-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

MBK, Air Premia team up for Asiana’s cargo unit; Jeju Air exits

Airlines

MBK, Air Premia team up for Asiana’s cargo unit; Jeju Air exits

MBK-backed Air Premia has emerged as a strong candidate in a 3-way race vied by 2 Korean LCCs Eastar Jet and Air Incheon

By

Apr 25, 2024 (Gmt+09:00)

3

Min read

News+

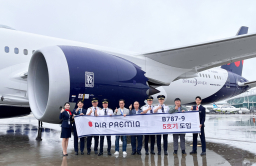

South Korea's low-cost carrier Air Premia Inc. has teamed up with North Asia-focused private equity firm MBK Partners to win Asiana Airlines Inc.'s lucrative cargo unit worth up to 500 billion won ($364 million) after the country's No. 1 budget carrier Jeju Air Co. dropped out of the race.

According to sources in the investment banking industry on Thursday, Jeju Air has decided not to join a main bid for Asiana’s cargo unit, leaving Air Premia, Eastar Jet and Air Incheon as the only bidders.

Earlier this month, Jeju Air was in talks with MBK to join hands to take over the cargo business from Asiana, but Jeju Air’s parent AK Holdings Inc., the holding firm of Korean retail conglomerate Aekyung Group, called off the plan.

Following Jeju Air’s exit, MBK has chosen Air Premia as its partner for Asiana's cargo unit, making the Korean LCC underdog a strong candidate in now a three-way race.

Air Premia originally tapped Seoul-based alternative asset management firm SkyLake Investment Co. as its financial backer for the deal but their talks collapsed.

Following the latest deal between MBK and Air Premia, the major Asian PEF could become the largest stakeholder of the LCC founded in 2017, offering international-only flights at low costs for full-service carrier-like services.

Air Premia’s current largest stakeholder is AP Holdings, a private equity house set up jointly by Korean tire retailer Tirebank Co. Chairman Kim Jeong-gyu and former Leisure Q Chief Executive Moon Bo-guk.

But Tirebank Chairman Kim is sentenced to four years in jail for tax evasion, which could obstruct Air Premia's attempt to get approval for its takeover bid from the government.

Under the current Korean law, should the largest stakeholder have violated financial acts, such as the Punishment of Tax Evaders Act or Fair Trade Act, he or she will face a suspension of voting rights.

Air Premia’s second-largest stakeholder JC Partners, a Seoul-based PE house, is also reluctant to inject additional funds to buy Asiana’s cargo business.

THREE-WAY RACE

Air Incheon, the only cargo-dedicated LCC in the race, is also floated as another strong candidate after a major Korean venture capitalist Korean Investment Partners lent a hand to be the cargo carrier’s financial investor.

Eastar Jet will raise extra funds from its major stakeholder VIG Partners, a leading PEF in Korea, instead of working with an outside financial investor. It is also said to be considering taking loans from Woori Bank and NH Investment & Securities Co.

Asiana’s cargo business is estimated at 300 billion to 500 billion won, excluding estimated liabilities of about 150 billion won, mainly bank loans and leasing.

The seller, Korean Air Lines Co. will review the contenders’ bidding prices and financing plans to pick a preferred bidder early next month.

Bidders also should prove their capability of running mid and long-haul cargo business.

UBS is the lead manager of the Asiana cargo sale deal.

REQUIREMENT TO HAVE ASIANA UNDER KOREAN AIR

Korea’s No. 1 full-service carrier Korean Air is selling Asiana’s cargo unit to get a definite nod for its acquisition of the country’s No. 2 full-service carrier Asiana from the European Commission (EC), the antitrust body of the European Union.

The EC approved the merger in February on the condition that Korean Air divest Asiana’s cargo business and its four lucrative European passenger routes.

Korean LCC T’way Air Co. has agreed to take over Korean Air’s operations on the four routes – Seoul Incheon-Paris, Seoul Incheon-Rome, Seoul Incheon-Barcelona and Seoul Incheon-Frankfurt.

Korean Air has now obtained approval or completed the review process with 13 of the 14 regulatory authorities across the world for its 1.8 trillion won merger with Asiana, which is expected to create the world’s seventh-largest airline.

The US is the only country that it needs to get approval.

Korean Air initially planned to complete the acquisition by the end of the first half of 2021 and launch the merged entity in 2022 after it agreed to buy beleaguered Asiana in November 2020.

Write to Jun-Ho Cha and Ji-Eun Ha at chacha@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Apr 05, 2024 (Gmt+09:00)

-

Feb 28, 2024 (Gmt+09:00)

-

Feb 14, 2024 (Gmt+09:00)

-

Jan 31, 2024 (Gmt+09:00)

-

Nov 30, 2023 (Gmt+09:00)

-

Nov 03, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsAsiana Airlines to sell cargo business for merger with Korean Air

Mergers & AcquisitionsAsiana Airlines to sell cargo business for merger with Korean AirNov 02, 2023 (Gmt+09:00)

-

Oct 19, 2023 (Gmt+09:00)

-

Jul 03, 2023 (Gmt+09:00)