-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

POSCO Chemical may clinch megadeal to supply cathode to Ford Motor

Batteries

POSCO Chemical may clinch megadeal to supply cathode to Ford Motor

The highly anticipated deal, at the request of Ford, shows Korean firms’ growing clout in the global EV materials supply chain

By

Oct 18, 2022 (Gmt+09:00)

4

Min read

News+

POSCO Chemical Co., a unit of South Korea’s steel giant POSCO Holdings Inc., is looking to forge a long-term contract to supply cathode, a key material for electric-vehicle batteries, to US automaker Ford Motor Co.

Ford Motor Chief Executive Jim Parley, who made an unannounced trip to Seoul last month to discuss with Korean battery makers issues surrounding the US EV tax credit law, has also met with POSCO CEO Choi Jeong-woo on Sept. 20.

During the undisclosed meeting, Parley sought to receive cathode, the ingredient for rechargeable batteries, from POSCO Chemical, people close to the matter said on Tuesday.

The Ford CEO also wanted to forge a comprehensive partnership to procure battery minerals such as lithium and nickel from POSCO Group affiliates, sources said.

POSCO Chemical hopes to clinch a cathode contract with Ford that would last at least five years, and if a formal deal is signed, it will supply the material to BlueOval SK, a joint venture between Ford and Korean battery maker SK On Co., the people said.

The value of the long-term deal wasn't known.

POSCO Chemical said it is seeking to forge broad business tie-ups with Ford and other automakers. But no decisions have yet been made on the exact terms of a cathode supply deal with Ford, including volume and duration, it said.

In July, POSCO Chemical signed a three-year cathode supply contract with General Motors Co.

Under the 13.8 trillion won ($9.7 billion) deal, POSCO Chemical agreed to supply the material to Ultium Cells LLC, GM's EV battery cell manufacturing JV with Korea’s LG Energy Solution Ltd., from next year through 2025.

KOREA’S ONLY FIRM TO MAKE BOTH CATHODE, ANODE

Cathode materials are made up of nickel, lithium and other materials, and comprise around 40% of the cost of electric vehicle batteries.

POSCO Chemical is the only Korean supplier that can produce both cathode and anode, another building block of lithium-ion batteries.

During his stay in Seoul, Parley also met with chief executives of its battery suppliers LG Energy and SK On to jointly explore ways to respond to the Inflation Reduction Act, which requires a certain percentage of critical minerals used in EV batteries to come from the US or its free trade partners.

Ford, which ranks second in the US EV market after Tesla Inc., uses LG battery cells in its electric sport utility vehicle (SUV) Mustang Mach-E and SK batteries in its electric truck F-150 Lightning.

Qualifying EVs must contain at least 40% of the battery minerals and 50% of the battery components supplied from or processed in the US or its free trade partner countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

KOREAN BATTERY MAKERS HAVE THE UPPER HAND

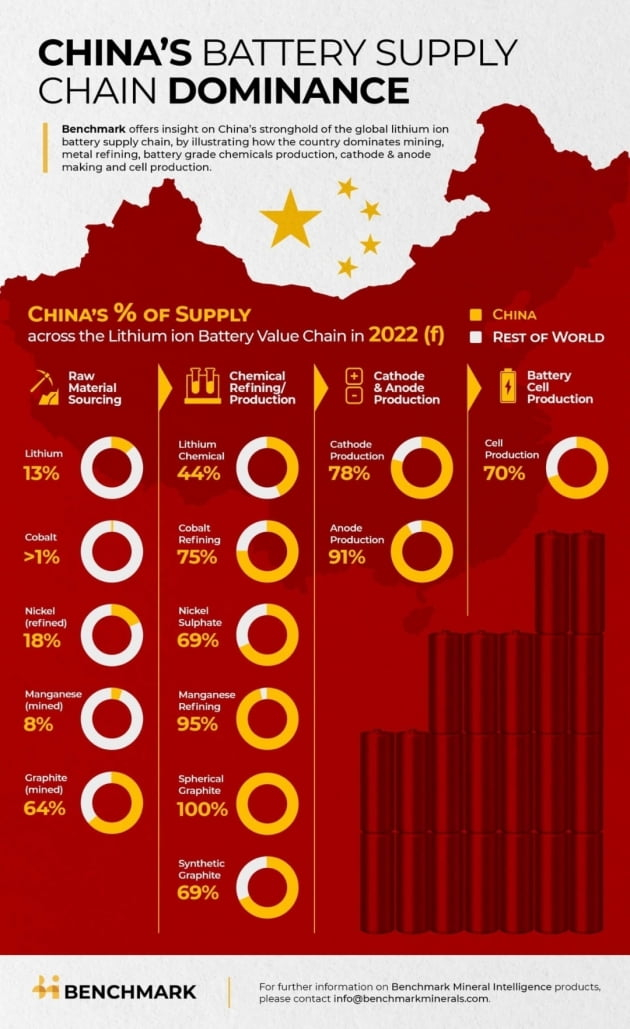

Analysts say Korean battery makers and materials suppliers – global heavyweights – stand to benefit from the strengthened requirements of the rules, which are aimed at weaning the EV industry off its dependence on China for battery materials.

In addition to the rising thresholds, starting in 2024 any battery components from “foreign entities of concern,” including Russia and China, would be ineligible for subsidies. And from 2025, critical minerals from such entities would disqualify batteries too.

Ford currently receives cathode materials from EcoPro BM Co., Korea’s largest cathode supplier, which largely sources raw materials from Chinese companies to make cathode. Ford CEO Parley conveyed his concerns over the issue to SK On during his Seoul visit, sources said.

A supply deal with POSCO Chemical would provide Ford with an opportunity to diversify its sourcing, while maintaining its business relationships with SK On and EcoPro BM.

POSCO Group has been strengthening its battery materials value chain from developing mines to producing minerals.

POSCO Holdings, the investment holding company of the steel giant, said last week it will invest an additional $1.09 billion in its lithium production facility in Argentina amid a growing resource nationalism trend worldwide.

Meanwhile, sources said Stephen Biegun, former US deputy secretary of state, played a role in the cathode supply deal in the making between POSCO Chemical and Ford.

In September of 2021, POSCO Group hired him as its adviser for its American business.

Before being tapped as a diplomat under the Donald Trump administration, he served as the vice president of international government affairs for Ford Motor for 10 years.

Write to Kyung-Min Kang and Hyung-Kyu Kim at Kkm1026@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Sep 16, 2022 (Gmt+09:00)

-

Jul 14, 2022 (Gmt+09:00)

-

Jun 30, 2022 (Gmt+09:00)

-

Dec 02, 2021 (Gmt+09:00)

-

Sep 29, 2021 (Gmt+09:00)