-

KOSPI 2946.66 +52.04 +1.80%

-

KOSDAQ 777.26 +8.40 +1.09%

-

KOSPI200 394.16 +6.86 +1.77%

-

USD/KRW 1366 -4.00 0.29%

Kia hits record 2024 sales; profit margins highest among global automakers

Earnings

Kia hits record 2024 sales; profit margins highest among global automakers

It posted a double-digit margin for nine straight quarters in the October-December quarter, led by pricey SUVs and hybrids

By

Jan 24, 2025 (Gmt+09:00)

3

Min read

News+

South Korea’s second-largest automaker Kia Corp. on Friday posted its highest-ever annual sales, operating profit and profit margins in 2024, driven by brisk sales of pricey SUVs and hybrid models.

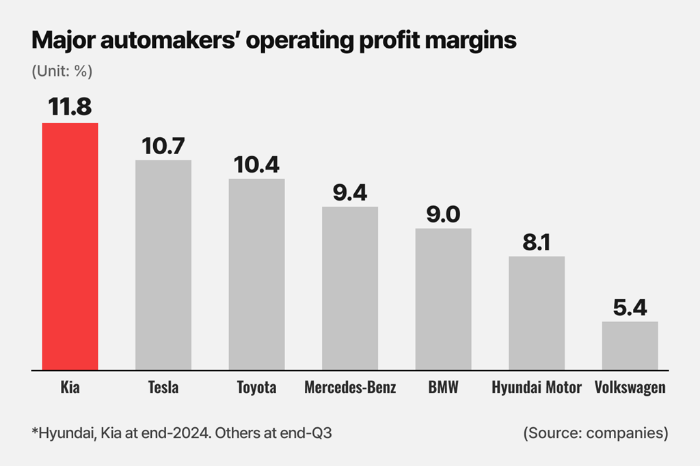

With its 11.8% annual profit margin, Kia became the highest earner per vehicle sold, putting its global rivals such as Tesla, Toyota Motor, Mercedes-Benz, BMW and Volkswagen as well as its sister firm Hyundai Motor Co. behind it in terms of profitability.

Kia said in a regulatory filing that its 2024 sales revenue reached a record 107.45 trillion won ($75 billion), up 7.7% from 99.8 trillion won a year earlier.

The automaker said it posted annual sales of more than 100 trillion won for the first time since its founding in 1962. With that figure, Kia became Korea’s third company with sales above 100 trillion won following Samsung Electronics Co. and Hyundai Motor.

Kia’s full-year operating profit was 12.67 trillion won, up 9.1% from 11.61 trillion won.

Net profit rose 11.5% on-year to 9.8 trillion won.

It sold 3.09 million vehicles globally in 2024, up 0.1% from the previous year.

The company’s operating profit margin stood at 11.8%, higher than 11.6% a year earlier.

Kia’s profit margin was higher than its global rivals.

As of the end of the third quarter, Tesla’s operating profit margin was 10.7%, followed by Toyota’s 10.4%, Mercedes-Benz’s 9.4%, BMW’s 9.0% and Volkswagen’s 5.4%.

On Thursday, Hyundai Motor posted its largest-ever annual sales for a second consecutive year, with its profit margin at 8.1%.

DOUBLE-DIGIT MARGIN FOR NINE STRAIGHT QUARTERS

In the fourth quarter of last year, Kia’s net profit rose 8.5% to 1.76 trillion won from 1.62 trillion won in the year-earlier period.

Quarterly operating profit gained 10.2% on-year to 2.72 trillion won. Sales rose 11.6% to 27.15 trillion won.

“Incentives for dealers and sales warranty provision have risen due to the higher dollar-won exchange rate. These negatives, however, were offset by strong sales, particularly in the North American market,” Kia said in a statement.

Its fourth-quarter operating profit margin stood at 10%, posting a double-digit margin for nine straight quarters.

The company sold 769,985 vehicles in the fourth quarter, up 5% from the year-earlier period, led by the Sportage SUV, K8 sedan and the hybrid model of the Carnival RV.

Sales of eco-friendly vehicles rose 14.5% on-year to 164,000 units in the fourth quarter. Sales of hybrids rose 31.7% to 100,000 units.

2025 GUIDANCE, BUSINESS PLANS

Kia unveiled ambitious 2025 guidance that projects a 4.7% revenue increase to 112.5 trillion won, with a sales volume of 3.22 million vehicles.

For this year, it aims to achieve 12.4 trillion won in operating profit with a profit margin of 11%.

“Despite growing external uncertainties, we are confident that we will continue to maintain a double-digit operating profit margin this year, driven by our fundamental competitiveness, including improvements in product mix and the average selling price,” the company said.

SHAREHOLDER RETURN POLICY

Kia said it will pay 6,500 won per common share in dividends to 2024 shareholders, higher than its 2023 full-year dividend of 5,600 won.

Its budget for share buybacks and cancellations has been set at 700 billion won, an increase of 200 billion won from the previous year.

To enhance shareholder value, all shares purchased for buyback will be fully canceled without conditions starting this year, it said.

Under its recently announced value-up program, the company’s total shareholder return (TSR), which includes dividends, share buybacks and cancellations, will rise to 35% this year from 33.3% in 2024 and 30.7% in 2023.

TSR is a measure of financial performance indicating the total amount an investor reaps from an investment — specifically equities or shares of stock.

Kia plans to hold its CEO Investor Day in early April to promote active communication with shareholders and investors.

On Friday, Kia's shares finished 1% lower at 101,700 won, while the broader benchmark Kospi index ended up 0.9%.

Write to In-Soo Nam at isnam@hankyung.com

Joel Levin edited this article.

More To Read

-

Jan 23, 2025 (Gmt+09:00)

-

Jan 14, 2025 (Gmt+09:00)

-

Jan 03, 2025 (Gmt+09:00)

-

Electric vehiclesHyundai, Kia EVs qualify for US subsidies for first time

Electric vehiclesHyundai, Kia EVs qualify for US subsidies for first timeJan 02, 2025 (Gmt+09:00)

-

Dec 04, 2024 (Gmt+09:00)

-

Corporate strategyKia vows to drastically raise shareholder returns, hike EV, hybrid sales

Corporate strategyKia vows to drastically raise shareholder returns, hike EV, hybrid salesDec 04, 2024 (Gmt+09:00)