-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

Everon attracts $39 mn thanks to hot VC demand for EV charging

The S.Korean EV charging infrastructure and management startup initially aimed to raise about $23.5 million

By

Jul 13, 2023 (Gmt+09:00)

Everon, one of South Korea’s top three electric vehicle charging infrastructure and management service providers, raised 50 billion won ($39 million) in its latest funding round, more than its initial target thanks to hot demand from venture investors betting big on the burgeoning EV market.

The Korean EV charging startup attracted 50 billion won in a Series B funding round on Wednesday, according to The VC, a Seoul-based VC data platform company.

It received new funds from 10 investors, including Korea Development Bank, Industrial Bank of Korea, DSC Investment, L&S Venture Capital and K2 Investment Partners.

With the latest investment, Everon has raised a total of 63 billion won in venture deals and is expected to speed up bold investment to gain the upper hand in the Korean EV charging market fiercely competed for among startups and large conglomerates such as SK, LG and GS.

“The new investment is expected to lay the groundwork for Everon to cement its leadership in the market in the future,” said You Dong-soo, chief executive officer of Everon. “We will take a leap forward to become a global company with our leading technology that can innovate the customer experience.”

The number of EV chargers in the country also doubled to 205,205 in 2022 from 2021. The market for standard chargers, which are normally installed in residential areas, is currently competed for by about 30 companies, including Everon.

INTENSIFYING COMPETITION IN THE EV CHARGING MARKET

The EV charging market is set to grow rapidly after the Korean government last year amended laws to require builders of apartment complexes to install EV charging stations, which are expected to take up 2% of the entire parking area for existing complexes and 5% for newly built complexes, in three years.

Founded in 2012, Everon currently manages about 30,000 EV chargers across Korea.

This is considered one of Korea’s big three EV charging infrastructure providers by charger supply volume. The other two companies are Powercube Korea and ChargEV.

Starkoff, Pluglink, Humax EV and Easy Charger are also aggressively expanding their EV charging infrastructure in Korea to try to catch up to the frontrunners.

As the market looks promising, large Korean conglomerates have also rushed to join the sector, either through alliances with smaller startups or mergers and acquisitions, posing a threat to the current leaders.

In June 2022, LG Electronics Inc. acquired a 60% stake in Korean EV charging startup AppleMango. Its telecom affiliate LG Uplus Corp. also runs EV charging service platform VoltUp.

LS Corp. and E1 Corp. under LS Group last year set up a joint venture LS E-Link to provide comprehensive EV charging services, from installation and maintenance to management and billing.

Hyundai Motor Co. also aims to lead the country’s EV charging market with ultra-fast chargers under its new E-pit brand.

SK Networks Co., a trading arm of Korea’s second-largest conglomerate SK Group, in early January of this year acquired SS Charger Co., a leading EV charging platform operator in Korea.

It also became the second-biggest shareholder of Everon after it invested 10 billion won in the company in early 2021.

Everon was initially founded as an EV charging service subsidiary of LG CNS Co. but left the LG Group in 2016 when it was put up for sale.

Since the separation, Everon has built its expertise in EV charging services and is recognized for its leading technologies in EV chargers and management software.

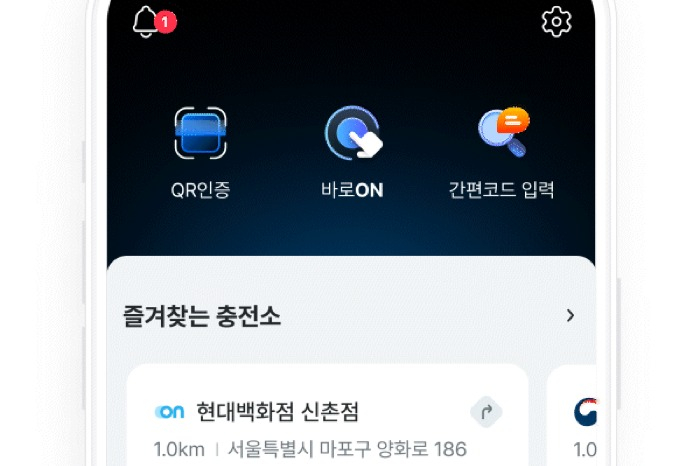

The company, which boasts about 100,000 members, has recently launched the newly upgraded mobile EV charging app, which enables Everon charger users to start and end EV charging with just one click -- without card tagging or a QR code verification process.

It has also expanded its on-site service crew so that more members can access Everon’s 24-hour charging service stations anywhere in the country, the company said.

Write to Lan Heo at why@hankyung.com

Sookyung Seo edited this article.

-

Electric vehiclesHyundai Engineering to enter EV charging maintenance, service market

Electric vehiclesHyundai Engineering to enter EV charging maintenance, service marketJul 10, 2023 (Gmt+09:00)

-

Electric vehiclesS.Korea's NongHyup advances into EV charging

Electric vehiclesS.Korea's NongHyup advances into EV chargingJul 03, 2023 (Gmt+09:00)

-

Electric vehiclesLG Uplus, Kakao Mobility to form EV charging JV

Electric vehiclesLG Uplus, Kakao Mobility to form EV charging JVJul 03, 2023 (Gmt+09:00)

-

Electric vehiclesTmap Mobility to launch EV charging delivery service

Electric vehiclesTmap Mobility to launch EV charging delivery serviceJun 20, 2023 (Gmt+09:00)

-

Electric vehiclesLS E-Link partners with Logen to boost EV charging

Electric vehiclesLS E-Link partners with Logen to boost EV chargingMar 21, 2023 (Gmt+09:00)

-

Electric vehiclesSK Networks renames its EV charger unit to SK Electlink

Electric vehiclesSK Networks renames its EV charger unit to SK ElectlinkMar 13, 2023 (Gmt+09:00)

-

Electric vehiclesSK Energy teams up with state-run power supplier for EV charging station

Electric vehiclesSK Energy teams up with state-run power supplier for EV charging stationJan 13, 2023 (Gmt+09:00)

-

Electric vehiclesSK Networks completes acquisition of local EV charging platform operator

Electric vehiclesSK Networks completes acquisition of local EV charging platform operatorJan 03, 2023 (Gmt+09:00)

-

Electric vehiclesLG Uplus enters Korea’s EV charging service market with VoltUp app

Electric vehiclesLG Uplus enters Korea’s EV charging service market with VoltUp appDec 22, 2022 (Gmt+09:00)

-

Electric vehiclesEV charging service firm Scalardata attracts 3 bn won from GS Energy

Electric vehiclesEV charging service firm Scalardata attracts 3 bn won from GS EnergyDec 12, 2022 (Gmt+09:00)

-

Electric vehiclesLG Group revs up EV charging businesses to lead burgeoning sector

Electric vehiclesLG Group revs up EV charging businesses to lead burgeoning sectorSep 13, 2022 (Gmt+09:00)