-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korea’s factory output backpedals, but spending recovers in March

Economy

Korea’s factory output backpedals, but spending recovers in March

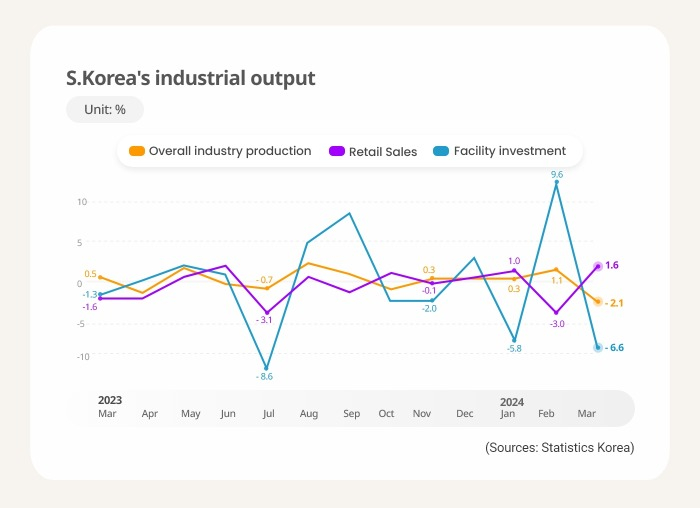

S.Korea’s industry production contracted the most in 4 years in March and facility investment also fell the most in 8 months

By

Apr 30, 2024 (Gmt+09:00)

3

Min read

News+

South Korea’s factory activity weakened in March on a fall in manufacturing output, stoking concerns about Asia’s fourth-largest economy despite a recovery in private consumption, which helped the economy grow at the fastest rate in over two years in the first quarter.

According to data released by Statistics Korea on Tuesday, seasonally adjusted mining and manufacturing output in March fell 3.2% from the previous month when it recorded the first gain in three months.

Manufacturing production, accounting for the bulk of factory output, dropped 3.5% on a 10.6% fall in metal processing and a 7.8% decline in electronic parts, mainly liquid crystal displays for informative technology devices.

The slowdown in factory activity led Korea’s seasonally adjusted overall industry production in March to shrink 2.1% from the previous month, marking its first fall in five months and the biggest contraction since February 2020 with a 3.2% loss.

The statistics office blamed the high basis effect in the previous months for the sluggish industrial activity last month and growing volatility, but other data raised a question about the Korean economy.

STRONG ECONOMIC GROWTH ON PRIVATE CONSUMPTION

In the January-March quarter of this year, Korea’s gross domestic product (GDP) grew 1.3% from the preceding three months on a seasonally adjusted basis, the sharpest expansion since the fourth quarter of 2021, data from the Bank of Korea (BOK) showed last week.

That came above market expectations of less than 1% growth thanks to a pickup in the country’s private consumption.

Domestic spending in the first three months of this year in Korea gained 0.8% after a 0.2% addition three months earlier, according to the central bank.

But market analysts and the BOK were not fully convinced about the sustainability of the economic recovery, citing the country’s lackluster labor market and lingering uncertainties from geopolitical risks from the Middle East, as well as foreign exchange rate moves and inflation.

External factors could thwart the growth of the export-reliance Korean economy.

LOW FACILITY INVESTMENT

In March, retail sales, a gauge of private consumption, turned around with a 1.6% gain from the previous month when it weakened 3.0%.

Sales of non-durable goods like food, groceries and petrol, rose 2.4%, and those of durable goods like home appliances and vehicles added 3.0%. But sales of semi-durables like clothing dropped 2.7%.

Due to the weakened factory activity, facility investment last month decreased 6.6% from the prior month, the biggest fall in eight months. Construction investment shed 8.7% over the same period.

Manufacturing inventories were reduced by 1.2% from the previous month but the manufacturing utilization rate averaged 71.3%, down 3.2 percentage points on-month.

Service activity also declined 0.8% on a 3.5% fall in wholesale and retail operations and a 4.4% drop in hospitality and restaurant businesses.

The cyclical component of the composite coincident index, which measures current economic activity, stood at 99.6 in March, down 0.3 point from the previous month.

The cyclical component of the composite leading indicator, which predicts the turning point in the business cycle, came at 100.3, down 0.2 point on-month.

This is the first time the two indicators have dropped since January last year.

But the Korean finance ministry considered the weak factory activity as a one-off event amid high volatility and expected the country’s economy will continue recovering, driven by solid exports and domestic spending, the Ministry of Economy and Finance in a statement.

Write to Kyung-Min Kang at kkm1026@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Mar 29, 2024 (Gmt+09:00)

-

Nov 30, 2023 (Gmt+09:00)

-

May 22, 2023 (Gmt+09:00)

-

May 10, 2023 (Gmt+09:00)

-

Apr 13, 2023 (Gmt+09:00)