-

KOSPI 2697.67 -22.97 -0.84%

-

KOSDAQ 734.35 -1.94 -0.26%

-

KOSPI200 359.62 -3.46 -0.95%

-

USD/KRW 1381 -7.00 0.51%

South Korea’s forex reserves dip to nearly 5-year low in February

Foreign exchange

South Korea’s forex reserves dip to nearly 5-year low in February

The Bank of Korea attributes its swap line extension with the NPS for the reserve loss

By

Mar 06, 2025 (Gmt+09:00)

2

Min read

News+

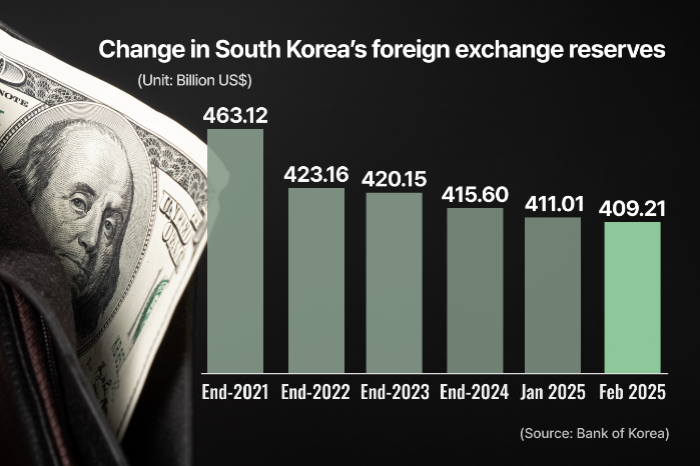

South Korea’s foreign exchange reserves diminished to the lowest level in nearly five years last month, largely due to the expanded forex swap line between the country’s central bank and national pension fund.

The forex reserves held by Asia’s fourth-largest economy came to $409.21 billion as of the end of February, down $1.8 billion from a month ago after extending the losing streak for two straight months.

This is the first time the country's forex cache shrank below $410 billion since May 2020, when the country’s reserve assets stood at $407.31 billion.

The erosion comes despite exchange gains in a basket of major currencies and foreign currency-denominated assets against the weakened US dollar earlier this year.

In February, the dollar index against a basket of major currencies dropped 0.5%.

EXPANED SWAP LINE

The central bank cited its expanded swap line with the National Pension Service (NPS) late last year as a main reason for the fall.

“The NPS borrowed US dollars through the forex swap line, affecting the forex reserves,” said Kim Young-woong, an official from the Bank of Korea’s foreign exchange transactions’ accounting team. “They have to return them six months or a year later.”

Last December, the Bank of Korea expanded its foreign exchange swap line to $65 billion from the previous $50 billion. It extended it by one year until the end of 2025 as the Korean currency dropped to its lowest level in 15 years.

The swap line allows the NPS to borrow from the BOK’s forex reserves for overseas investment for a certain period. The pension fund has to return it upon a maturity date.

BY ASSETS

In the portfolio of the forex reserves, the balance of treasury and corporate bonds shrank by $4.64 billion on-month to $357.38 billion as of the end of February.

The value of the BOK’s special drawing rights (SDR) added $130 million to $14.84 billion over the same period.

An SDR is a supplementary forex reserve asset, created and maintained by the International Monetary Fund. Its holder can tap into it when needed.

BOK’s gold reserves stayed at $4.79 billion, unchanged from January despite the recent rally in gold prices on high demand.

South Korea boasts the world’s ninth-largest forex reserves as of the end of February.

China and Japan are the world’s two biggest forex reserve holders with $3.21 trillion and $1.24 trillion, respectively.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Feb 14, 2025 (Gmt+09:00)

-

Foreign exchangeSouth Korea’s forex reserves drop to 5-year low in 2024

Foreign exchangeSouth Korea’s forex reserves drop to 5-year low in 2024Jan 07, 2025 (Gmt+09:00)

-

Foreign exchangeKorea to relax FX rules by December to boost dollar selling

Foreign exchangeKorea to relax FX rules by December to boost dollar sellingDec 23, 2024 (Gmt+09:00)

-

Dec 20, 2024 (Gmt+09:00)

-

Dec 03, 2024 (Gmt+09:00)

-

Foreign exchangeSouth Korea returns to US FX monitoring watchlist

Foreign exchangeSouth Korea returns to US FX monitoring watchlistNov 15, 2024 (Gmt+09:00)

-

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertainty

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertaintyJul 07, 2024 (Gmt+09:00)

-

Nov 03, 2023 (Gmt+09:00)