-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

India: Tantalizing frontier for K-food’s global ambitions beyond China

Food & Beverage

India: Tantalizing frontier for K-food’s global ambitions beyond China

Korea’s three food giants – Lotte Wellfood, Nongshim and Orion – are battling for dominance in the booming Asian market

By

Apr 18, 2025 (Gmt+09:00)

3

Min read

News+

South Korea’s processed food exports to India have surged to a record 6 trillion won ($4.1 billion), marking a significant milestone in the growing appetite for K-food in one of Asia’s fastest-rising consumer markets.

The boom is prompting an intensifying three-way race among Korea’s top three food brands – Lotte Wellfood Co., Nongshim Co. and Orion Co. – each betting big on India with the world’s largest population as the next major growth engine after China.

With Korea’s processed food exports setting a new record and a population of 1.4 billion hungry for novelty and spice, India may well prove to be the most tantalizing frontier yet for K-food’s global ambitions, analysts said.

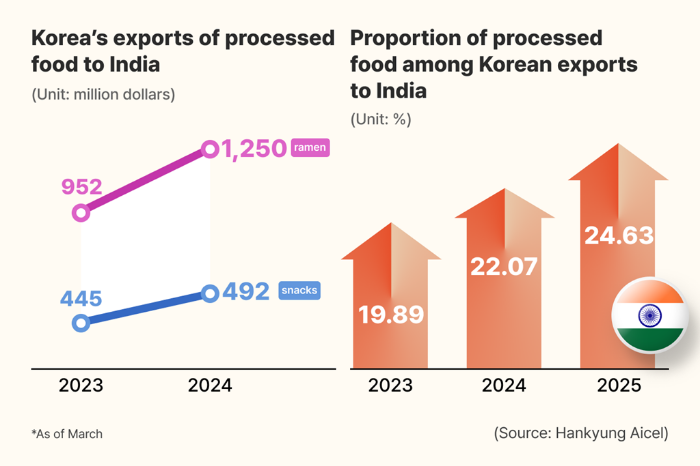

According to Korean alternative data platform KED Aicel on Friday, processed foods made up a record 24.6% of Korean exports to India in March, up from 22.1% a year earlier.

The value of processed food exports to India in 2024 hit 5.84 trillion won ($4.1 billion), a 14.9% increase from the previous year. It is the first time Korea's food shipments to India have exceeded the 5 trillion won threshold, underscoring the rapid growth of Korean culinary influence in the subcontinent.

Ramen, or ramyun as the instant noodles are called in Korea, led the surge, accounting for $1.25 billion in exports last year – a 31.1% jump from 2023. It is followed by confectionery products at nearly $500 million.

Industry officials said the actual market size of Korean processed foods sold in India could be larger once local production is factored in.

LOTTE LEADS, BUT RIVALS ARE CLOSING IN

Lotte Wellfood has been at the forefront of the K-food wave in India, following its acquisition of a local confectionery company in 2004.

It now operates five factories across the country and has successfully tailored its flagship products, such as Choco Pie and Pepero, to suit local tastes and climate.

Last year, the company made 290.4 billion won in sales from India, accounting for 33% of its global revenue, with Choco Pies alone bringing in 88.1 billion won in India.

Lotte’s dominance is facing new challenges, however.

Nongshim, Korea’s leading instant noodle maker, is ramping up its presence after years of operating through local distribution networks.

The company has set an ambitious revenue target of $8.5 million for India this year and recently showcased its Shin Ramyun “Toomba” variant at the country’s largest food exhibition.

Samyang Foods’ “Buldak Bokkeum Myeon,” or spicy chicken-flavored ramen, has also gained traction among spice-loving Indian consumers.

“India’s food palate is proving to be a natural fit for Korean spiciness,” said a Nongshim official.

Orion, meanwhile, has identified India as its next key market after China, already operating a production plant since 2021.

In partnership with local conglomerate Reliance Group, Orion has introduced an array of fruit-flavored Choco Pies – from mango to coconut – to appeal to regional tastes.

The company’s overseas sales now account for 65% of its total revenue, with India becoming an increasingly critical pillar in its portfolio.

K-FOOD’S INDIAN ASCENT SPURS SHIFT IN STRATEGY

As the Indian middle class expands and demand for international foods rises, Korea’s food majors are adapting their market strategies, shifting from mere export operations to full-fledged local manufacturing and branding efforts.

“The days of relying solely on distribution partners are ending,” said a Korean food company executive. “Localization, both in production and marketing, is now the name of the game.”

Yet, as competition heats up, companies are growing more secretive about their India strategies.

“No one wants to tip their hand too early,” said an executive of a Korean confectionery firm. “But it’s clear that the next few years will be critical in determining who wins the K-food race in India.”

Write to Yun-Sang Ko at kys@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Food & BeverageKorean snacks mesmerize global consumers amid K-pop popularity

Food & BeverageKorean snacks mesmerize global consumers amid K-pop popularityMar 10, 2025 (Gmt+09:00)

-

Corporate strategyOrion behind original Choco Pie to invest $580 million in new plants

Corporate strategyOrion behind original Choco Pie to invest $580 million in new plantsApr 16, 2025 (Gmt+09:00)

-

Nov 08, 2024 (Gmt+09:00)

-

Oct 07, 2024 (Gmt+09:00)

-

Aug 26, 2024 (Gmt+09:00)

-

Jun 14, 2024 (Gmt+09:00)