-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Resale platform Bunjang to raise funds at over $300 mn valuation

By

Nov 22, 2021 (Gmt+09:00)

South Korea's leading resale platform Bungaejangter Inc., also known as Bunjang, will raise 83 billion won ($70 million) in fresh funding at a valuation of up to 430 billion won ($363 million), according to venture capital industry sources on Monday.

The enterprise value of the country's first mobile flea market has nearly trebled in less than two years, since it sold its management rights in January 2020 to Seoul-based Praxis Capital Partners. The private equity firm valued the startup at around 150 billion won at the time.

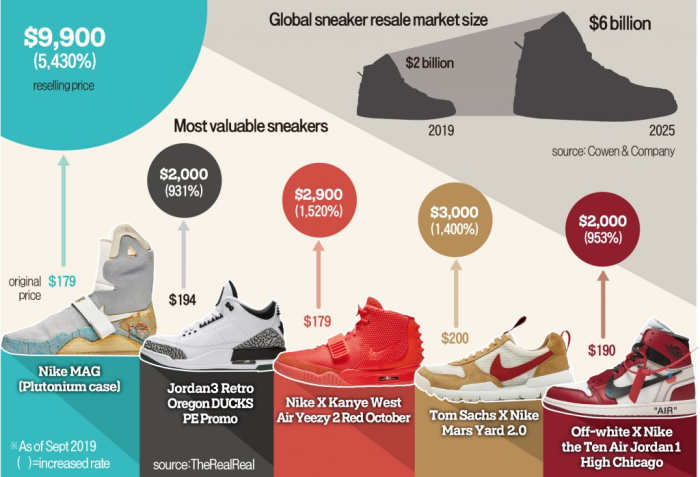

Founded in 2010, Bunjang has tightened its grip on the domestic resale market of limited-edition items, such as sneakers and K-pop stars' signed albums and fan meeting goods.

By year's end, it will receive 30 billion won in new funding from Shinhan Financial Group; 25 billion from Signite Partners of Shinsegae Group; 20 billion won from Praxis Capital Partners, 5 billion won from Atinum Investment; and 3 billion won from Mirae Asset Capital.

They put the platform's value after the investment at between 420 billion and 430 billion won ($350 million-$360 million).

In March 2020, Bunjang was valued at 190 billion won when it raised 56 billion won from BRV Capital Management, Base Investment, S2L Partners, Mirae Asset Venture Investment and Timewise Investment.

Bunjang is among the country's top three online flea markets, alongside Danggeun Market and Joongo Nara. It has been headed by CEO Lee Jaehoo since January 2020.

Prior to joining the resale platform, Lee led TMON Inc., one of the very first e-commerce players in South Korea, between 2017 and 2019.

Bunjang attracted the eyes of shoppers by unveiling convenient payment methods that prevent fraudulent transactions and offering one-stop services from pick-up to packaging to delivery.

With over 16 million registered users, transactions on the marketplace this year have exceeded 1.4 trillion won in value for 14 million cases. That compared with 1.3 trillion won in transaction value for the entire year of 2020, when it posted revenue of 14 billion won.

The online platform has bulked up through acquisitions, including the purchase of a big data-specialized startup Boost in 2019 to improve product recommendations algorithms.

Last year, it acquired an online sneakers sale community Footsell, followed by the string of purchases of a secondhand golf equipment trading platform, a secondhand clothes retailer and a used mobile phone business.

Since the start of this year, it has been establishing offline bases by opening two stores for used sneakers in Seoul. It is set to open a third offline outlet soon.

"Bunjang introduced convenient payment methods for the first time in the industry and has strength in personalized services, offering big data-based recommendations tailored to customers' needs," said a VC industry source. "It also differentiates itself from other online platforms by utilizing offline stores."

Among its new investors, Shinhan Financial Group expects to cooperate with Bunjang in the sneaker resale segment for its credit card business. Shinsegae Group Vice Chairman and CEO Chung Yong-jin has also expressed his interest in the resale market of limited edition sneakers.

Write to Jong-woo Kim at jongwoo@hankyung.com

Yeonhee Kim edited this article.

-

Sep 28, 2021 (Gmt+09:00)

-

May 26, 2021 (Gmt+09:00)

-

Aug 10, 2020 (Gmt+09:00)