-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Lotte Chem to buy Iljin at $1.9 bn for battery material biz

Batteries

Lotte Chem to buy Iljin at $1.9 bn for battery material biz

The Korean petchem maker is set to raise its overseas copper foil capacity in an aim to become a major player in the global EV sector

By

Sep 27, 2022 (Gmt+09:00)

3

Min read

News+

South Korea’s Lotte Chemical Corp. is set to acquire major domestic battery material maker Iljin Materials Co. at some 2.7 trillion won ($1.9 billion) as it looks to become a global player in the world electric vehicle industry.

The petrochemical unit of South Korea’s No. 5 conglomerate Lotte Group plans to sign a stock purchase agreement this week for a 53.3% stake in the world’s fourth-largest copper foil maker owned by its Chief Executive Heo Jae-Myeong, according to investment banking industry sources on Tuesday. Iljin’s market capitalization was 2.6 trillion won based on the day’s stock closing price of 57,000 won.

Lotte is known to be considering borrowing 1.2 trillion won from financial institutions and raising the rest on its own for the deal managed by Citigroup Global Markets.

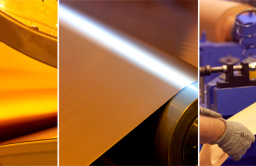

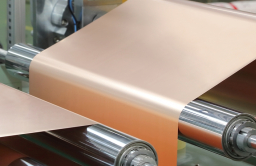

Lotte plans to expand its copper foil business, a key EV battery material, through the takeover, as Iljin, the second-largest copper foil producer in South Korea, accounted for 13% of the world market last year. The global leader was South Korea’s SK Nexilis Co. with a 22% market share, followed by China’s Londian Wason Holdings Co. and Taiwan’s Chang Chun Group.

“Lotte made a big bet at the group level to secure a clear competitive edge in the core EV material sector,” said an industry source. “The acquisition will intensify competition against SK in the future.”

Iljin reported an operating profit of 46.7 billion won in the first half on a consolidated basis with sales of 388.4 billion won. In 2021, its operating profit and sales were 69.9 billion won and 688.8 billion won, respectively.

LATECOMER

Lotte was a relatively new player in the secondary battery materials industry. It started the business in 2020 when other conglomerates such as SK Group and LG Group were actively expanding their presence in the sector.

Lotte has been regarded as the strongest candidate for the acquisition of Iljin as the petrochemical company earlier unveiled plans to invest 4 trillion won in the battery materials business by 2030 for a target 5 trillion won in annual sales.

Lotte was looking for an acquisition for the copper foil business, while it has been nurturing other materials such as cathode foil, anode foil, separators and electrolytes through direct investments in overseas plants.

The company is building a cathode foil plant with an annual capacity of 18,000 tons at an industrial complex in Tatabánya, Hungary, nearby an anode foil factory at Solus Advanced Materials, formerly known as Doosan Solus Co., in which Lotte Fine Chemical Co. and Lotte Aluminum Co. invested 300 billion won.

In the electrolyte sector, Lotte Chemical plans to build an electrolyte organic solvent plant with Sasol Chemicals. Lotte Chemical also aims to ramp up its separator capacity to 100,000 tons a year from the current 7,000 tons.

AGGRESSIVE EXPANSION

Lotte is expected to develop the copper foil business further through additional capacity expansions worldwide after completing the acquisition, although it needs agreements on such investments with local private equity firm STIC Investments Inc., which invested 1 trillion won in Iljin.

Iljin, whose customers include China’s BYD, as well as South Korea’s Samsung SDI Co. and LG Energy Solution Ltd., unveiled in May a 500 billion won plan to build a factory in Spain, which will be its first production base in Europe.

Once the plant is completed in 2024, its total capacity will increase to 130,000 tons, including 15,000 tons in South Korea and 90,000 tons in Malaysia. Iljin has also considered a business in North America.

Global demand for EV battery copper foil was forecast to soar by more than 3.5 times to 1.6 million tons by 2025 from last year, according to industry sources.

Write to Chae-Yeon Kim and Jun-Ho Cha at why29@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Mergers & AcquisitionsKorea’s Iljin sticks to higher stake sale price than bid

Mergers & AcquisitionsKorea’s Iljin sticks to higher stake sale price than bidAug 29, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsBain Capital, Lotte Chem. among shortlisted bidders for Iljin

Mergers & AcquisitionsBain Capital, Lotte Chem. among shortlisted bidders for IljinJul 13, 2022 (Gmt+09:00)

-

Private equitySTIC invests $843 mn in Korean copper foil maker ILJIN

Private equitySTIC invests $843 mn in Korean copper foil maker ILJINNov 30, 2021 (Gmt+09:00)

-

May 17, 2022 (Gmt+09:00)

-

Sep 23, 2020 (Gmt+09:00)