-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Global NAND market in game of chicken as Samsung ups ante

NAND competition

Global NAND market in game of chicken as Samsung ups ante

By

Dec 01, 2020 (Gmt+09:00)

3

Min read

News+

Samsung Electronics Co. is upping the ante to extend its leadership in the memory chip sector with a vow to invest heavily in the NAND business next year to widen the gap with its rivals.

Samsung, the world’s largest NAND flash memory chipmaker, plans to “invest in its NAND business in excess of global demand” in 2021 to grab a greater share of the market, according to semiconductor industry sources on Dec. 1.

Samsung's remarks came during its investors’ forum held on Monday, where it forecasted the global NAND market to grow at an average annual rate of 30-35% until 2024, sources said.

Analysts said Samsung’s aggressive NAND investment is aimed at further increasing its market share by strengthening its technology and price competitiveness.

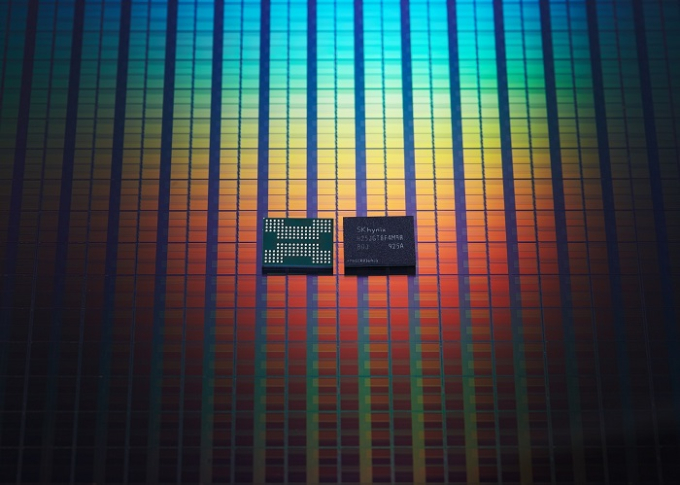

According to market researcher TrendForce, Samsung is the global NAND leader with a market share of 33.1% as of the third quarter, followed by Japan’s Kioxia Corp. (21.4%), US chipmaker Western Digital Corp. (14.3%) and Korea’s SK Hynix Inc. (11.3%).

A NAND flash is a type of non-volatile memory chip that stores data even when power is off.

The market for memory chips slumped in 2018 due to an oversupply of devices, but it started to recover late last year. Demand for NAND memory chips used in data storage devices such as hard drives and cameras rose from early this year owing to the global shift toward working from home in the COVID-19 pandemic era.

ADVANCED TECH KEY TO COMPETITIVE EDGE

As in any industry, advanced technology is crucial in gaining the edge in the chip business.

Last month, Micron Technology Inc., the world’s sixth-largest NAND player, surprised the market by announcing that it has developed 176-layer 3D NAND flash memory, the world’s highest-density chip. Most players, including Samsung, are currently focused on 128-layer NAND.

Touching on Micron’s 176-layer chips, Samsung said at Monday’s forum that its NAND products are more profitable due to their advanced chip stacking technology, which enables 15% higher density than rival products, meaning more layers in a stack.

Samsung said Chinese companies pose no threat to Samsung’s NAND leadership.

“It won’t be possible for Chinese chipmakers to ramp up production in a short period of time. Tech barriers are increasing in the chip industry,” said Ha Jin-man, senior vice president at Samsung’s memory business unit.

Samsung said it aims to manufacture 10-nanometer and narrower DRAM chips by 2030 using its extreme ultraviolet (EUV) lithography technology. A company executive said it is currently mass producing 14-nanometer DRAMs using its EUV technology.

Regarding image sensors, the mainstay in its system chip business, the company said it plans to unveil a 600-million-pixel image sensor by 2025 at the latest to narrow the gap with market leader Sony Corp.

GLOBAL NAND CHICKEN GAME

Samsung’s ambitious plans come as other NAND players are also engaged in a game of chicken to get ahead of their rivals.

Last month, SK Hynix vowed to triple its NAND flash memory sales within five years, buoyed by its recent acquisition of Intel Corp.’s NAND memory and storage business for $9 billion.

Chief Executive Lee Seok-hee said SK Hynix aims to become the world’s No. 2 NAND player once the Intel deal is completed by 2025.

Write to Jeong-Soo Hwang and Jae-Won Park at hjs@hankyung.com

In-Soo Nam edited this article.

More To Read

-

CryptocurrenciesRedotPay lands in Seoul with crypto cards

CryptocurrenciesRedotPay lands in Seoul with crypto cards9 HOURS AGO

-

11 HOURS AGO

-

Corporate strategyHankook & Company to set up CVC with $11 mn in funding

Corporate strategyHankook & Company to set up CVC with $11 mn in funding13 HOURS AGO

-

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea17 HOURS AGO

-

May 08, 2025 (Gmt+09:00)