-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

S.Korea’s 20-somethings tighten belts due to high interest rates: report

Economy

S.Korea’s 20-somethings tighten belts due to high interest rates: report

The Korea Development Institute says a one percentage point hike cuts annual consumption by $223

By

Apr 27, 2023 (Gmt+09:00)

1

Min read

News+

The decline in consumption by 20-somethings due to benchmark interest rate hikes is over eight times greater than those in their 60s.

Analysts blame severe belt tightening due to 20-somethings’ high burden of repayment of real estate loans that they aggressively took out when rates were low.

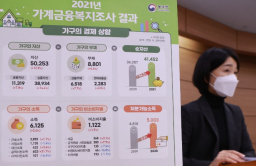

The Korea Development Institute on Wednesday released a study on the higher burden of debt repayment of young people due to rate hikes and its implications. The institute analyzed borrower incomes, home ownership and credit card use from January 2018 to December last year.

When the benchmark interest rate is raised one percentage point, the report said, the annual reduction in consumption for people in their 20s is 299,000 won ($223.6), 8.3 times that of those aged 60 and older of 36,000 won. Consumption by those in their 30s also fell 204,000 won.

When rates fell due to the COVID-19 pandemic, 20- and 30-somethings who secured mortgage loans were hit hard. The report said that unlike the middle aged, the younger generation lacks the ability to maintain consumption levels through asset disposal or additional borrowing.

The share of real estate loans among all borrowings by young people was 82.4%-85%, far higher than that of the middle aged of 63.6%-73.1%.

Write to Se-Min Huh at semin@hankyung.com

More To Read

-

Dec 01, 2022 (Gmt+09:00)

-

Feb 22, 2022 (Gmt+09:00)

-

Feb 21, 2022 (Gmt+09:00)