-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Hanwha bond bookbuilding 10 times oversubscribed

Corporate bonds

Hanwha bond bookbuilding 10 times oversubscribed

Over $1 bn flocked to $111 mn bond corporate bond offering, the company considers raising more

By

Jan 18, 2024 (Gmt+09:00)

1

Min read

News+

Hanwha Corp., the parent company of Hanwha Group, announced on Thursday that it had received orders totaling 1.49 trillion won ($1.14 billion) in its public issue offering conducted on Jan. 17.

The offering, initially set at 150 billion won ($111 million), drew significant investor interest, with orders significantly exceeding the target amount.

The 3-year bonds, with a target amount of 90 billion won, attracted more than 11 times the intended volume, reaching 1.013 trillion won in orders.

Hanwha set the interest rates for these bonds within a range based on individual average market rates, as determined by private bond evaluators, with an added or subtracted margin of 50 basis points (1bp=0.01 percentage point).

The two-year bonds were issued at a rate of -16bp, while the three-year maturity bonds were set at -25bp.

In response to the robust demand, Hanwha is contemplating an increase in the bond issuance size to 250 billion won. The funds raised will be allocated toward repaying maturing bonds.

Hanwha oversees subsidiaries including Hanwha Aerospace Co., Hanwha Solutions Corp., Hanwha Life Insurance, and Hanwha Hotel & Resort.

Earlier, Hanwha Aerospace successfully attracted 1.42 trillion won in orders for its 200 billion won bond offering on Jan. 3.

Hanwha Solutions amassed 1.345 trillion won for its 200 billion won bond issuance on Jan. 5.

Write to Sang Hoon Sung at uphoon@hankyung.com

More To Read

-

Jan 11, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha Ocean, Gabler to collaborate for submarine MRO

Aerospace & DefenseHanwha Ocean, Gabler to collaborate for submarine MROJan 10, 2024 (Gmt+09:00)

-

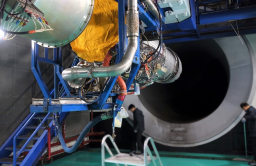

Aerospace & DefenseHanwha to develop own gas turbine engine for future growth

Aerospace & DefenseHanwha to develop own gas turbine engine for future growthJan 04, 2024 (Gmt+09:00)

-

Aerospace & DefenseHanwha wins S.Korean military anti-drone system deals

Aerospace & DefenseHanwha wins S.Korean military anti-drone system dealsDec 22, 2023 (Gmt+09:00)

-

Aerospace & DefenseHanwha Aerospace to export more K9 howitzer to Poland

Aerospace & DefenseHanwha Aerospace to export more K9 howitzer to PolandDec 04, 2023 (Gmt+09:00)