-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Global macro investing to revive for more volatile age: M&G

Asset management

Global macro investing to revive for more volatile age: M&G

Market psychology and pricing will periodically offer investors potentially attractive opportunities, Fishwick says

Mar 15, 2023 (Gmt+09:00)

7

Min read

News+

The value of investments will fluctuate, which will cause prices to fall as well as rise and investors may not get back the original amount they invested.

Following more than a decade of central bank inactivity, the hawkish policies in 2022 appear to have ushered in a new golden era for global macro investing, says London-based M&G Investments’ head of Macro Investing, Dave Fishwick.

The following is an article from Dave Fishwick early this month. He discusses lessons learned from 35 years of macro investment and how those shape the outlook for M&G’s Episode Macro Strategy.

▲ Last year was a very challenging period for long-only investors. Have you been surprised by how markets have reacted?

“As a macro strategy, we are big-picture investors looking for long or short opportunities across global equity, government bond, credit and foreign exchange markets. With that in mind, last year was certainly surprising in the magnitude of repricing across asset classes, if not the direction.

Correlated losses across equity and bond markets were particularly painful for investors’ portfolios and challenged the concept of government bonds as a defensive and diversifying asset class.

However, a key tenet of our approach is that the future is unknown and will certainly surprise us, other investors and the market as a whole and that market psychology and thus pricing will periodically offer investors potentially attractive opportunities to be contrarian and lean against a prevailing consensus.

Our unique ‘Episode’ view of the world coupled with the flexibility to go directionally long or short markets, including short US treasuries in particular, enabled the fund to deliver positive returns last year despite painfully correlated equity and bond sell-offs by profiting from short positions in US treasuries and equities.”

▲ You mentioned the ‘Episode’ approach. Can you elaborate more on that and how this may be different?

“Our experience in running the strategy for more than 20 years is that markets are not efficient. However, trying to outperform by successfully forecasting the future is a thankless task for two reasons.

First, as a mental example, just think how many economics PhDs are out there trying to successfully forecast the next consumer price index (CPI) data point or the next employment number, and ask yourself whether you believe you have a better, more accurate model than them.

Second, even if you can generate consistently superior forecasts, markets do not always react to data as expected – for example, markets often rally on bad news or sell off despite good news leading commentators to suggest that such news was ‘already in the price’.

We know this to be true because, before the evolution of the Episode framework in 1999, we employed such traditional approaches to asset allocation with some successes but also some significant failures.

Episode was developed to provide a more reflexive and repeatable framework for investing that can be adaptive to challenging market conditions and help profit from the natural human emotions of fear, greed, complacency, myopia, etc. that are inherent in markets.”

▲ Given you don’t try and forecast economic series or market prices, what does your approach use?

“Our approach aims to avoid the need to consistently ‘out-forecast’ other market participants by understanding the journey prices have taken, how that journey has shaped investors’ risk appetite and thinking in probabilistic terms about where prices could go and how much we are getting paid to assume that risk.

To do so, our approach rests upon a combination of longer-term assessments of prospective returns (valuation) and short-term tactical responses to behavioral episodes in market prices.

We classify episodes as instances when asset price volatility seems to be at odds with changes in what we see as the asset’s underlying fundamentals due to behavioral over- or under-reaction. Put another way, valuation tells us where markets should go but experience tells us that the path there will often be beset by significant changes in investor psychology.

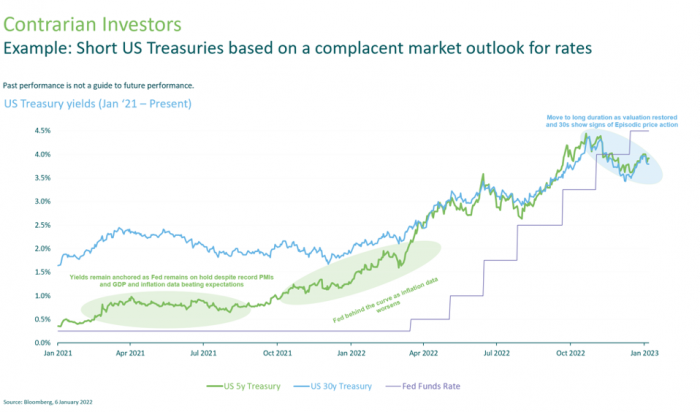

For example, back in March 2021, valuations for US five-year treasuries suggested yields were expensive while behavior suggested that market beliefs were stubbornly anchored in the ‘transitory inflation’/’lower for longer’ narratives. Such beliefs were in contradiction to strong growth data and increasingly sticky inflation data. Taken together markets offered investors asymmetric odds to be positioned for a move in the US higher in treasury yields.

