-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

SK's 5-year journey toward batteries, bio and chips

Corporate restructuring

SK's 5-year journey toward batteries, bio and chips

For the next five years, SK envisions 'one team' with other S.Korean conglomerates to further expand global share

By

Jan 23, 2022 (Gmt+09:00)

3

Min read

News+

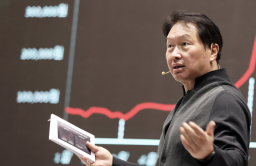

Back in January 2017, SK Group Chairman Chey Tae-won emphasized the need for “deep change," in his New Year message and presented the phrase as the South Korean conglomerate's business keyword for the year.

The deep change, in short, stands for the fundamental group-wide transformation to maintain competitiveness and ensure business sustainability.

Five years on, the domestic sales-oriented conglomerate has come a long way. It has undergone dramatic changes to transform from a group with a focus on petrochemical, chemical and telecom services into one pivoting on electric vehicle batteries, bio and chips, with eyes set on overseas markets.

As a first toward the move, the country's third-largest business group has made massive investments into the new so-called BBC businesses, an acronym for batteries, bio and chips.

Of the total of its 48 trillion won ($40 billion) spending on global businesses between 2017 and 2021, 38 trillion won, or 80%, had been funneled into the BBC sectors, according to SK Group.

The 38 trillion won was then divided into 19 trillion won for batteries; 17 trillion won for chips; and 2 trillion won for the bio sector.

BATTERIES

At the forefront of the deep change was SK Innovation Co. In 2017, the company announced massive spending plans to improve corporate value, including expanding the capacity of its battery plants and the business of battery separators, used to keep the positive and negative electrodes apart.

Kim Jun, who took the reins of the company in 2017, vowed to further boost its enterprise value through strategic investments and mergers or acquisitions.

SK On, a battery arm spun off from SK Innovation Co. last year, is building its second battery plant in the US state of Georgia. Last year, it also announced plans to build three more battery plants -- one in Tennessee and two other battery factories in Kentucky -- jointly with Ford Co.

Once the three battery plants jointly owned by Ford are completed by 2025, SK will likely become the largest battery producer in the US with a capacity of 150.5 gigawatt-hours.

CHIPS

To beef up its NAND flash business, SK Hynix Inc., the world's second-largest memory chipmaker, acquired Toshiba Corp.'s memory chip unit in 2017 in a consortium with Bain Capital. Subsequently, it took over a local silicon wafer manufacturer, now renamed SK Siltron Co., from LG Group.

In 2020, it acquired Intel Corp.'s NAND business unit for $9 billion. It is now looking to list the US arm on Nasdaq.

In the same year, SK Group established an artificial intelligence (AI) chip designing company SAPEON and an AI solutions developer Gauss Labs in San Jose, California. It is now working on launching a semiconductor R&D center in the US for 1.2 trillion won.

BIO

To increase its foothold in the US pharmaceutical market, the group's holding firm SK Inc. combined its pharmaceutical businesses scattered in a number of countries into SK Pharmteco Co. in 2019.

The California-based contract development and manufacturing organization is seeking a Nasdaq listing next year, its CEO Aslam Malik said in a healthcare conference hosted by JPMorgan earlier this month.

Prior to its IPO, it plans to raise between 400 billion won and 600 billion won in new funding.

NEXT FIVE YEARS

Looking ahead, Chairman Chey is trying to deepen cooperation with other South Korean business groups such as Samsung and LG to tackle global supply chain bottlenecks as "one Korean team," and further expand its share in the semiconductor and battery markets, said an SK source.

South Korea's three EV battery makers -- SK On, LG Energy Solution Ltd. and Samsung SDI Co. -- are expected to control 70% of the battery production capacity in the US by 2025, when the three companies plan to complete the construction of their new US plants.

Write to Kyung-Min Kang at kkm1026@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

CES 2022SK subsidiaries form ICT alliance

CES 2022SK subsidiaries form ICT allianceJan 09, 2022 (Gmt+09:00)

-

Corporate governanceSK Group to reform governance structure with stronger board of directors

Corporate governanceSK Group to reform governance structure with stronger board of directorsOct 12, 2021 (Gmt+09:00)

-

Mar 09, 2021 (Gmt+09:00)