-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Fast-shrinking chip lead time clouds semiconductor industry’s future

Korean chipmakers

Fast-shrinking chip lead time clouds semiconductor industry’s future

The chip industry braces for a steep downturn as rising inventory at clients' warehouses heralds sharp price falls

By

Nov 15, 2022 (Gmt+09:00)

3

Min read

News+

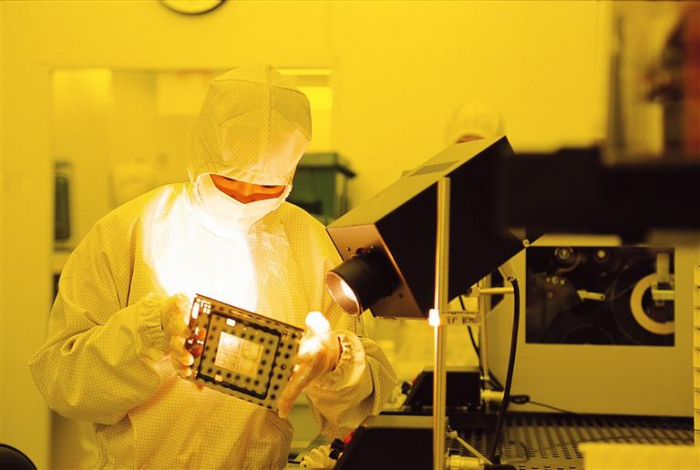

The global semiconductor industry has been plagued by a chip shortage for a couple of years with automakers and other manufacturers struggling to secure enough semiconductors.

Many chipmakers, however, are now concerned about the opposite problem: growing chip inventory.

According to research firm Susquehanna Financial Group, chip lead times, or chip delivery times, shrank to 25.5 weeks on average in October from 26.3 weeks in the previous month.

The October decline – six days shorter than in the prior month – marks the biggest drop since Susquehanna began to compile such data in 2016.

The lead time, or the gap between when a chip is ordered and when it is delivered, has been increasing for the most part of the past two years, triggered by disruptions in the production of automotive chips.

Chip delivery times averaged 27.1 weeks in May, a record high for the semiconductor industry, meaning a wait time of at least seven months after ordering semiconductors.

OVER THE HILLS

However, the lead time began shrinking in June, when the wait time was a day shorter than it was in May.

Since then, delivery times have continuously declined, with Texas Instruments Inc. falling by 25 days in October from the previous months. Other chipmakers have also shown similar declining patterns, industry officials said.

Analysts said the shorter wait times reflect slowing demand for chips from makers of smartphones, personal computers and other electronic devices.

Industry officials said the appliances industry is quickly building up inventory, signaling a precursor to a slump across industries, including the chip manufacturing sector.

Industry watchers said the industrywide chip inventory buildup is at a worrisome level at a time when the global economy is fighting inflation and a potential recession.

"The warehouses of companies that produce and distribute PCs and smartphones are full of semiconductors. We can hardly expect new chip orders from them,” said an official at a chip manufacturing company.

The protracted Russia-Ukraine war, increasing inflation and aggressive interest rate hikes by central banks around the world are choking demand for home appliances, analysts said.

PRECURSOR FOR A BIG SLUMP

The fast-shrinking chip lead times will likely lead to a further decline in semiconductor prices.

Taiwan-based chip research firm TrendForce expects DRAM chip prices to fall between 13% and 18% in the fourth quarter of this year from the previous quarter. NAND chip prices are forecast to shed 15-20% over the same period, it said.

Many chipmakers are responding to the expected memory chip downcycle by slashing their planned investments.

Sanjay Mehrotra, chief executive of the world’s No. 3 memory chipmaker Micron Technology Inc., recently said the current oversupply situation is “unprecedented.”

Korea’s SK Hynix Inc., which is the world’s No. 2 memory chipmaker, and Japan’s Kioxia Corp., a leading NAND player, said it will reduce its wafer input volumes to counter slowing demand.

Samsung Electronics Co, the world’s largest memory chipmaker, in September gave a cloudy industry outlook by saying that its semiconductor sales revenue in the second half will likely come in below its own forecast made in April.

However, Samsung said last month it not considering slashing its memory chip production despite dwindling demand.

The company said it will further advance its chipmaking technologies to tide over the industry’s supply glut and widen its tech gap with rivals.

Write to Sungsu Bae at baebae@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Korean chipmakersSamsung fast-forwards digital transformation of its chip business

Korean chipmakersSamsung fast-forwards digital transformation of its chip businessNov 07, 2022 (Gmt+09:00)

-

Korean chipmakersSamsung sets sights on new chips for self-driving homes on wheels

Korean chipmakersSamsung sets sights on new chips for self-driving homes on wheelsNov 03, 2022 (Gmt+09:00)

-

Oct 27, 2022 (Gmt+09:00)

-

Sep 30, 2022 (Gmt+09:00)

-

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flash

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flashSep 07, 2022 (Gmt+09:00)