-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

NPS incurs $500 million in missed gains due to improper forex hedging

Foreign exchange

NPS incurs $500 million in missed gains due to improper forex hedging

The state fund’s bet on the dollar’s weakness and related hedging two years ago might have been at the government's urging

By

Dec 03, 2024 (Gmt+09:00)

2

Min read

News+

The National Pension Service (NPS), South Korea’s state-run pension fund and the country’s largest institutional investor, has likely incurred some $500 million in missed gains due to its currency risk hedging aligned with the government’s foreign exchange policy.

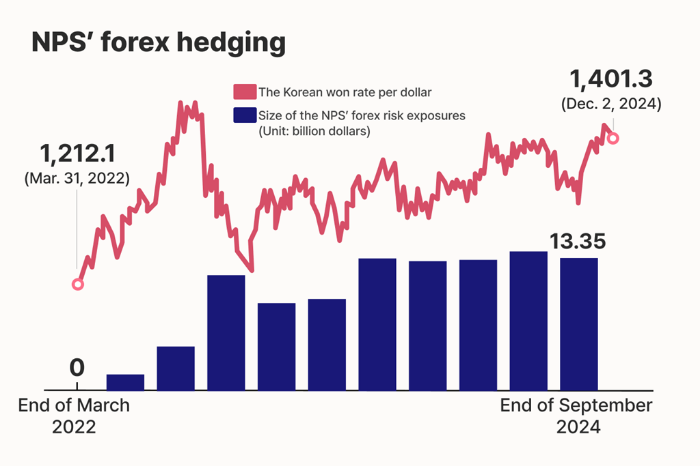

According to investment banking industry sources, the NPS in November reported to the fund management committee, the state fund’s top decision-making body, that of the fund’s total foreign assets of $48.55 billion, its currency exposure ratio stood at 2.75%, or $13.35 billion, as of the end of September.

Since 2022, the state pension fund has been betting on a decline in the dollar-won exchange rate from around the 1,350 won range, believing that the Korean won would strengthen going forward. The NPS engaged in currency hedging by selling forward exchange contracts.

The dollar's value, however, has risen 3.8% over the past two years, meaning the NPS has lost foreign exchange gain opportunities.

Had the NPS not hedged its dollar-won currency risk, it would have generated an additional $500 million in foreign asset operation gains, sources said.

Now that the foreign exchange rate is hovering around 1,400 won per dollar, with an upward bias, the NPS’ potential losses are expected to swell even more, industry officials said.

URGED BY THE GOVERNMENT?

Sources said the government might have influenced the NPS’ betting on the dollar’s weakness and related hedging.

As the exchange rate hovered around 1,400 won at the time, the government requested that pension funds increase their hedging ratio in November 2022.

The NPS then raised its tactical hedging scale by about $7.3. The state pension fund also raised its strategic hedging ratio to 10% from 0%.

Tactical hedging refers to adjustments made at the discretion of the NPS fund management committee, while strategic hedging involves setting a uniform hedging ratio for all its overseas assets.

With the dollar-won exchange rate again heading north, above 1,400 won, the government is set to request further support from the NPS, sources said.

The Ministry of Economy and Finance is said to begin discussions with the NPS soon, ahead of the expiration of the heightened strategic hedging this month.

Separately, the Bank of Korea is in talks with the NPS to expand the size of foreign exchange swaps.

Critics are questioning whether it is appropriate for the government to mobilize the NPS for its foreign exchange market stabilization policy.

“If the NPS’ betting on the won’s gains and related hedging was made on its own, it’s their fault. But if the government nudged it, that’s a problem,” said an industry official.

Last month, the US Treasury Department reinstated Korea on its foreign exchange monitoring watchlist, a year after it removed Asia’s No. 4 economy from the list.

The dollar-won rate was moving at 1,402.9 in late Tuesday trade in Seoul.

Write to Byeong-hwa Ryu at hwahwa@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Pension fundsNPS enjoys 9.2% return as of Q3 on bullish US stocks

Pension fundsNPS enjoys 9.2% return as of Q3 on bullish US stocksNov 29, 2024 (Gmt+09:00)

-

Nov 24, 2024 (Gmt+09:00)

-

Foreign exchangeSouth Korea returns to US FX monitoring watchlist

Foreign exchangeSouth Korea returns to US FX monitoring watchlistNov 15, 2024 (Gmt+09:00)

-

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertainty

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertaintyJul 07, 2024 (Gmt+09:00)

-

Foreign exchangeKorea FX authorities, NPS raise currency swap limit to $50 bn

Foreign exchangeKorea FX authorities, NPS raise currency swap limit to $50 bnJun 21, 2024 (Gmt+09:00)