-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Samsung SDI relinquishes polarizer film unit for $834 mn

Batteries

Samsung SDI relinquishes polarizer film unit for $834 mn

The S.Korean battery maker will focus on semiconductor and battery materials after selling the division to a Chinese rival

By

Sep 10, 2024 (Gmt+09:00)

3

Min read

News+

Samsung SDI Co., the South Korean battery maker with the world’s sixth-largest market share, has decided to sell its polarizer film business to Chinese rival Wuxi Hengxin Optoelectronic Materials for 1.12 trillion won ($834 million) to focus more on battery and semiconductor materials, the company said on Tuesday.

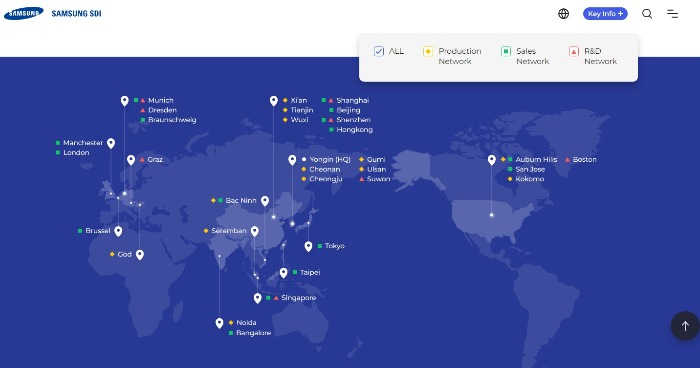

Under an agreement signed by the two companies, Samsung SDI will hand over its polarizer film manufacturing facilities and sales network in Cheongju and Suwon, Korea, as well as a 100% stake in its Chinese operation in Wuxi to Wuxi Hengxin Optoelectronic Materials.

Polarizer film is an optical film that controls the amount of light on a screen and affects its image quality. It is mainly used in liquid crystal displays (LCDs) for IT devices.

The Korean company has decided to let go of the polarizer film business as the unit has been grappling with deteriorating profitability amid intensifying competition from cheaper Chinese options and sluggish demand for IT devices.

Samsung SDI’s crosstown rivals have already shuttered their polarizer film businesses or are considering selling them. LG Chem Ltd. sold off its polarizer film and related materials businesses to a Chinese rival last year, while SKC Ltd. transferred its film business to Korean private equity firm Hahn & Co. in 2022.

Kolon Industries Inc. is mulling setting up a film-manufacturing joint venture with Hahn & Co. after suffering mounting losses.

FOCUS ON BATTERY AND SEMICONDUCTOR MATERIALS

After jettisoning the polarizer film business, Samsung SDI will focus more on battery, semiconductor and organic light-emitting (OLED) materials businesses to enhance their competitiveness in the global market and maximize synergy with its mainstay battery business, the company said in a regulatory filing.

It plans to use the proceeds from the sale of its polarizer film business to develop next-generation materials for batteries, OLED and semiconductors. In particular, it is expected to invest most of the funds into the development of all-solid-state batteries, considered a game changer in the battery market.

The company plans to mass-produce all-solid-state batteries by around 2027.

Samsung SDI has no plan to scale down its battery investment as it expects the battery industry to recover soon after what it sees as a short-term slowdown. It is making bold investments during the chasm-led EV downturn so it can stay ahead of its rivals after the market recovers.

In late August, Samsung SDI and General Motors Co. agreed to build a $35 billion battery cell plant in the US.

The Korean company is already building a battery plant with multinational automaker Stellantis NV in the world’s third-largest EV market while planning to add another one in the country.

Samsung SDI reported 280.2 billion won in operating profit on sales of 4.45 trillion won in the second quarter this year, which dropped 38% and 24%, respectively, from the same quarter last year mainly owing to stagnant demand for electric vehicles.

But its capital expenditures for this year are forecast to jump 50% from last year to about 7 trillion won.

The Samsung SDI-Wuxi Hengxin Optoelectronic Materials polarizer deal needs approval from each country’s related authorities.

Write to Hyeon-woo Oh at ohw@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Aug 28, 2024 (Gmt+09:00)

-

Jul 30, 2024 (Gmt+09:00)

-

Jul 05, 2024 (Gmt+09:00)

-

Sep 27, 2023 (Gmt+09:00)

-

Sep 27, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billion

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billionJun 02, 2022 (Gmt+09:00)