which had weighed on its share price over the past six years.

Carlyle made a bet that Chairman Chung, as the top shareholder of Glovis, would strive to boost its corporate value.

The 10% stake sold to Carlyle was divided into a 3.29% stake held by Chung and a 6.71% stake from the senior Chung, the entirety of the honorary chairman's holdings in Glovis.

NEW MOMENTUM, EXIT OPTIONS

For its part, Carlyle is expected to help Glovis increase margins from transactions with sister companies, which account for 60% of its 20 trillion won in revenue.

In intra-group transactions, Glovis had sacrificed some margins to avoid criticism that it received favors from affiliated companies, according to industry observers.

As a board member, Carlyle could urge the car shipping company to charge its affiliates standard rates and to increase dividend payments as well.

Glovis could also team up with the PE firm to chase logistics software developers and robotics companies in other countries to find a new growth driver. Additionally, Carlyle could give a helping hand to Hyundai in communicating with activist shareholders such as Elliott Management.

For divestment, Carlyle may consider selling its 10% stake in Glovis, together with Chairman Chung's 19.99% stake, to a third party with a management premium. But that option seems unrealistic unless other Hyundai Motor Group units assure the would-be buyer they will maintain business relations with Glovis.

A second option would be unloading its shares on the market after its share price rises. Alternatively, Carlyle may take part in a transaction led by Chung when he trades his Glovis shares for those of Mobis held by Kia Corp. Afterward, the PE house could sell the Mobis shares, which it swaps with Glovis shares, in the stock market.

Still, such options are just ideas being floated in the market.

"It seems that Carlyle did not have a clear exit strategy in mind when investing in Glovis," said an investment banking source. "They made a bet on a successful reform of Hyundai Motor's ownership structure under Chairman Chung's leadership."

Carlyle CEO Lee, a US citizen of Korean descent, took the helm of the PE giant as co-CEO in 2018 and was appointed CEO in July 2020.

The 56-year-old is more familiar with the Korean culture and systems than other global funds' leaders since he spent his early years in South Korea with his parents. His late father Hak-jong Lee served as dean of Yonsei University's college of business administration in Seoul.

"This investment in Glovis would be hardly thinkable for other private equity firms managed by Americans only," a PE industry source told The Korea Economic Daily.

"It means getting involved in the process of overhauling Hyundai's complex ownership structure."

Carlyle's bet on the governance reform of the family-controlled Korean conglomerate is expected to help the $300 billion investment firm build an unparalleled track record and reputation in the country.

If successful, the deal will pave the way for Carlyle's new partnership opportunities with other South Korean conglomerates.

Write to Chang Jae Yoo at yoocool@hankyung.com

Yeonhee Kim edited this article.

-

Private equityCarlyle buys $510 mn stake in Hyundai Glovis

Private equityCarlyle buys $510 mn stake in Hyundai GlovisJan 06, 2022 (Gmt+09:00)

-

Nov 19, 2021 (Gmt+09:00)

-

Carlyle GroupCarlyle names co-CEO Kew Lee as sole CEO

Jul 22, 2020 (Gmt+09:00)