-

KOSPI 2607.33 +30.06 +1.17%

-

KOSDAQ 725.40 +2.88 +0.40%

-

KOSPI200 347.08 +5.59 +1.64%

-

USD/KRW 1405 -9.00 0.64%

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Beauty & Cosmetics

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Korean skin boosters ride the 'glossy water' craze as local rivals gradually challenge Korean dominance

By

6 HOURS AGO

4

Min read

News+

HANGZHOU – The capital of China’s Zhejiang province, Hangzhou, is the southern terminus of the ancient Grand Canal waterway, which originates in Beijing. Since the 9th century, poets and artists have praised the city’s natural beauties associated with water, such as the West Lake.

Centuries later, the city of water is redefining the meaning of “shuiguang,” or glossy water in Chinese – a word associated with the glossy, radiant skin look originally popularized in South Korea.

Industry executives say that K-beauty is once again capturing the Chinese market's imagination, this time with Korean-style skin boosters, broadly called shuiguang.

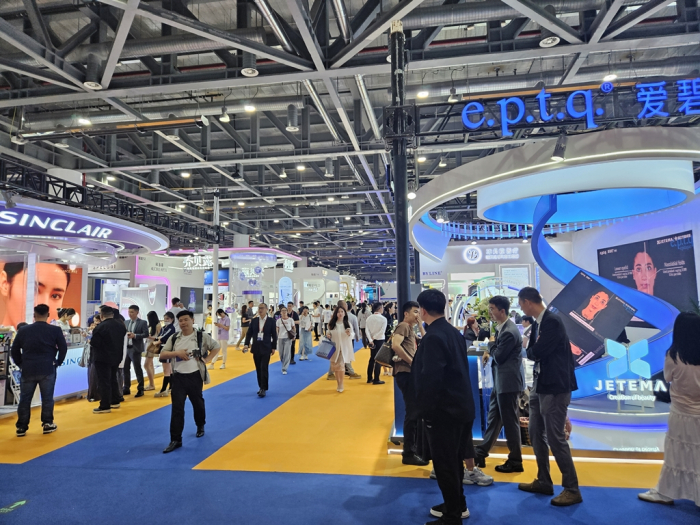

At this year’s MEVOS International Congress of Aesthetic Surgery and Medicine, held from May 9-11 in Hangzhou, the term shuiguang was ubiquitous across the event venue.

The burgeoning appetite for Korean-style skin boosters comes against the backdrop of a fast-growing Chinese medical aesthetics market.

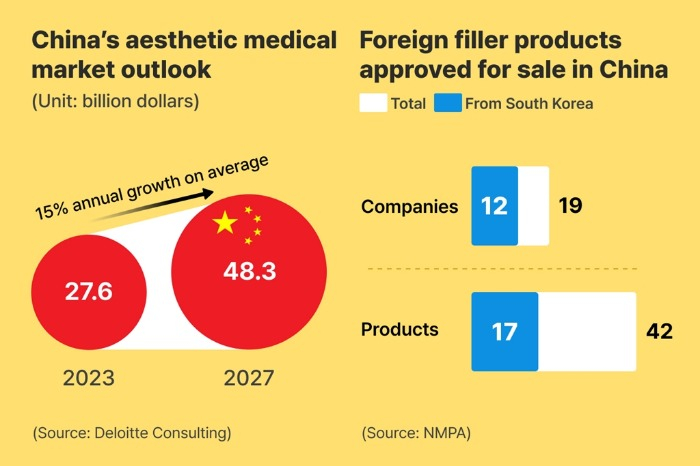

According to Deloitte Consulting, the sector is forecast to grow to $48.3 billion by 2027 in China from $27.6 billion in 2023, representing an annual average growth rate of 15%.

KOREAN FIRMS DOMINATE CHINA’S SKIN BOOSTER SCENE

Over the past five years, all seven foreign companies that have received Chinese regulatory approval for skin booster products were from South Korea, cementing Korea’s dominance in this niche.

Korean beauty makers, including LG Chem Ltd., Huons Co., L&C Bio Co., CHA Meditech Co., Jetema Co. and Dongbang Medical Co., had a conspicuous presence at MEVOS.

Jetema made a particularly bold statement, opening the largest booth at the exhibition's entrance and using the venue to launch its filler product in China.

