-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korean companies’ 2024 facility investment doubles to $39.4 billion

Corporate investment

Korean companies’ 2024 facility investment doubles to $39.4 billion

In addition to measures to boost shareholder value, companies are taking steps to secure future growth engines

By

Apr 08, 2024 (Gmt+09:00)

3

Min read

News+

South Korea’s major companies invest heavily in facilities to seek new growth engines and drive up their corporate value amid tough business conditions.

According to the Financial Supervisory Service on Monday, 37 large companies, including SK Hynix Inc., Hyundai Motor Co., LG Electronics Inc. Korean Air Lines Co., Hyundai Steel Co. and Lotte Shopping Co., announced through public disclosures a combined 53.37 trillion won ($39.4 billion) in 2024 facility investment and asset purchases from Jan. 1 through April 7.

The investment value is double the 26.5 trillion won announced by 28 companies over the same period.

Most Korean companies announce their full-year investment plans ahead of or just in time for their annual shareholders’ meetings.

Government data showed the lion’s share of the investment in future growth sectors, including high bandwidth memory (HBM) chips, rechargeable batteries and eco-friendly materials.

Korean Air topped the list with its announcement last month to spend 18.47 trillion won to buy 33 units of Airbus A350 airplanes.

Hyundai Motor came in second with 12.52 trillion won, followed by SK Hynix’s 5.2 trillion won, LG Electronics with 4.38 trillion won, Kia Corp.'s 3.32 trillion won, Hyundai Mobis Co.’s 3.18 trillion won, Hyundai Steel’s 2.05 trillion won, EcoPro Materials Co.'s 957.3 billion won and NCSOFT Corp.'s 580 billion won.

PROJECTS TO BOOST CORPORATE VALUE

Analysts said companies are spending heavily to raise their corporate value over the long term amid worsening business conditions and growing investor demand for higher dividends and share cancellation requests to boost shareholder value.

According to the Korea Exchange, 615 companies listed on the main bourse, excluding those in the financial sector, posted a combined 123.83 trillion won in operating profit in 2023, down 24.6% from the previous year, meaning less room for reinvestments.

SK Hynix, the world’s second-largest memory chipmaker after Samsung Electronics Co., said last week that it would spend $3.87 billion to build advanced packaging and R&D facilities for artificial intelligence chips in Arizona, US – the chipmaker’s first overseas HBM chip plant.

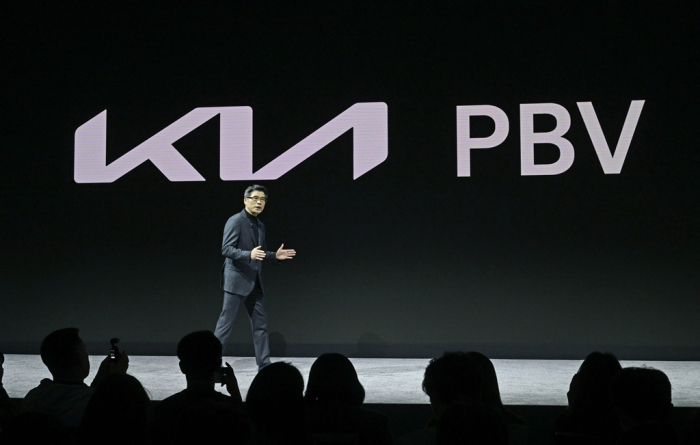

Hyundai Motor and Kia, Korea’s two largest automakers, plan to spend a combined 15.84 trillion won this year to build facilities for next-generation cars, including purpose-built vehicles (PBVs). The investment plan is an increase of 1.53 trillion won, or up 10.7% from last year.

Among companies that plan on ambitious investments are battery materials makers.

Besides EcoPro Materials, Eco & Dream Co., an automotive catalyst maker, and electric vehicle parts maker Daejoo Electronic Materials Co. plan to spend 180 billion won and 19.1 billion won, respectively, on battery materials facilities.

LG Innotek Co., a camera module supplier, said in a regulatory filing that it will spend 383 billion won on building a new camera module plant.

SHAREHOLDER-FRIENDLY POLICY

While spending heavily to secure the basis for their future growth engines, companies also take measures to enhance shareholder value.

Kia, Korea’s second-largest automaker, said it is increasing this year’s total dividend payouts by 60% to 2.19 trillion won, or 5,600 won per common share.

Hyundai Mobis has raised this year’s dividends by 12.5% to 4,500 won a share and decided to retire 660,000 shares from the market. Its share cancellation volume is up 30,000 shares from last year.

Write to IK-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bn

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bnApr 04, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

-

Mar 14, 2024 (Gmt+09:00)

-

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBV

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBVJan 11, 2024 (Gmt+09:00)