-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

T’way, Air Premia to take off with Korean Air-Asiana merger

Airlines

T’way, Air Premia to take off with Korean Air-Asiana merger

Starting in May, T'way will fly to Croatia and Air Premia is set to launch its first route to San Francisco

By

Feb 14, 2024 (Gmt+09:00)

2

Min read

News+

The proposed 1.8 trillion-won ($1.3 billion) merger between Korean Air Lines Co. and Asiana Airlines Inc. will offer a tailwind to South Korea’s low-cost carriers striving to increase long-haul flights and cargo services.

T'way Air Co. is poised to take over Korean Air’s four golden routes to Europe, with Air Premia Inc. set to acquire three US-bound routes from the country’s flagship carrier.

The European Commission on Tuesday gave its nod to Korean Air’s acquisition of Asiana Airlines on the condition that the merged entity will divest Asiana’s global cargo business and give up four Europe-bound routes and their slots to T’way.

The routes are between Incheon, Korea's gateway airport, and Europe’s four major hub cities of Paris, Frankfurt, Rome and Barcelona. Slots refer to the permissible number of takeoffs and landings per hour at an airport.

“Korean Air has committed to not complete the merger until T'way has started operating on the four overlap routes,” the commission said in a press release.

Korean Air operates the four European routes 23 times a week: Paris (7 times), Frankfurt (7 times), Rome (5 times) and Barcelona (4 times).

Adding the four Europe routes will bump up T’way’s sales by about 500 billion won annually, or 31-35% higher than its estimated sales in 2024, according to Bae Se-ho, an analyst at HI Investment & Securities.

In a timely move, T’way said on Wednesday it will launch a new regular route between Incheon and Zagreb, Croatia, in May, becoming the first Korean budget airline to fly to Europe.

AIR PREMIA

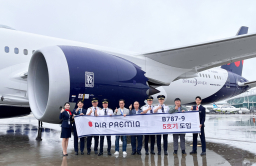

Air Premia is also gearing up to increase its US flights.

Starting in May, it will fly to San Francisco, bringing the number of its regular US-bound flight routes to three after Los Angeles and New York, before taking over three US routes from Korean Air.

In November 2020, Korean Air agreed to buy a majority stake in Asiana Airlines for 1.8 trillion won, in a deal that was expected to create the world’s seventh-largest airline.

The deal has won the nod from 13 countries out of the 14 from which Korean Air requested approval. The US remains the only country yet to give the merger the green light.

Korean Air will lease five aircraft to T’way and four to Air Premia this year to support their new long-haul flight launches, according to the Ministry of Land, Infrastructure and Transport.

CARGO SERVICES

Industry watchers are eyeing who will take over Asiana’s cash-cow cargo services. Among Korea’s four leading budget carriers, HI Investment’s Bae picked Jeju Air Co., Korea’s No. 1 low-cost carrier, as the most suitable candidate.

Asiana is believed to be asking for 500 billion to 700 billion won for its cargo business, which has estimated liabilities of 1 trillion won and 350 billion won in cash and cash equivalents, respectively.

Write to Jin-Won Kim at jin1@hankyung.com

Yeonhee Kim edited this article

More To Read

-

Jan 31, 2024 (Gmt+09:00)

-

Jan 09, 2024 (Gmt+09:00)

-

Nov 30, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsAsiana Airlines to sell cargo business for merger with Korean Air

Mergers & AcquisitionsAsiana Airlines to sell cargo business for merger with Korean AirNov 02, 2023 (Gmt+09:00)

-

Oct 19, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsKorean Air may give up Asiana’s cargo business, 4 routes for EU approval

Mergers & AcquisitionsKorean Air may give up Asiana’s cargo business, 4 routes for EU approvalSep 25, 2023 (Gmt+09:00)

-

May 22, 2023 (Gmt+09:00)

-

May 19, 2023 (Gmt+09:00)

-

May 08, 2023 (Gmt+09:00)