Kim Jae-young, chief executive of Jetema, was the only Korean corporate leader invited to speak at MEVOS, where he introduced the company's flagship hyaluronic acid dermal filler, Epitique, or e.p.t.q., to an eager Chinese audience.

Following its regulatory approval on April 28, the company staged a live demonstration with Korean doctors, impressing local medical professionals with the filler’s smooth application and texture.

L&C Bio, while not in the aesthetics segment, showcased its MegaDerm Plus skin graft product, recently approved by Chinese regulators, leveraging the event’s significant attendance by hospital executives and distributors.

LUCRATIVE YET RELATIVELY UNTAPPED FRONTIER

Korean beauty companies’ focus on the Chinese market is not without reason.

China, with its population of 1.3 billion and over 15,000 aesthetic clinics – compared to just 4,000 in Korea – remains a lucrative and relatively untapped frontier.

Jetema has partnered with Huadong Ningbo Medicine Co., the distributor that previously propelled LG Chem's filler products to China’s top market position.

CEO Kim said Jetema aims to start commercial sales of its filler products at the end of May, targeting 100 billion won ($71 million) in Chinese sales this year.

The company could hit 200 billion won in annual sales by 2027 with the planned launch of its botulinum toxin, or botox, product that year, he said

Jetema is looking to a longer-term goal of 500 billion won by 2031 through expansions in the US as well as China, the CEO said.

DISTRIBUTION: THE DECISIVE BATTLEGROUND

As China’s medical aesthetics market is maturing, the race is no longer solely about superior products, but about embedding in local ecosystems.

For K-beauty, the battle has only just begun, analysts said.

Competition is heating up as domestic Chinese players quickly move up the value chain, eroding market share once dominated by Korean and Western brands.

Once market leaders in China, LG Chem and Huons have been overtaken in recent years by local players, reflecting the rapid advancement of Chinese firms in filler and skin booster technology.

While Korean products boast technological advantages and brand cachet, executives stress that winning the Chinese market ultimately comes down to securing the right distribution partners.

"China is a battlefield of distribution," said Jetema’s Kim, pointing out that each province has dominant medical and pharmaceutical distributors, making partner selection a critical success factor.

The example of Huadong Ningbo underscores this dynamic.

As LG Chem moved to sever ties with the distributor, the Korean company saw its market share eroded, illustrating how fragile foreign players' positions can be without the right local allies.

Korean executives said that relentless R&D investment is essential to preserving their technological edge in China amid rising competition from increasingly sophisticated Chinese rivals.

“If we don't accelerate innovation, we will be caught by local competitors within five years,” warned Kang Min-jong, CEO of Humedix Co.

Write to Yoo-Rim Kim at youforest@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Apr 29, 2025 (Gmt+09:00)

-

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as May

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as MayFeb 19, 2025 (Gmt+09:00)

-

Apr 18, 2025 (Gmt+09:00)

-

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soar

Beauty & CosmeticsPackaging rides K-beauty wave: Shares of cosmetics container makers soarApr 21, 2025 (Gmt+09:00)

-

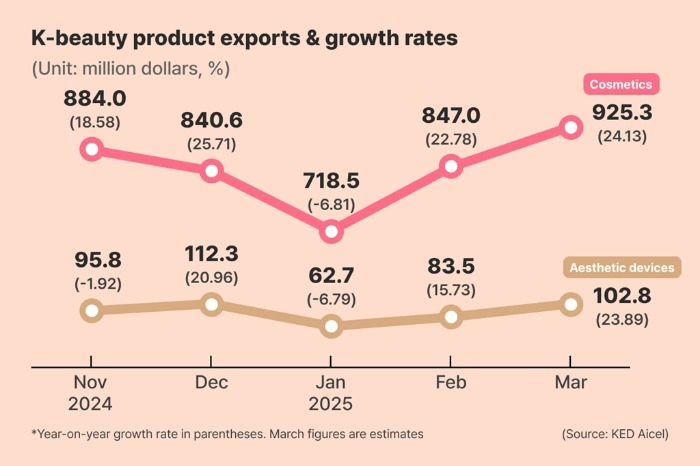

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growth

Beauty & CosmeticsK-beauty defies trade headwinds as exports to China, US lead sales growthApr 08, 2025 (Gmt+09:00)

-

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slump

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slumpApr 04, 2025 (Gmt+09:00)

-

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

-

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woes

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woesFeb 06, 2025 (Gmt+09:00)