-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

South Korea’s forex reserves drop to 5-year low in 2024

Foreign exchange

South Korea’s forex reserves drop to 5-year low in 2024

Asia’s fourth-largest economy held the world’s ninth-largest foreign exchange reserves as of the end of November

By

Jan 07, 2025 (Gmt+09:00)

2

Min read

News+

South Korea’s foreign exchange reserves shrank to a five-year low at the end of last year after the country’s foreign exchange authorities sold the US currency in the foreign exchange market throughout the year to prop up the weak Korean won.

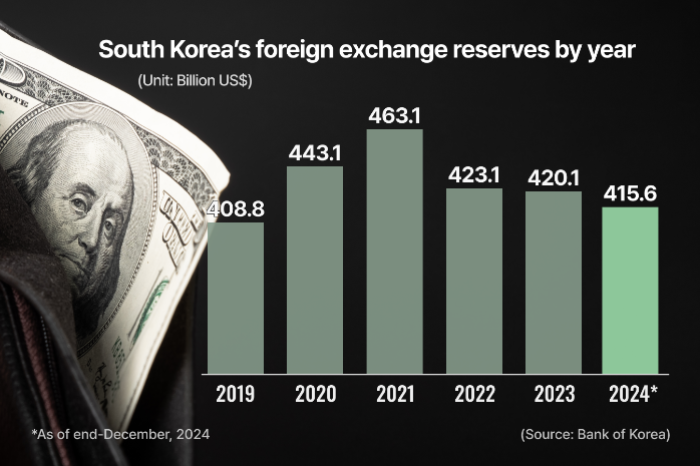

According to the Bank of Korea on Monday, Korea’s foreign exchange reserves stood at $415.6 billion as of the end of December 2024, a $4.55 billion fall from the year previous.

The country’s reserve assets diminished to the lowest amount since 2019 after contracting for three straight years since 2021.

The decrease is largely due to the sluggish Korean won against the US dollar throughout last year, triggering the local foreign exchange authorities’ frequent interventions in the foreign exchange market to ease market volatility.

The Korean won closed the year 2024 at 1,472.50 per dollar versus 1,300.40 on January 2, 2024.

Even before the forex market tantrum triggered by Korean President Yoon Suk Yeol’s ill-fated bid to impose martial law in early December, the Korean won had already plunged by more than 100 to 1,402.90 per dollar from the beginning of the year.

Korean authorities were believed to have sold the greenback to ease volatility in the country’s foreign exchange market throughout 2024.

Korean foreign exchange authorities net sold $7.42 billion worth of US dollars in the first three quarters of last year.

THE WORLD’S 9TH-LARGEST RESERVE ASSETS

In December alone, Korea’s reserve assets, however, increased by $210 million compared to the end of November, refuting market speculation about the authorities’ hefty dollar-selling intervention to shore up the Korean unit in the aftermath of the martial law decree havoc.

To prevent the won’s crash, the Korean foreign exchange authorities issued several intervention warnings last month.

The recent data, however, suggested that the authorities mostly intervened in the country’s foreign exchange market verbally, with limited dollar sales last month.

The reserve assets were also fortified by an increase in US dollar deposits by local banks determined to get their BIS capital adequacy ratios to healthy levels at the end of the year.

The capital adequacy ratio is a key measure of a bank's capital to its risk-weighted assets.

Deposits grew $6.09 billion to $25.22 billion as of the end of December from a month ago.

As of the end of November, Korea’s foreign exchange reserves remained the world’s ninth-largest.

The US dollar-won exchange rate fell 8.60 to 1,454.30 from the previous session on Tuesday morning.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Foreign exchangeKorea to relax FX rules by December to boost dollar selling

Foreign exchangeKorea to relax FX rules by December to boost dollar sellingDec 23, 2024 (Gmt+09:00)

-

Dec 20, 2024 (Gmt+09:00)

-

Dec 04, 2024 (Gmt+09:00)

-

Foreign exchangeSouth Korea returns to US FX monitoring watchlist

Foreign exchangeSouth Korea returns to US FX monitoring watchlistNov 15, 2024 (Gmt+09:00)

-

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertainty

Foreign exchangeKorean won hits 15-year low in Q2 amid FX, economic uncertaintyJul 07, 2024 (Gmt+09:00)

-

Foreign exchangeKorea FX authorities, NPS raise currency swap limit to $50 bn

Foreign exchangeKorea FX authorities, NPS raise currency swap limit to $50 bnJun 21, 2024 (Gmt+09:00)

-

Foreign exchangeNavigating choppy waters: Dollar-won FX forecasting

Foreign exchangeNavigating choppy waters: Dollar-won FX forecastingApr 26, 2024 (Gmt+09:00)

-

Nov 03, 2023 (Gmt+09:00)