-

KOSPI 2601.80 -1.62 -0.06%

-

KOSDAQ 715.55 +1.80 +0.25%

-

KOSPI200 347.02 +0.45 +0.13%

-

USD/KRW 1398 -4.00 0.29%

Samsung gears up for foray into space infrastructure industry

Aerospace & Defense

Samsung gears up for foray into space infrastructure industry

Space experts say South Korea could hold a competitive edge in the launch pad construction market

By

7 HOURS AGO

3

Min read

News+

Samsung Group is stepping up efforts to venture into the space infrastructure industry, a sector analysts say remains a blue ocean where South Korea could secure a first-mover advantage.

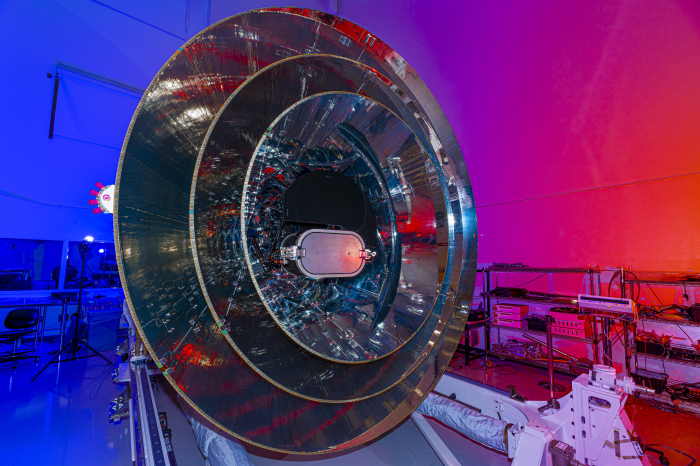

Samsung C&T Corp. recently kicked off early-stage research and development on a so-called “space plant” project that includes the construction of a rocket launch facility, according to industry sources on Tuesday.

The construction and engineering company is in talks with Seoul National University’s Department of Aerospace Engineering to establish an R&D center to build a rocket launch site.

The move comes after Samsung Research under Samsung Electronics Co. hired space experts for the first time in its history early this year.

Space industry experts view the space infrastructure market, including rocket launch pads and spacecraft components, as a new growth engine for South Korea, as the country is trying to catch up with global space leaders.

“South Korea is one of the few countries capable of transferring its manufacturing strengths from semiconductors and nuclear power to offshore plants into the space industry,” said Park Hyeong-jun, a professor of aerospace engineering at Seoul National University.

According to Precedence Research, the US space launch services market is projected to grow from around $5.1 billion in 2025 to around $18.7 billion by 2034, representing a compound annual growth rate of 13.7%.

On May 7, Samsung signed an agreement with the Korea Astronomy and Space Science Institute to collaborate in developing secondary payloads for a CubeSat, dubbed K-Rad Cube, to be aboard NASA’s Artemis II test flight.

“Under the agreement, Samsung Electronics will test its next-generation semiconductors under development in-house in the high-radiation environment of space's high Earth orbit,” the institute said in a statement.

In a related move, South Korea’s Defense Acquisition Program Administration announced on Monday that it will push to localize five types of space defense semiconductors, including monolithic microwave integrated circuits (MMICs) and gyroscopic sensors, for use in satellites and next-generation fighter jets.

For South Korea to join the ranks of the world’s top five space powers, experts argue the country should prioritize building launch infrastructure and advancing space components and manufacturing tools, rather than pouring resources into high-cost deep space exploration or into rocket development, both of which have high technological barriers.

Seraphim Space, a dedicated space investment firm, projected that the global space industry will reach $1 trillion within the next decade, with non-space players expected to take the lead in driving that growth.

In tandem with the rapid expansion of the space industry, the space launch services market has been growing at an average annual rate of 10% since 2019, according to the US-based Satellite Industry Association.

“It’s like having more packages and delivery vehicles, but no terminal to process them,” said the chief executive of a local space startup.

South Korea is not alone in its aim to lead in the rocket launch pad market.

Taiwan and the UK are building launch sites in their countries. In January, Sweden opened the Esrange Space Center, a new launch facility dedicated to small rockets.

Norway’s Andøya Space Center is being transformed from a research-focused launch site to one capable of sending small orbital rockets into space.

However, space industry experts say South Korea could gain a competitive edge in the launch pad construction market thanks to its experience in constructing ultra-high-rise structures, Arctic and deep-sea industrial plants.

In January, Samsung Venture Investment Co. participated in a $170 million late-stage funding round of Loft Orbital. The Silicon Valley-based satellite startup counts Microsoft, NASA, and the European Space Agency among its clients, as well as BAE Systems, Europe’s largest defense contractor.

This year, Loft Orbital plans to deploy several satellite constellations for Earth observation.

Write to Kyung-Ju Kang and Hae-Sung Lee at kurasoha@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Apr 10, 2025 (Gmt+09:00)

-

Aerospace & DefenseSpaceX's Falcon 9 launches S.Korean satellite into orbit

Aerospace & DefenseSpaceX's Falcon 9 launches S.Korean satellite into orbitNov 12, 2024 (Gmt+09:00)

-

Nov 11, 2024 (Gmt+09:00)

-

Tech, Media & TelecomKT, KT SAT, Nara Space to launch satellite data biz

Tech, Media & TelecomKT, KT SAT, Nara Space to launch satellite data bizOct 14, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha teams up with Australian startup for space business

Aerospace & DefenseHanwha teams up with Australian startup for space businessSep 12, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha Systems, Airbus to jointly develop space solar cells

Aerospace & DefenseHanwha Systems, Airbus to jointly develop space solar cellsAug 22, 2024 (Gmt+09:00)

-

Aerospace & DefenseSamsung to send chips into space via Nuri rocket

Aerospace & DefenseSamsung to send chips into space via Nuri rocketJun 28, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha Systems to build Jeju Hanwha Space Center

Aerospace & DefenseHanwha Systems to build Jeju Hanwha Space CenterApr 30, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher deal

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher dealApr 25, 2024 (Gmt+09:00)

-

Aerospace & DefenseKASA, Korea’s NASA, embarks on hunt for space talent

Aerospace & DefenseKASA, Korea’s NASA, embarks on hunt for space talentMar 15, 2024 (Gmt+09:00)