-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Carlyle, GS team up to buy Korean dental scanner maker

Mergers & Acquisitions

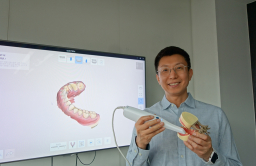

Carlyle, GS team up to buy Korean dental scanner maker

KKR, Blackstone, MBK Partners reportedly consider bids for Medit; Swiss dental implant maker Straumann also mulls acquisition

By

Aug 16, 2022 (Gmt+09:00)

2

Min read

News+

The Carlyle Group, a US private equity giant, has joined hands with South Korean energy-to-retail conglomerate GS Group to buy Medit Corp., the world’s third-largest 3D dental scanner maker, in a deal estimated at up to 4 trillion won ($3.1 billion).

Carlyle and GS Holdings Co. are set to participate in a preliminary bid for Medit scheduled for Aug. 19, according to investment banking sources on Tuesday.

Unison Capital Inc., a mid-market-focused private equity firm and Medit’s top shareholder, has put a 100% stake in the global 3D dental clinic scanning solutions provider up for sale. Citigroup Global Markets is handling the deal.

Other major PE firms such as Kohlberg Kravis Roberts & Co. (KKR), Blackstone Inc. and MBK Partners were known to be considering joining the race for the takeover, while Swiss dental implant maker Straumann was also understood to be mulling a bid, according to the sources.

Carlyle and KKR and other global peers such as Affinity Equity Partners competed against Unison for Medit in late 2019 but lost the game.

That year, Unison spent 320 billion won for its controlling stake in Medit, founded in 2000 by Korea University mechanical engineering professor Chang Minho, who has a doctorate from MIT. The founder Chang, currently the No. 2 shareholder, is not involved in the company’s management.

Medit has been growing fast as Unison has expanded its global businesses since its acquisition. Its earnings before interest, taxes, depreciation and amortization (EBITDA) nearly tripled to 103.9 billion won last year, from 36.7 billion won in 2019, with sales more than doubling to 190.6 billion won last year from 72.2 billion won in 2019.

GS SEEKS MORE FUTURE GROWTH ENGINES

GS Group seeks to acquire Medit as the conglomerate has been hunting for new growth sectors to reorganize its business structure, focused on the refining and energy industries.

Last year, the group and its partners bought Korea’s top botox maker Hugel Inc. in a $1.5 billion deal from Bain Capital.

GS Holdings’ future business division, led by Hur Suh-Hong, a member of the group's founding family and a senior vice president of the company, carried out the acquisition. The division was understood to have pushed for the Medit bid.

Some industry sources, however, doubted that GS would take over Medit due to its high price tag, as the company is unlikely to create much synergy with the group’s existing businesses.

Other Korean conglomerates such as SK Group and LG Group reportedly decided not to bid for the company as the acquisition was not deemed synergistic.

Write to Chae-Yeon Kim at why29@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for sale

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for saleJul 05, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsBehind the scenes of GS-led group's $1.5 bn Hugel purchase

Mergers & AcquisitionsBehind the scenes of GS-led group's $1.5 bn Hugel purchaseAug 31, 2021 (Gmt+09:00)

-

Mergers & AcquisitionsBain Capital sells management rights of Hugel to GS-led group for $1.5 bn

Mergers & AcquisitionsBain Capital sells management rights of Hugel to GS-led group for $1.5 bnAug 25, 2021 (Gmt+09:00)

-

Sep 10, 2019 (Gmt+09:00)