-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Unison Capital puts Korea dental scanner maker up for sale

Mergers & Acquisitions

Unison Capital puts Korea dental scanner maker up for sale

The PE firm has invested $246 million in Medit, which is expected to be sold at up to $3.1 billion on strong interest

By

Jul 05, 2022 (Gmt+09:00)

2

Min read

News+

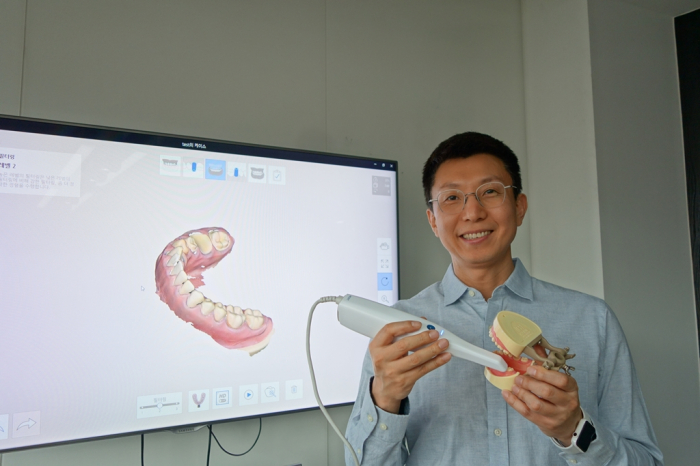

Unison Capital Inc., a middle-market focused private equity firm, put the world’s third-largest 3D dental scanner maker on the market.

The deal to sell South Korea’s Medit Corp. was known to have attracted not only companies in the sector but also global major PE houses and domestic conglomerates, raising its price tag to up to 4 trillion won ($3.1 billion), investment banking sources said on Monday.

Unison, Medit’s top shareholder, sent teaser letters to potential buyers to sell a 100% stake in the global 3D scanning solutions provider for dental clinics, including 51% held by the PE firm and the rest by others such as the founder, according to the sources. Citigroup Global Markets is handling the sale.

The seller plans to open limited auctions only for a small number of selected buyers, starting from preliminary bidding in August with a target to complete the sale in October.

Unison invested 320 billion won ($246.2 million) in the controlling stake in October 2019, winning the race to acquire the company against global PE majors such as KKR & Co. and The Carlyle Group. Unison is set to hit another jackpot if Medit is sold at the price after the 350-billion-won divestment from milk tea brand Gong Cha in 2019.

UNISON-POWERED GROWTH

Medit, founded in 2000 as a 3D industrial scanner maker, applied its production technology to the dental market. The latecomer in the dental scanner industry accelerated growth after Unison invested, betting that demand for dental scanners will rise in line with the increasing digitalization of medical sector devices.

Medit’s earnings before interest, taxes, depreciation and amortization (EBITDA) nearly tripled to 103.9 billion won last year from 36.7 billion won in 2019 with sales more than doubling to 190.6 billion won last year from 72.2 billion won during the period.

Unison established a systematic management structure after the acquisition by hiring specialists for each division such as sales and production. In June 2020, the PE firm appointed Ko Gyu Bum as CEO, an industry veteran with over two decades of management experience in multinational medtech companies, such as Procter & Gamble, Johnson & Johnson, and Stryker.

In addition, it set up a separate sales division for the global market as the company generates most of its revenue from overseas countries.

Unison refinanced the acquisition financing for Medit in April, arranged by NH Investment & Securities Co. increasing the existing loan of 80 billion won to 450 billion won.

NH Investment was known to have estimated Medit’s corporate value at some 3.2 trillion won at that time. Given the valuation, a buyer may have to pay at least mid-3 trillion won for the company, industry sources said.

Write to Si-Eun Park and Jun-Ho Cha at seeker@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Private equity[Dealmaker] Unison Capital shines in Korea’s niche sectors

Private equity[Dealmaker] Unison Capital shines in Korea’s niche sectorsFeb 15, 2020 (Gmt+09:00)

-

Sep 10, 2019 (Gmt+09:00)

-

Aug 26, 2019 (Gmt+09:00)