-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

S.Korea’s No.1 soju maker HiteJinro to foray into global beauty market

Food & Beverage

S.Korea’s No.1 soju maker HiteJinro to foray into global beauty market

The country’s top alcoholic beverage maker is seeking a new growth engine to offset a slowdown in the domestic soju market

By

Oct 18, 2024 (Gmt+09:00)

3

Min read

News+

HiteJinro Group, South Korea’s No. 1 alcoholic beverage maker with a century-old history, has tapped cosmetics development and production as a new growth engine, to diversify its business portfolio now reliant on alcoholic drinks whose demand has been stagnant.

Seoyoung e&t Co., a beer cooler-making and food-importing company under HiteJinro Group, acquired a 100% stake in BNB Korea Co., a local cosmetics original design manufacturing (ODM) company, from Seoul-based private equity firm SKS Private Equity, the company announced on Thursday.

It did not disclose the financial terms of the acquisition, which was joined by financial investors Korean PEF The Turning Point and investment firm SB Partners.

“Amid intensifying competition in our mainstay (alcoholic drinks) business, we have actively explored new opportunities, and K-beauty’s ascent has grabbed our attention, leading us to take over BNB Korea,” said a Seoyoung E&t official.

The company hopes BNB Korea, with its solid research and development capabilities, can help it quickly grow its presence in the overseas beauty market, the official added.

SEOYOUNG E&T AT THE CENTER OF HITEJINRO OWNERSHIP

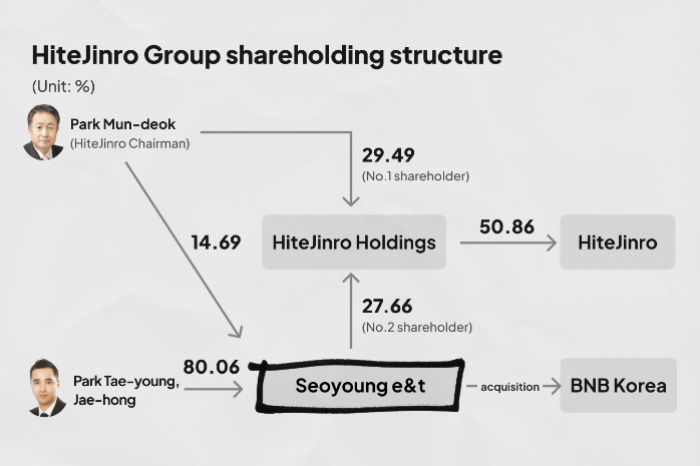

Seoyoung e&t is at the heart of HiteJinro Group’s ownership structure considering that its largest stakeholder is HiteJinro Group’s heir apparent Park Tae-young, eldest son of group Chairman Park Mun-deok.

The son holds a 58.44% stake, while his younger brother Park Jae-hong and his father hold 21.62% and 14.69%, respectively.

HiteJinro Group is led by HiteJinro Holdings Co., which also controls Kospi-listed HiteJinro Co. and 16 non-listed affiliates, including Seoyoung e&t.

But Seoyoung e&t apparently controls the group in the cross-shareholding structure.

The group’s latest acquisition is expected to play a crucial role in the century-old HiteJinro Group’s future through diversification, said the company official.

SLOWDOWN IN KOREAN ALCOHOLIC DRINKS MARKET

HiteJinro has been seeking out new opportunities in new sectors and markets abroad after grappling with stagnating profit growth at home stemming from the saturated alcoholic beverage market.

HiteJinro reported 123.9 billion won ($90.3 million) in operating profit in 2023, down 35% from the prior year.

To shore up its profitability, it has shifted its eyes toward overseas markets.

HiteJinro will open its first overseas brewery in Vietnam in 2026 as part of a grand plan to boost foreign sales of its soju products to 500 billion won by 2030, which was announced in June.

The new overseas sales target is three times bigger than this year’s goal to bring in 158.5 billion won.

Soju, dubbed Korean vodka for its strong alcohol content, is a clear, distilled alcoholic beverage traditionally made from rice. It originated in Korea and remains the country’s most sought-after alcoholic beverage.

HiteJinro controls 65% of the 3.5 trillion won Korean soju market, with smaller rival Lotte Chilsung Beverage Co. claiming 20% and others holding the remainder.

It currently exports soju to 86 countries, with Vietnam being the first back in 1968.

In recent years, however, the colorless distilled firewater has been losing ground at home as the nation's alcoholic drinks market grew increasingly crowded with imported beers, whiskeys and wines.

K-BEAUTY ON A ROLL

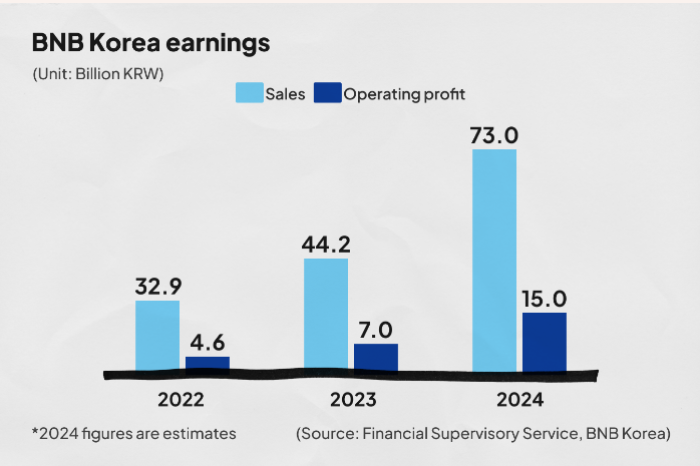

BNB Korea is the country’s 15th-largest cosmetics ODM company in terms of sales.

Founded in 2011, BNB Korea reported 7 billion won in operating profit on sales of 44.2 billion won in 2023, up 52.2% and 34.3% on-year, respectively.

It produces beauty products for some 100 clients, mostly small, fledgling Korean cosmetics firms. Dermafactory, d’Alba and Dr.Pepti are among its customers.

Korean beauty products are popular abroad thanks partly to the ongoing Korean pop culture boom.

In response, foreign companies such as Amazon.com, Inc. and the world's largest cosmetics group L'Oréal are reaching out to Korean cosmetics makers to help them introduce Korean beauty products to overseas markets.

Write to Hun-Hyoung Ha at hhh@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Food & BeverageHiteJinro to boost soju marketing in UK

Food & BeverageHiteJinro to boost soju marketing in UKAug 30, 2024 (Gmt+09:00)

-

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reach

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reachJun 26, 2024 (Gmt+09:00)

-

Food & BeverageHiteJinro invests in table order service startup

Food & BeverageHiteJinro invests in table order service startupJun 24, 2024 (Gmt+09:00)

-

Jun 19, 2024 (Gmt+09:00)

-

Beauty & CosmeticsL'Oréal to nurture K-Beauty startups

Beauty & CosmeticsL'Oréal to nurture K-Beauty startupsJun 13, 2024 (Gmt+09:00)

-

May 10, 2024 (Gmt+09:00)

-

Food & BeverageSoju no longer working-class liquor

Food & BeverageSoju no longer working-class liquorOct 31, 2023 (Gmt+09:00)

-

Food & BeverageHiteJinro to build first overseas soju plant in Vietnam

Food & BeverageHiteJinro to build first overseas soju plant in VietnamOct 16, 2023 (Gmt+09:00)