-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Saturday Jun 07, 2025

Shinhan Financial returns to top in Korea with record NP in 2022

Banking & Finance

Shinhan Financial returns to top in Korea with record NP in 2022

Shinhan Financial beat KB Financial to become South Korea’s biggest financial holding firm in 2022

By

Feb 09, 2023 (Gmt+09:00)

3

Min read

News+

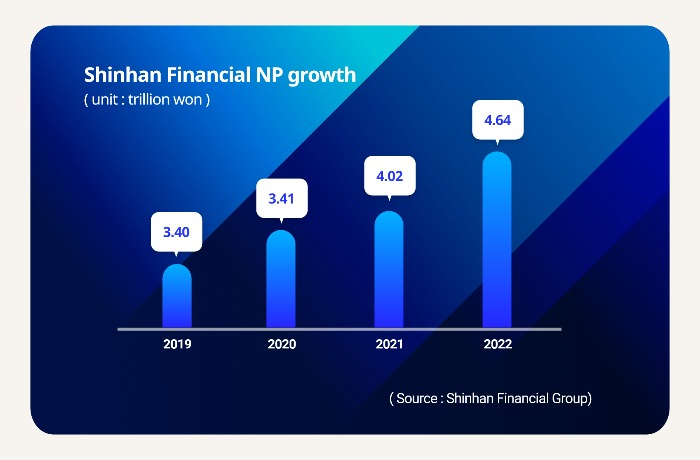

Shinhan Financial Group Co. reported a record-high net profit of 4.6 trillion won ($3.6 billion) last year, snatching back the crown of South Korea’s leading financial holding firm from its arch rival KB Financial Group Inc. in three years mainly thanks to interest income gains in a high interest rate environment.

Shinhan Financial on Wednesday announced in a regulatory filing that its consolidated net profit for 2022 stood at 4.6 trillion won, up 15.5% from the previous year on a revenue of 61.9 trillion won, up 35.3% over the same period. It reported the biggest-ever annual bottom line, breaking the record for five straight years since 2018.

With the record-breaking result, Shinhan Financial has returned to top in the Korean financial market after it lost the title to KB Financial three years ago. The latter reported 4.4 trillion won in net profit last year.

Shinhan Financial’s operating income for 2022 reached 5.9 trillion won, down 1.1% from a year ago.

It saw a 28.9% on-year fall in net income in the fourth quarter ending in December 2022 to 326.9 billion won due to redundancy payments of 145 billion won and an additional 197 billion won reserve for losses set aside in the quarter to prepare an economic slump.

HIGH INTEREST INCOME

The company posted stellar earnings for last year thanks to strong interest income in the high interest rate environment following a series of rate hikes by the central bank to tame inflation. It also reaped a one-off gain from the disposal of Shinhan Securities Co.’s head office building for 443.8 billion won.

Its interest income in 2022 increased 17.9% on-year to 10.7 trillion won. Its net interest margin (NIM), which measures profits from the gap in interest rates banks charge and those they pay on deposits, hit 1.96% for the year, up 0.15 percentage point from a year ago, while NIM of its flagship banking unit Shinhan Bank added 0.22 percentage point to 1.63%.

The country’s policy rate climbed to 3.50% in January from 1.25% on November 2021 after the Bank of Korea joined its global peers in monetary tightening to control inflation.

But the financial holding firm’s non-interest rate income mainly composed of fees for stock trading shrank 30.4% to 2.5 trillion won due to the stagnant stock market.

Its core banking unit Shinhan Bank on the same day reported that its net income for 2022 jumped 22.1% on-year to 3 trillion won.

SHARE BUYBACK/CANCELATION

With the strong financial results, Korea’s No. 1 financial holding firm announced a shareholder-friendly policy.

The company announced in a separate filing on Wednesday that its board approved a 150 billion won worth share buyback program. The company will buy back 3,676,470 shares in the market at 5,000 won apiece between February 9 and March 8 to retire them.

It will pay out quarterly cash dividends, 865 won per common share. Combined with previous dividends paid out in the first three quarters last year, it has paid a total 1.09 trillion won for dividends in 2022 with a 5.5% dividend payout ratio.

WOORI FINANCIAL

Woori Financial Holding on Wednesday also reported its historic high net profit of 3.2 trillion won in 2022, up 22.5% from the previous year.

Like its bigger peers, it enjoyed high interest income, which rose 24.5% on-year to 8.7 trillion won. Its NIM hit 1.84%, up 0.22 percentage point, while its flagship banking unit Woori Bank saw its NIM also up 0.22% to 1.59%. The latter’s bottom line added 22.9% on-year to 2.9 trillion won last year.

Write to Bo-Hyung Kim and Sang-Yong Park at kph21c@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Dec 30, 2022 (Gmt+09:00)

-

Dec 12, 2022 (Gmt+09:00)

-

Banking & FinanceKorea Shinhan Financial taps banking unit head as group CEO

Banking & FinanceKorea Shinhan Financial taps banking unit head as group CEODec 08, 2022 (Gmt+09:00)