-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Naver, CJ ENM join forces to acquire Korea's No.3 web novel platform

[Exclusive] Deals

Naver, CJ ENM join forces to acquire Korea's No.3 web novel platform

Korea's platform giant goes on M&A spree to hold lead in North America, Korea

By

May 28, 2021 (Gmt+09:00)

2

Min read

News+

South Korea’s platform giant Naver Corp. has joined forces with CJ Group to acquire the country's leading web novel platform Munpia Inc. in a deal valued at around 240 billion won ($215 million).

This is the first collaboration between Naver and CJ Group since inking a 600 billion won ($531 million) share-swap deal in a strategic tie-up to create synergy in their entertainment content and logistics businesses last October.According to investment banking industry sources on May 28, the Naver-led consortium, including domestic private equity firms, entered a share purchase agreement to purchase a 64% stake in and the management rights of Munpia held by the S2L Partners-KDB Capital consortium and Kim Hwan-cheol, Munpia's founder.

CJ ENM and Kim will each acquire a 10% stake from the 20% stake held by the web novel platform's second-biggest shareholder CLL, the investment arm of Chinese technology firm Tencent Holdings.

Online giant Kakao Corp. had also chased after Munpia, with plans to team up with NCSoft Corp., Munpia's third-largest shareholder -- but dropped the deal at the last minute.

Naver has been on an M&A spree of late, notably its $600 million purchase of the world's largest web novel platform, Wattpad Corp. in January and investing 33.4 billion won into the No. 2 US webtoon platform Tappytoon in February.

And now, Naver will be adding Munpia to its content portfolio in fewer han six months since the Wattpad purchase -- inking two large M&A deals within a half-year period.

Naver's aggressive move is driven by the rapid growth of Kakao, its rival and the industry latecomer. Until just about a year ago, Naver was the unrivaled webtoon provider in Japan, the world's largest digital comics market.

In the second half of last year, however, Naver’s Japanese webtoon arm, LINE Manga, gave up its No.1 position in Japan to Kakao’s Piccoma. It was a painful loss for Naver, making it even more determined to acquire Munpia to hold onto its dominant positions in North America and Korea.

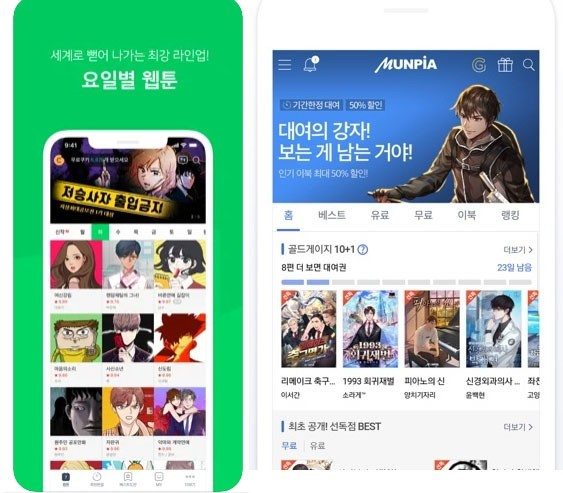

Munpia is the third-largest web novel platform in Korea, following Naver and Kakao. It boasts an average 100 million page views and over 400,000 visitors a month. There are around 47,000 writers registered on the platform.

Also, Munpia's blockbuster novel, Omniscient Reader's Viewpoint, has exceeded 100 million views. It has been adapted into a webtoon and is set to be made into a film.

Following the Munpia acquisition, Naver and CJ ENM are expected to beef up their content offering, using the IPs of popular Munpia novels to develop a wide range of content such as movies, drama series and games.

The Munpia deal grabbed attention as the target of fierce competition between Korea's two online giants, Naver and Kakao. Although Naver won this round, the two firms are expected to battle it out for other M&A deals as their rivalry heats up at home and abroad.

In 2020, Munpia logged an operating profit of 7.3 billion won compared to the 5.3 billion won from the year-earlier period. Its revenue also jumped from 28.7 billion won in 2019 to 41.7 billion won in 2020.

Write to Chae-yeon Kim and Min-ki Koo at why29@hankyung.com

Danbee Lee edited this article.

More To Read

-

[Exclusive] OTT streamingKakao joins OTT race with INISOFT acquisition

[Exclusive] OTT streamingKakao joins OTT race with INISOFT acquisitionMay 27, 2021 (Gmt+09:00)

-

May 11, 2021 (Gmt+09:00)

-

Apr 27, 2021 (Gmt+09:00)

-

Apr 21, 2021 (Gmt+09:00)

-

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay Korea

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay KoreaApr 08, 2021 (Gmt+09:00)