-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

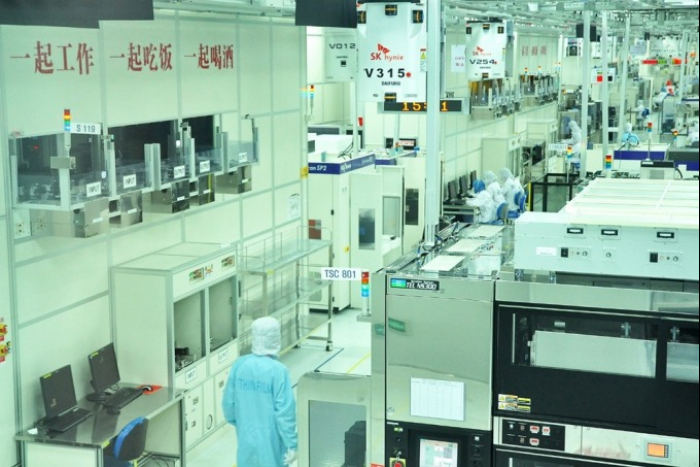

S.Korean chips’ heavy reliance on China, US poses risk to national economy

Korean chipmakers

S.Korean chips’ heavy reliance on China, US poses risk to national economy

Semiconductor exports from Asia’s fourth-largest economy are more easily swayed by external factors than those of Taiwan and Japan

By

May 29, 2023 (Gmt+09:00)

5

Min read

News+

South Korea’s semiconductor industry is more vulnerable to economic and industrial shifts in its key export markets than those of its rivals Taiwan and Japan due to its heavy reliance on China and the US, as well as smartphones and data centers, the country’s central bank said on Monday.

According to the Bank of Korea’s latest economic outlook report for May, Korea’s exports have been 1.9 times more volatile than Taiwan’s and 2.7 times more than Japan’s in the past decade in terms of value.

Such high chip export volatility mainly stems from the Korean chip industry’s heavy dependence on just a few markets, such as China and the US, as well as chips headed for smartphones and data centers. This makes the Korean chip industry more susceptible to economic and industrial shifts in its key export markets, the report found.

The slowdown in its key chip export markets’ economies, and weakening dynamic random access memory (DRAM) chip demand has led to a 40% fall in Korean chip exports this year, posing a huge threat to the export-reliant economy.

To shore up the country’s main growth driver, Korea must diversify its chip export markets, the Bank of Korea recommended in the report.

HEAVY RELIANCE ON US, CHINA

Korea exports its chips as intermediate goods to these countries, where finished chip products are produced for smartphones, PCs and data center servers for domestic consumption or sale to third countries.

More than 40% of Korea-made chips were used to produce mobile devices, and another 20.6% were used in data center servers, mainly by big US tech companies.

In all, more than 60% of Korean chips were applied to smartphones and data center servers.

By chip type, 72.3% of non-memory chips, which accounted for 44% of Korea’s total chip exports as of 2021, were used in mobile devices. Some 39% of memory chips, which took up the remaining 56% of chip exports, were employed in servers.

In contrast, Korea’s biggest chip export rival, Taiwan, ships a more balanced mix of chip products to more countries, protecting the Asian chip powerhouse from volatile market conditions.

It not only exports memory chips for smartphones and servers but also non-memory chips for EV batteries and appliances.

SOFTENING US, CHINA'S DEMAND FOR KOREAN CHIPS

Korea’s heavy reliance on the US data center server market and China’s smartphones exposes Korea to high economic risk.

Outbound shipments of Korean chips have been on a downward spiral since August 2022 after reversing their year-on-year upswing. They shrank 24.5% on-year in the fourth quarter of last year, 39.2% in the first quarter of this year and 40.5% in April.

The chief culprit for Korea's chip export slump is declining chip demand from China.

Korea delivered 55% of its total outbound chip shipments to China last year, 12 percentage points lower than 67% in 2018.

As the world’s second-biggest economy seeks to reduce its reliance on chip imports, Korean chip shipments to China are expected to continue falling even after Beijing fully reopened its economy earlier this year.

Bank of Korea Governor Rhee Chang-yong also noted China’s growing capability to produce intermediate goods as one of the main causes of Korea’s falling exports to China, its largest trading partner.

The more pressing matter, he said, is how to enhance Korea's export competitiveness so that it can maintain a healthy level of exports to China.

Softening memory chip demand from the US is also blamed for Korea’s export downturn.

Korea’s outbound chip shipments to the US plunged 68% on-year in April, more than those to China and Vietnam, due to a contraction in US big tech companies’ investments in data centers amid lingering economic uncertainty.

The US's demand for mobile devices is also due to head south after peaking during the pandemic, boding ill for Korean memory chip sales.

EXPAND NON-MEMORY EXPORTS, EXPLORE NEW MARKETS

Korea must diversify its chip export markets to lower its export volatility, according to the central bank’s report.

In particular, Asia’s fourth-largest economy, home to the world’s No.1 memory chip maker Samsung Electronics Co., should expand exports of non-memory chips known for less price fluctuation while producing more system chips for automotive and AI uses, the central bank said.

Exploration of new markets should also continue, the central bank said.

Amid the intensifying US-China rivalry, Vietnam has emerged as an alternative market and manufacturing base to China thanks to its still-cheap labor costs and its proximity to Beijing.

India is also being floated as another global chip manufacturing hub.

As the US and China engage in a chip war, Korea should devise measures to cope with potential fallouts that could gravely impact its chipmakers’ production and investment, the report said.

The US has introduced the CHIPS and Science Act as part of its efforts to contain China’s growing clout in the microchip sector and strengthen US companies’ competitiveness.

Under the guidelines of the $53 billion CHIPS Act, its beneficiaries including Samsung Electronics and SK Hynix Inc. cannot make new high-tech investments in China, which is the Korean chipmakers’ key market.

In retaliation for the US CHIPS Act, China recently banned its key infrastructure operators from buying chips from US chipmaker Micron Technology Inc., further complicating Korea’s position between its close trading and military allies.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Tech, Media & TelecomLG Display to invest $500 mn to boost smaller OLED output

Tech, Media & TelecomLG Display to invest $500 mn to boost smaller OLED output7 HOURS AGO

-

Shareholder activismProxy voting rises in South Korea, but few vetoes cast

Shareholder activismProxy voting rises in South Korea, but few vetoes cast10 HOURS AGO

-

Business & PoliticsKorea signs definitive $19 bn Czech nuclear plant deal after twists and turns

Business & PoliticsKorea signs definitive $19 bn Czech nuclear plant deal after twists and turns16 HOURS AGO

-

Food & BeverageCJ Foodville goes global from in-flight meals to Starbucks bread

Food & BeverageCJ Foodville goes global from in-flight meals to Starbucks breadJun 04, 2025 (Gmt+09:00)

-

Jun 04, 2025 (Gmt+09:00)