-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Korea’s Daol to sell another unit to secure liquidity

Corporate restructuring

Korea’s Daol to sell another unit to secure liquidity

Daol agrees to sell credit service subsidiary at $10.2 mn, while seeking to raise $236.2 mn through sales of VC, Thai units

By

Jan 06, 2023 (Gmt+09:00)

2

Min read

News+

South Korea’s Daol Financial Group agreed to sell another unit as part of its efforts to raise money in preparations for a possible liquidity crunch caused by the debt default by the local developer of a Legoland theme park in the country.

Daol Investment & Securities Co., the group’s brokerage affiliate, said on Thursday it signed a deal to sell a 100% stake in Daol Credit Service Co. for 13 billion won ($10.2 million) to South Korea’s Mason Capital Corp. and another company. The two firms are each set to acquire a 50% stake in the credit check and collection agency of the group.

Daol Investment & Securities acquired the subsidiary from the Korea Deposit Insurance Corp. in 2001. The company reported a net profit of 160 million won based on sales of 17.7 billion won last year.

The group plans to complete the sale in the first half with regulatory permissions including approval of changes in major shareholders from the Financial Services Commission.

“The sale is a part of the reorganization of the group’s business structure,” said a Daol Financial Group official. “It is a measure to preemptively deal with the uncertainties in financial markets and continue business in a stable manner in the future.”

FALLOUT OF LEGOLAND DEFAULT

Daol Investment & Securities, the group’s key unit, put all of its 52% stake in a venture capital subsidiary Daol Investment Co. up for sale. The brokerage house, formerly known as KTB Investment & Securities Co., reportedly hopes to sell the stake at around 200 billion won, while Woori Financial Group and Eugene Group, South Korea’s construction materials-to-financial conglomerate, are known to be interested in the VC unit.

In addition, Daol Investment & Securities is seeking to sell a controlling stake in its Thai subsidiary, Daol Thailand PCL at about 100 billion won.

Such sales came as the brokerage faced liquidity problems after the default on municipal government-guaranteed debt worth 205 billion won for Legoland Korea in Gangwon Province hammered the local short-term money and corporate bond market.

Daol Investment & Securities is one of the major local players in the financial brokerage business for alternative investments such as real estate project finances. The firm has been taking steps to cut costs such as early retirement programs since last year.

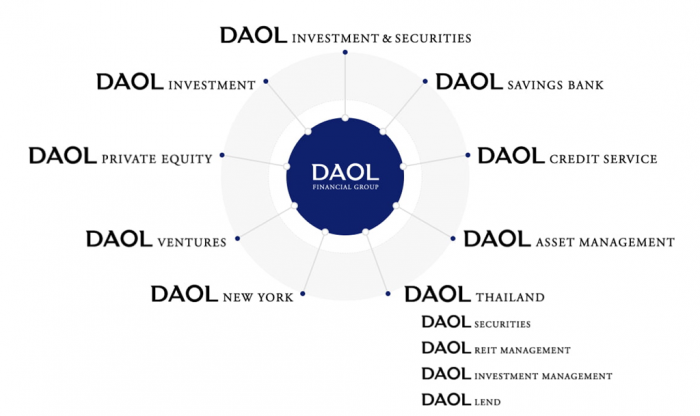

Daol Financial Group currently has six affiliates in South Korea – Daol Investment & Securities, Daol Investment, Daol Savings Bank Co., Daol Asset Management Co., Daol Private Equity and Daol Credit Service. The group has two affiliates in the US and five in Thailand.

Write to Seok-Cheol Choi at dolsoi@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Dec 06, 2022 (Gmt+09:00)

-

Banking & FinanceDaol Investment seeks to sell Thai subsidiary, eyes $75 mn in proceeds

Banking & FinanceDaol Investment seeks to sell Thai subsidiary, eyes $75 mn in proceedsNov 18, 2022 (Gmt+09:00)

-

Banking & FinanceKTB rebrands with name change as Daol Financial Group

Banking & FinanceKTB rebrands with name change as Daol Financial GroupMar 27, 2022 (Gmt+09:00)