-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

LegoChem Bio, Janssen sign $1.7 bn ADC licensing deal

Bio & Pharma

LegoChem Bio, Janssen sign $1.7 bn ADC licensing deal

It is the biggest-ever drug out-licensing deal in S.Korea, buoying the Korean biotech company’s shares by more than 10%

By

Dec 26, 2023 (Gmt+09:00)

4

Min read

News+

LegoChem Biosciences Inc. has signed a blockbuster $1.7 billion deal to license out its proprietary antibody drug conjugate (ADC) candidate to Jassen Biotech Inc., signifying the South Korean biotech company’s top-tier position in the development of ADC drugs, of which demand is set to soar.

On Tuesday, LegoChem Bio announced that it has agreed to license the Johnson & Johnson company to develop and commercialize LCB84, a Trop2-directed ADC therapy.

Under the agreement, the Korean biotech company is eligible for up to $1.7 billion in total, including a $100 million upfront fee, an option exercise payment of $200 million and potential development, regulatory and commercial milestone payments. It can also receive separate, tiered royalties on net sales later.

This is the biggest-ever drug out-licensing deal that a Korean biotech or pharmaceutical company has ever signed, suggesting that LegoChem Bio is neck and neck with global ADC giants such as US-based Seagen and Japanese players Daiichi Sankyo and Astellas Pharma.

“Merck & Co (MSD) in October agreed to pay Daiichi Sankyo about $1.5 billion for just one of the latter’s ADC candidates now in phase 1 trials,” said Kwon Hae-soon, an analyst at Eugene Investment Co. “Considering longstanding ADC giant Daiichi Sankyo’s reputation and renowned ADC technology, LegoChem Bio’s deal (with Janssen) is deemed a good deal.”

MSD has entered a multibillion-dollar agreement with Daiichi Sankyo to develop and commercialize three of the Japanese company’s ADC candidates.

Kwon also said it is highly likely that Janssen would exercise the $200 million option in a few years, considering that the Johnson & Johnson pharmacy arm focusing on the development of solid tumor treatments is racing to beat ADC giant AstraZeneca.

Kosdaq-listed LegoChem Bio shares jumped 10.4% to end at 57,400 won ($44.29) apiece on the Janssen licensing deal news on Tuesday.

ADC UNDERDOGS JOIN FORCES

Under the deal, LegoChem Bio and Janssen will work together for the ongoing phase 1 and 2 trials of LCB84.

Janssen will be solely responsible for the clinical development and commercialization of LCB84 across the world after the US biotech company exercises its exclusive development rights.

LCB84 is a Trop2-directed ADC based on the Korean biotech company’s next-generation ADC platform technology and Italy-based startup Mediterranea Theranostic’s licensed Trop2 antibody, the company explained.

ADC therapy has emerged as a promising cancer treatment despite its high technological barriers. It is hard to synthesize ADC drugs, improve safety and reduce off-target and toxic side effects.

But once they are successfully developed, ADC drugs have shown excellent clinical efficacy against various cancers such as breast and gastric cancers as well as urothelial carcinoma.

The global ADC therapy market is forecast to expand from $7.7 billion in 2023 to $38.7 billion in 2029 at a compound annual growth rate of 23.7%, according to global bio data compiled by the Korea Drug Development Fund.

ADCs are called biological missiles, consisting of antibodies, payloads and linkers. The antibody guides the payload, or small molecule drugs that act as a warhead, and the linker connects the antibody and the payload.

LegoChem Bio’s linker technology is considered superior.

Janssen is known to have thoroughly verified the efficacy and safety of LCB84 for more than a year before it signed the deal.

FIRST INDEPENDENT ADC CLINICAL TRIAL

LCB84’s close competitor is Trodelvy, the Trop2-directed ADC drug developed by Gilead Sciences to treat breast cancer. It raised 500 billion won in sales last year.

Daiichi Sankyo’s DS-1062BS and AstraZeneca’s Datopotamab Deruxtecan, a specifically engineered Trop2-directed DXd ADC, are also considered LCB84’s rivals.

LegoChem Bio last year unveiled LCB84’s animal test results that showed superior efficacy even at a lower dosage.

LCB84 was also LegoChem Bio’s first ADC candidate to enter into independent clinical trials in the US without a partner.

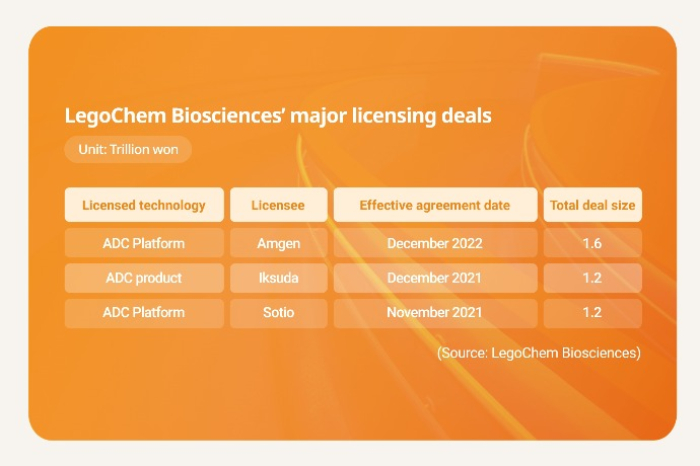

Before the LCB84 deal with Janssen, the Korean biotech company had signed other ADC out-licensing deals based on only preclinical trial results, resulting in smaller deals.

LegoChem Bio will expedite clinical trials of other ADC candidates for more out-licensing deals, said LegoChem Bio’s President and Chief Executive Officer Kim Yong-zu after the announcement of the Janssen deal.

He, however, declined to disclose the name of the next ADC candidate that will undergo the company’s wholly independent clinical trials.

(Updated with a brokerage analyst’s comment on the meaning of the deal, the global ADC market outlook and LegoChem Bio’s stock information)

Write to Woo-Sang Lee and In-Hyuk Park at idol@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Bio & PharmaLegoChem Bio mulls name change after defeat to Lego

Bio & PharmaLegoChem Bio mulls name change after defeat to LegoDec 08, 2023 (Gmt+09:00)

-

Jun 23, 2023 (Gmt+09:00)

-

Dec 23, 2022 (Gmt+09:00)