-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

LG Display to invest $500 mn to boost smaller OLED output

Tech, Media & Telecom

LG Display to invest $500 mn to boost smaller OLED output

The company repaid a $740 million loan to LG Electronics before maturity

By

Jun 05, 2025 (Gmt+09:00)

3

Min read

News+

LG Display Co., the world’s No. 1 manufacturer of large-sized organic light-emitting display (OLED), will invest about 700 billion won ($500 million) to boost small- and mid-sized OLED production in South Korea, according to industry sources on Thursday.

The investment – its largest capital expenditure at home since August 2021 – is aimed at narrowing the gap with sector leader Samsung Display Co. in the smaller display market, while fending off Chinese rivals.

As smartphone and tablet manufacturers like Apple Inc. shift toward premium OLED, small- and mid-sized panels are emerging as game changers in the display industry.

The expansion of the autonomous driving and software-defined vehicle markets also bodes well for the segment.

The facility expansion plans followed LG Display’s withdrawal from the large-sized liquid crystal display (LCD) market by selling its LCD plant in Guangzhou, China, to TCL’s subsidiary China Star Optoelectronics Technology (CSOT) last year.

LG had pledged to spend the $1.5 billion proceeds on facility investments, R&D and operating expenses.

LG will set up production lines dedicated to next-generation OLED panels in its Paju plant, about 30 km north of Seoul.

The sale of the LCD plant in China qualified the company for reshoring incentives of up to 50 billion won under South Korea’s industrial policy. LG Display aims to stage a turnaround this year.

Thanks to the acceleration of OLED TV adoption worldwide, LG Display’s large-sized OLED panel business is projected to swing to profit in the first half of this year, analysts said.

“We have a strong sense of urgency to improve performance and make a turnaround this year. We must accomplish it,” Jung Chul-dong, chief executive of LG Display, said in a press conference early this year. “We are determined to deliver meaningful results, believing now is the time.”

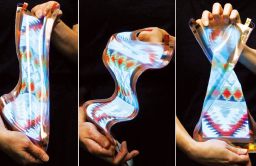

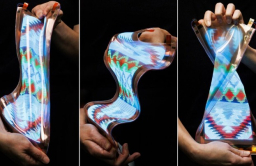

To strengthen its position in the premium OLED sector, LG invested in fourth-generation OLED, third-generation tandem OLED, stretchable displays and OLED on silicon in 2024.

A tandem OLED is a type of screen technology that makes displays brighter and last longer.

However, LG Display lags far behind Samsung Display in the smaller OLED market. LG has focused on large-sized panels optimized for TVs, whereas Samsung has expanded production of small panels optimized for smartphones and tablets.

LG Display controlled 19.0% of the world’s small- and mid-size OLED market in the first quarter, well behind Samsung Display Co.’s 40.9% share, according to market research firm Omdia.

LG was just 0.5 percentage points ahead of China’s BOE Technology Group Co., which ranked third.

Samsung was the world’s first to invest in 8.6-generation OLED panels. In a bid to catch up, LG announced a 3.3 trillion won investment in August 2021 to build sixth-generation small- and mid-sized OLED production lines.

PREMIUM STRATEGY

LG will sharpen its premium strategy for smaller OLED panels.

The South Korean company was the industry's first to begin mass production of automotive plastic OLED (P-OLED) in 2019. It has retained the top spot in the high-end automotive display market, which includes both OLED and low-temperature polysilicon (LTPS) LCD.

Underscoring its improved financial health, LG Display has repaid a 1 trillion won ($740 million) loan to LG Electronics Inc. before maturity, according to its regulatory filing on Thursday.

The display maker borrowed 1 trillion won from the sister company in March 2023 to fund OLED facility investments and cover operating expenses.

LG Display swung to a quarterly profit in the fourth quarter of last year, posting an operating profit of around 80 billion won. It extended its earnings growth streak in the first quarter of this year.

Write to Chae-Yeon Kim at why29@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Apr 22, 2025 (Gmt+09:00)

-

Jan 16, 2025 (Gmt+09:00)

-

Nov 17, 2024 (Gmt+09:00)

-

Nov 11, 2024 (Gmt+09:00)

-

Sep 26, 2024 (Gmt+09:00)

-

ElectronicsLG Display unveils stretchable display clothing

ElectronicsLG Display unveils stretchable display clothingSep 06, 2024 (Gmt+09:00)

-

Aug 14, 2024 (Gmt+09:00)

-

Aug 02, 2024 (Gmt+09:00)

-

Corporate restructuringLG Display cuts vendors’ stakes, axes jobs for turnaround

Corporate restructuringLG Display cuts vendors’ stakes, axes jobs for turnaroundJul 24, 2024 (Gmt+09:00)

-

Jul 23, 2024 (Gmt+09:00)

-

Jun 24, 2024 (Gmt+09:00)

-

Oct 25, 2023 (Gmt+09:00)

-

Tech, Media & TelecomLG Display steps up efforts in foldable laptop screen market foray

Tech, Media & TelecomLG Display steps up efforts in foldable laptop screen market foraySep 24, 2023 (Gmt+09:00)

-

Mar 31, 2023 (Gmt+09:00)

-

Capital raisingLG Display borrows $772 million from LG Electronics

Capital raisingLG Display borrows $772 million from LG ElectronicsMar 28, 2023 (Gmt+09:00)