-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Money pours in for technology to reshape Korean restaurants

High hourly wages and a labor shortage are accelerating the digitalization of the food and beverage industry

By

Apr 01, 2024 (Gmt+09:00)

Investors are betting big on food service technology startups in South Korea as the adoption of self-service systems in the country’s food and beverage industry is expected to accelerate in response to high hourly wages and a prolonged labor shortage.

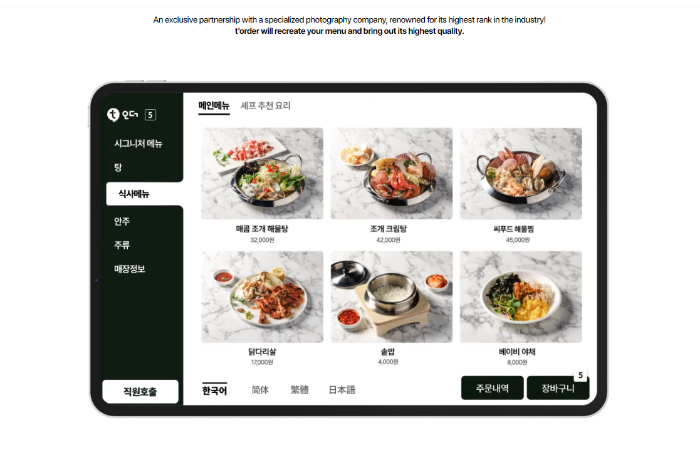

t’order Inc., a Korean startup offering tablet-ordering system t’order and other food-service solutions, recently raised 13 billion won ($9.6 million) from Korea Development Bank (KDB) and LB Investment Inc. during a Series B funding round.

The company, which is seeking to raise 30 billion won, is expected to draw the remaining 17 billion won shortly, according to industry sources.

The startup will use the proceeds to ramp up the supply of tablet PCs, mainly used as part of a self-ordering system at restaurants, to meet its surging demand. t’order expects orders for new tablet PCs to exceed 10,000 units monthly.

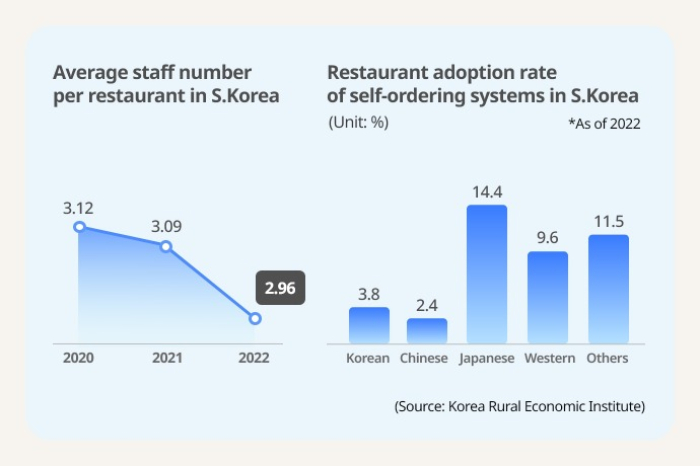

Restaurant owners in Korea are implementing automated food-service technologies to cope with a jump in the country’s hourly rate and ongoing labor shortages.

HIGH LABOR COST AND ONGOING LABOR SHORTAGES

Korea’s minimum wage has more than doubled since 2013 to 9,860 won per hour this year. Despite this, restaurant owners can’t find enough workers.

The country’s hospitality sector lacked 52,493 workers as of the second half of last year, according to data from Korea’s Ministry of Employment and Labor.

Restaurant owners expect the industry to continue to grapple with labor shortages for the next four to five years. According to a survey conducted by the Korea Agro-Fisheries & Food Trade Corp., 54.9% of 3,000 food and beverage restaurant owners that responded expect it will still be hard to find employees three years from now.

“A restaurant has to pay a monthly commission of 10,000 or 20,000 won per table to use a tablet-ordering system, but that is much cheaper than hiring workers,” said an official in the food and beverage industry. “It will also help restaurants save costs on hiring and staff management.”

Investors also see growth potential in the country’s food service tech sector as most of the related local startups eye global expansion.

Payhere Inc., which offers food service automation solutions, plans to go global with leading Korean fried chicken restaurant chain operator Kyochon F&B Co. with its point-of-sale (POS) system.

Aniai Inc., a startup that is developing robot cooks, has already clinched deals to supply its automated burger patty grilling system to two major US burger franchise operators under non-disclosure agreements.

ROSY OUTLOOK ATTRACTS MONEY TO FOOD SERVICE TECH

Pinning high hopes on their business models, investors have poured money into both startups.

Payhere succeeded in attracting 20 billion won during a Series B funding round last year, while Aniai raised $12 million in Pre-Series A funding in January.

The kitchen robot-developing startup has already signed a deal to supply 500 burger-cooking robots and is expected to receive orders to supply another 1,000 units by the end of this year, according to the company.

Among other food service technology startups on investors’ radar, Changupin Inc., the operator of mobile menu ordering system tablero, raised 2.3 billion won in a Pre-Series A funding round in November from multiple investors including CJ Investment Inc., SparkLabs and Magna Investment.

Bear Robotics Inc., a serving robot-developing startup based in Silicon Valley, attracted $60 million from Korea’s high-tech giant LG Electronics Inc. in March. It recently set a target to deliver more than 1,000 such robots this year.

Another robot-developing startup, B-Robotics, in November secured a 3 billion won investment from global mobile app developer Cheetah Mobile.

B-Robotics is a subsidiary of Woowa Brothers Corp., the operator of Korea’s No. 1 food delivery platform, Baedal Minjok, also known as Baemin.

Write to Joo-Wan Kim at kjwan@hankyung.com

Sookyung Seo edited this article.

-

Mar 12, 2024 (Gmt+09:00)

-

Korean startupsKorean kitchen automation startups' US advance gains traction

Korean startupsKorean kitchen automation startups' US advance gains tractionApr 03, 2023 (Gmt+09:00)

-

Feb 02, 2023 (Gmt+09:00)

-

Korean startupsService robot maker Bear Robotics raises $81 mn in Series B

Korean startupsService robot maker Bear Robotics raises $81 mn in Series BMar 16, 2022 (Gmt+09:00)

-

Venture CapitalMobile POS maker Payhere receives $84.2 mn in Series A funding

Venture CapitalMobile POS maker Payhere receives $84.2 mn in Series A fundingDec 28, 2021 (Gmt+09:00)