By late October, once US 30-year yields reached 4.4%, we observed investor behavior skewed in the opposite direction – price action was indicative of investors capitulating and rushing to exit a supposedly safe-haven asset that had lost around negative 35% year-to-day.

When combined with our valuation framework that showed treasury yields no longer looked expensive versus declining inflation; we were able to move from being short US five-year bonds to long US 30-year bonds.”

▲ How does your contrarian approach work within a broader investment portfolio?

“The concept of buying cheaply when others are fearful, or selling when others are greedy, resonates with most investors. Further, the diversification benefits of zigging when markets are zagging, or vice versa, have obvious benefits as highlighted this year.

However, executing a contrarian strategy is challenging in practice. Hindsight will always show that the best time to buy was when it felt the worst to do so, but this is never so clear at the time. Further, timely decision-making may be hindered by the red tape of investment committees or the illiquidity of other investments.

The Episode strategy was originally developed in 1999 to overcome these problems for one of M&G’s key internal clients. With sizeable, but slow-moving, allocations to traditional active equities and bonds as well as less liquid strategies, the ability of the portfolio to dynamically respond to changing macro conditions was limited.

Adding a specialist active top-down macro component with a clear mandate and defined framework helped add tactical investment performance.”

▲ What is your outlook for 2023 and beyond?

“We believe that markets have potentially entered an attractive period for global macro investing. The somewhat homogenous post-global financial crisis regime of artificially low policy rates, ample liquidity and suppressed market volatility appear to have given way to a more volatile and differentiated market environment.

This year has started with a growing consensus narrative that an economic soft landing is not just possible but is increasingly probable and that a pivot will come alleviating the upward pressure on rates that hurt so many investors in 2022.

In Europe, the falling natural gas price and European equities’ recent outperformance have buoyed investor sentiment. China’s pandemic policy u-turn and commitment to focus on delivering growth have kickstarted a bullish consensus on China re-opening and significant re-rating of Chinese equities.

While we have participated in most of these tailwinds; our contrarian nature and focus on behavioral analysis cautions us that whenever market consensus becomes too fixed on a single outcome, the potential for disappointment increases.

We would also note an inconsistency in the argument that growth outcomes will be ok and central banks will look to ease policy materially, including that the US 30 year-bonds are rallying seems less to do with robust growth and more to do with growth and recessionary concerns down the road.

As a result, we remain cautious about adding risk to the portfolio and expect to be tactical over the coming months as market episodes present themselves. Last year was an ugly year for buy-and-hold investors. We expect 2023 to look different but we also expect it to be highly uncertain and another year where flexibility and responsiveness in allocations are rewarded.”

▲ So what is in it for private investors?

“Similar to our experience with institutions, private investor portfolios can also struggle to be responsive to changes in the macro environment. M&G Episode Macro strategy’s unconstrained and flexible nature can potentially provide an attractive complement to clients’ existing equity and bond investments; either as a standalone investment or as part of a wider liquid alternatives allocation.”

** The views expressed in this article should not be taken as a recommendation, advice or forecast. With regard to the data and graph above, past performance is not a guide to future performance.

Jennifer Nicholson-Breen edited this article.

More To Read

-

Dec 19, 2022 (Gmt+09:00)

-

Aug 09, 2022 (Gmt+09:00)

-

Real estate debtM&G picks logistics, residential property for 2022

Real estate debtM&G picks logistics, residential property for 2022Oct 12, 2021 (Gmt+09:00)

-

May 04, 2018 (Gmt+09:00)