-

KOSPI 2920.85 +13.81 +0.48%

-

KOSDAQ 788.35 +2.06 +0.26%

-

KOSPI200 391.03 +1.24 +0.32%

-

USD/KRW 1368 -9.00 0.66%

Korean IPO boom sets record; bubbles burst post debut

Korean stock market

Korean IPO boom sets record; bubbles burst post debut

The IPOs for the first half were oversubscribed a record-high 1,610 times as retail investors rushed for huge gains

By

Jul 04, 2024 (Gmt+09:00)

2

Min read

News+

South Korea’s initial public offerings in the first half of this year were oversubscribed 1,610 times, the highest-ever rate for a half-year period, led by individual investors eyeing significant returns on stock trading debuts.

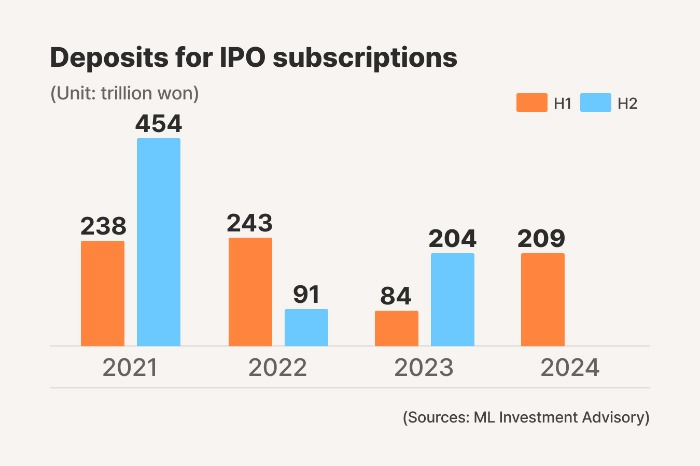

The Korean IPO market attracted 209.75 trillion won ($151.9 billion) from retail investors in subscription deposits for the first six months of this year, more than 2.3 times the deposits from a year earlier, according to Seoul-based ML Investment Advisory Co.’s data on Thursday.

Individual investors deposited about a whopping 25 trillion won for ship maintenance service provider HD Hyundai Marine Solution Co.'s main Kospi IPO in May. Electric vehicle motor controller maker Samhyun Co. and cancer detection solutions provider IMBdx Inc. attracted 12 trillion won and 10 trillion won in deposits, respectively, in the first half.

Korean stocks surged about 91.4% on their trading debut day during the first half. The share price gains on their first trading day have been further boosted as the government raised the upper limit of share prices on their debut day to 400% of IPO price from 260% in June 2023.

Among the 29 newly listed firms during the first half in Korea, only Innospace Co., a spaceflight venture, saw its share on the junior Kosdaq fall below the IPO price on the first trading day with a 20.2% drop.

BUBBLES

The number of Korean institutional investors participating in IPO bookbuilding increased 15% for the first six months of this year, hitting a record-high 2,300.

As the IPO market has been fuelled by such investors, 27 out of the 29 newly listed firms in the first half set their offering price about 23% higher than their upper limit of price band, except HD Hyundai Marine Solution and power management system developer Gridwiz Co.

In the first half of last year, only eight out of 33 firms that went public in the period set their offering price above the upper price band.

The bubbles in the newly listed stocks burst soon after their debuts. The 29 firms that went public in the first half saw their shares soar 91.4% on the first trading day, but the percentage declined to 60.9% a week and 35.5% a month from their opening day.

COMPANIES EYEING IPO IN US

Experts warn that these bubble pops could hurt investors and increase the reputational risks for companies and their IPO underwriters.

“Large companies with great growth potential may increase the need to list on the US market, rather than in Korea, for more appropriate valuation,” said Korea Capital Market Institute’s Senior Research Fellow Hwang Seiwoon.

SoftBank-backed travel and accommodation booking platform Yanolja Co. has been eyeing a Nasdaq listing, garnering investors’ attention on its successful IPO debut like retail giant Coupang Inc. on the New York Stock Exchange and Naver Corp.'s US subsidiary Webtoon Entertainment Inc. on the Nasdaq.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Jihyun Kim edited this article.

More To Read

-

Jun 27, 2024 (Gmt+09:00)

-

Jun 26, 2024 (Gmt+09:00)

-

Jun 23, 2024 (Gmt+09:00)

-

Jun 19, 2024 (Gmt+09:00)

-

Jun 18, 2024 (Gmt+09:00)