-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Music copyright trading platform Musicow attracts $46 mn from STIC

Korean startups

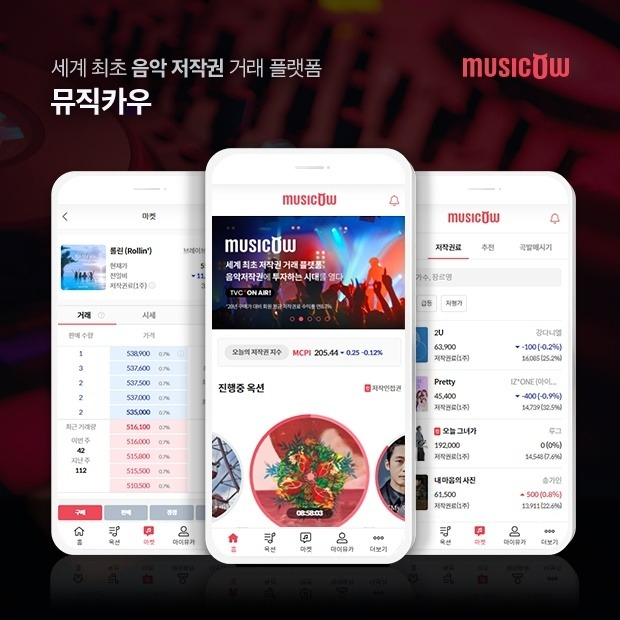

Music copyright trading platform Musicow attracts $46 mn from STIC

The latest investment in the South Korean startup comes as the company is preparing to go public later this year

By

May 23, 2023 (Gmt+09:00)

2

Min read

News+

Musicow Inc. has garnered an additional 60 billion won ($45.8 million) from Seoul-based venture capital and private equity firm STIC Investments Inc., which invested in South Korea's music copyright trading platform pioneer about a year ago.

The company announced on Tuesday that it issued new common shares to a fund run by STIC Investments to raise about 60 billion won, and the newly injected capital will be used to broaden its music intellectual property portfolio and advance into overseas markets.

This was the second investment from STIC Investments into the Korean music copyright trading platform operator. In a previous Series D funding round, the VC invested 100 billion won.

Musicow has so far attracted 214 billion won from various investors, including not only STIC Investments but also Korea’s state-run Korea Development Bank, Hana Financial Investment Corp., LB Investment Inc. and Premier Partners LLC.

The Korean startup succeeded in drawing additional investment despite the ongoing startup funding drought, thanks to its promising business model.

ROSY BUSINESS OUTLOOK

Founded in 2016, Musicow pays a lump sum to creators of music tracks for claims to request copyright fees. It then splits the claim rights into small fractions and puts them up for auction -- half the gains from the auction deals go to the artists.

The investors of the music claim rights earn profits from the music copyrights, similar to dividends paid to stock investors for shareholding. Individual investors can also trade the ownership of copyright claims via the platform.

Musicow achieved an 8.96% return over the past year until January, outperforming Korea’s main Kospi market’s 30% loss during the same period.

As of February, the company boasted 1.2 million users and cumulative transactions worth 400 billion won, it said. Musicow has so far secured about 20,000 music IPs.

The platform, allowing fractional investments in music such as popular K-pop songs with a relatively small outlay, is especially popular among young-generation investors.

The outlook for its business looks bright as Korea’s Financial Services Commission is set to legalize all kinds of fractional investment next year through amendments to the country's Electronic Securities Act and Capital Market Act.

While preparing for its initial public offering this year with Mirae Asset Securities Co. as its lead underwriter, the Korean music copyright fractional investment platform plans to advance into overseas markets later this year, with the US first.

In December 2021, it joined hands with Korean conglomerate Hanwha Group to launch its art copyright trading business abroad.

Musicow was picked by Korea’s Ministry of SMEs and Startups in 2021 as a “preliminary unicorn,” a company valued between 100 billion won and 1 trillion won.

Write to Mi-Hyun Jo at mwise@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

-

Feb 06, 2023 (Gmt+09:00)

-

Korean startupsFractional copyright ownerships are securities: Seoul

Korean startupsFractional copyright ownerships are securities: SeoulApr 20, 2022 (Gmt+09:00)

-

Oct 21, 2021 (Gmt+09:00)

-

Korean StartupsSTIC injects $168 mn in pre-unicorn Musicow

Korean StartupsSTIC injects $168 mn in pre-unicorn MusicowJan 18, 2022 (Gmt+09:00)

-

Korean startupsHanwha, Musicow to launch JV in US for copyright trading abroad

Korean startupsHanwha, Musicow to launch JV in US for copyright trading abroadDec 10, 2021 (Gmt+09:00)

-

Nov 22, 2021 (Gmt+09:00)