-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Find opportunities amid macro uncertainty in 2023: M&G

Alternative investments

Find opportunities amid macro uncertainty in 2023: M&G

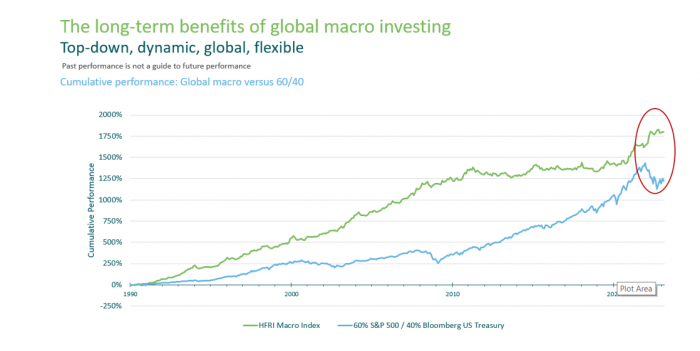

Macro investing, a skill-based hedge fund strategy, will generate profits from misaligned markets, says Investment Director Dyer

May 23, 2023 (Gmt+09:00)

6

Min read

News+

Other changes in demographics and geopolitics are shaping the world's macro environments, and this could create opportunities to profit from misaligned markets via macro investing, a skill-based strategy in hedge funds, says Michael Dyer, investment director at M&G.

The following is an article from Dyer. He discusses how global macro investing has performed over the past years and its outlook in 2023.

▲ What is global macro investing?

“Global macro investing can be considered one of the original hedge fund investment styles. Its emphasis is on delivering absolute returns by taking directional positions, either long or short, in broad markets from a top-down view of economies, markets and their respective interaction.

Unconstrained by asset class, the strategy can invest across equities, government bonds, credit, currencies and, for some managers, commodities. The ability to be tactical and responsive to changing market environments is a key attribute. Thus trades are typically expressed via the most liquid instruments such as index futures, ETFs, government bonds and currencies.

At its heart, global macro is a strategy that seeks to look through the complexity of the global economy, central bank policies, geopolitics, global trade, demographics, etc. to identify selective opportunities to profit from misaligned markets.”

▲ When does the strategy perform well?

“Like all hedge funds, global macro is ultimately a skill-based strategy whereby long-term returns may be driven by the repeatability of a manager’s investment edge. That said, as a flexible top-down investment style, macro tends to have a rich opportunity set when there is significant macro uncertainty and/or markets are experiencing potential regime shifts.

The last couple of years have been very fruitful in this respect.

The flexibility to short markets meant that managers were able to position themselves to profit from 2022’s bond market sell-off, particularly with our approach working extremely well last year, with double-digit positive returns. We believe such flexibility is in stark contrast to traditional long-only strategies.”

▲ How does that relate to today’s environment?

“Taking a multi-year view, we believe markets today could well be in the midst of another regime shift.

"The post-global financial crisis environment was characterized by central banks on hold and bouts of quantitative easing delivering ample liquidity that suppressed volatility and supported asset prices at lofty valuations. In our view, an environment that provided a headwind to macro’s sweet spot.

"In contrast, even as the rate-rising cycle in the US is seemingly peaking, the lagged effects of such meaningful interest rate increases are only just becoming apparent. Economic growth could be challenged from here and central banks, with the specter of inflation tying one hand behind their back, will be hard-pushed to return to the playbook of the 2010s.

"At the same time, there has been a shifting of demographics, domestic politics and geopolitics. With baby boomers moving into retirement, and millennials fast replacing them as the core voting age demographic in most developed countries, domestic politics could well see a shift in tone away from corporate profits towards labor.

"Further, accelerated by COVID-19, the past five years have witnessed an increase in a deglobalization or globalization narrative as governments and corporates reassess their global supply chain dynamics.

"While it’s too soon to see definitive answers on these issues, all can have profound implications of asset valuations, the relative attractiveness of different asset classes, economies, and markets – all of which can provide opportunities for tactical macro-management.”

▲ What’s unique about M&G's approach to global macro investing?

“We seek to be contrarians in our thinking. To seek out macro opportunities away from consensus. We believe this gives us the best repeatable edge to deliver differentiated long-term returns.

"To do so, our investment philosophy draws heavily from behavioral finance. We do not believe that markets are always efficient. In fact, we believe that markets reflect the collective expectations of investors globally and, from time to time, those expectations can become irrational.

"Put another way, traditional valuation measures can help tells us where markets should go in the medium to long term but experience tells us that the path there will often be beset by significant changes in investor psychology.

"We call these periods, 'Episodes' and they can be identified by looking for periods where the normal interaction of price and fundamentals break down.

"Identifying such behavioral Episodes can provide attractive asymmetries in risk-return without the need to correctly 'out-forecast' the market on the next economic data point.”

▲ Can you give an example of long and short positions taken with macro investing?

“From the long side, a good recent example would be buying Chinese equities in late October 2022. Chinese equity valuations had been cheap following prior sell-offs.

"Importantly, prior sell-offs appeared to be a relatively rational repricing of risk given uncertainty over fundamentals. We believe such an Episode presented the opportunity to enter Chinese equities at attractive valuations well in advance of the ‘re-opening’ narrative that has provided a subsequent tailwind to the market.

"From the short side, US interest rates in 2021 and 2022 were a good example. In 2021, US treasury yields were objectively expensive relative to their history. However, investors’ beliefs around the potential for rates to move higher were anchored by recency bias in Fed policy and forward guidance despite economic data at odds with market pricing.

"In hindsight, such a repricing feels obvious but the potential for short-term rates to hit 5% within 12-18 months wasn’t part of the market’s probability distribution and thus offered attractive odds to position against the consensus.”

▲ Where does global macro investing fit in a portfolio?

“Global macro’s most attractive attributes lie in the flexibility to go long or short to asset classes coupled with the liquidity to change investment views and positioning nimbly as the market environment changes. This makes it uniquely dynamic, tactical and responsive, elements that are often missing in other parts of client’s portfolios, be those long-term allocations to equities, bonds or even private assets.

"Investing with a specialist manager with a clear mandate to take directional positions within an appropriate risk tolerance can help overcome both institutional and behavioral inhibitors to adding contrarian thinking, and thus diversification, to traditional portfolios.

Important information.”

(The views expressed in this article should not be taken as a recommendation, advice or a forecast. Concerning the data and graph above, past performance is not a guide to future performance.)

Jennifer Nicholson-Breen edited this article.

More To Read

-

Dec 19, 2022 (Gmt+09:00)

-

Aug 09, 2022 (Gmt+09:00)