-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korea’s July factory output slows at fastest pace since February

Economy

Korea’s July factory output slows at fastest pace since February

Asia’s fourth-largest economy is losing steam with a slowdown in manufacturing, investment and consumption

By

Aug 31, 2023 (Gmt+09:00)

3

Min read

News+

South Korea’s factory output contracted at the fastest rate in six months last month on subdued global demand especially from China, while its two other key economic indicators -- retail sales and facility investment -- also slowed, justifying a lengthy timeout in the central bank’s tightening moves.

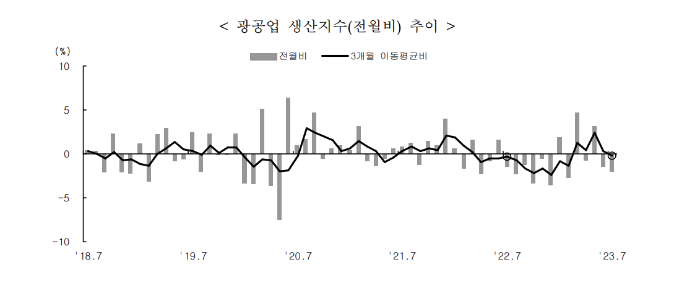

According to data from Statistics Korea on Thursday, seasonally adjusted mining and manufacturing output in July fell 2.0% from the previous month, the biggest monthly drop since February.

Against the same month of last year, it retreated 8%, the fastest since April.

TRIPLE NEGATIVE

Weak factory activity led the country’s overall industrial activity in the month to slow 0.7% from the previous month after more than offsetting a 0.4% gain in the service sector.

Manufacturing activity waned last month mainly due to the protracted slump in the export-reliant country’s outbound shipments amid the global economic downturn, especially the delayed economic recovery in its biggest trading partner China.

Korea’s exports fell 16.5% to $50.3 billion in July from a year earlier, the largest drop since May 2020, according to the Ministry of Trade, Industry and Energy. It was the 10th straight decline.

The output of electronic components and parts skid 11.2% on-month in July, semiconductors dropped 2.3%, and machinery equipment decreased 7.1%.

Worse yet, retail sales, a barometer of private consumption, fell 3.2% on-month in July on a seasonally adjusted basis, the biggest drop since July 2020, while facility investment shrank 8.9%, accelerating its decline from its 1.1% fall a month earlier. It was the fastest retreat since March 2012.

It was the first time that all three key economic indicators -- industrial activity, retail sales and investment -- have dropped since January this year.

“The economy showed signs of cooling,” said Kim Bo-kyung, a senior official at Statistics Korea who briefed the press about July industrial output data on Thursday. “Retail sales and facility investment fell by a big margin due to the stagnant automobile sales.”

She also noted that the unusually long rainy season in July partly dampened private consumption.

Sales of durable goods declined 5.1% in July, led by the weak automobile demand upon the expiry of the country’s car purchase tax cut scheme. Sales of other semi-durable and non-durable goods also declined.

Factory operation averaged 70.2% in the month, 1.6 percentage points lower than the previous month, while inventory levels rose 1.6% on-month and 5.2% on-year.

RATE FREEZE

As the Korean economy shows signs of cooling, the Bank of Korea is expected to stand pat with its latest stance of keeping the policy rate at the current level of 3.50% for a while.

The Korean central bank left the base interest rate at 3.50% for a fifth straight meeting in a unanimous decision a week ago.

On the same day, the BOK cut its growth forecast for the country’s economy for 2024 to 2.2% from the previous 2.3%. It maintained this year’s growth at 1.4% but warned growth in Asia’s fourth-largest economy could fall to as low as 1.2%.

BOK Governor Rhee Chang-yong, however, said the bank left the door open for another rate hike or hikes this year due to the country’s mounting household debts.

The cyclical component of the composite coincident index, which reflects the current economic situation, retreated 0.5 points on-month to 99.6 in July, while the cyclical component of the composite leading index, which predicts the turning point in the business cycle, added 0.4 points to 99.3, according to Statistics Korea.

The Korean government forecast the country’s industrial output will improve starting September or October after remaining subdued in July and August, said Choi Sang-mok, the senior presidential secretary for Economic Affairs.

Write to Sang-Yong Park at yourpencil@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Aug 24, 2023 (Gmt+09:00)

-

Aug 22, 2023 (Gmt+09:00)

-

Aug 01, 2023 (Gmt+09:00)

-

Business & PoliticsKorea’s trade deficit with China runs deep; chip support required

Business & PoliticsKorea’s trade deficit with China runs deep; chip support requiredJun 29, 2023 (Gmt+09:00)

-

Jun 09, 2023 (Gmt+09:00)